Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that AnaptysBio, Inc. (NASDAQ:ANAB) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for AnaptysBio

How Much Debt Does AnaptysBio Carry?

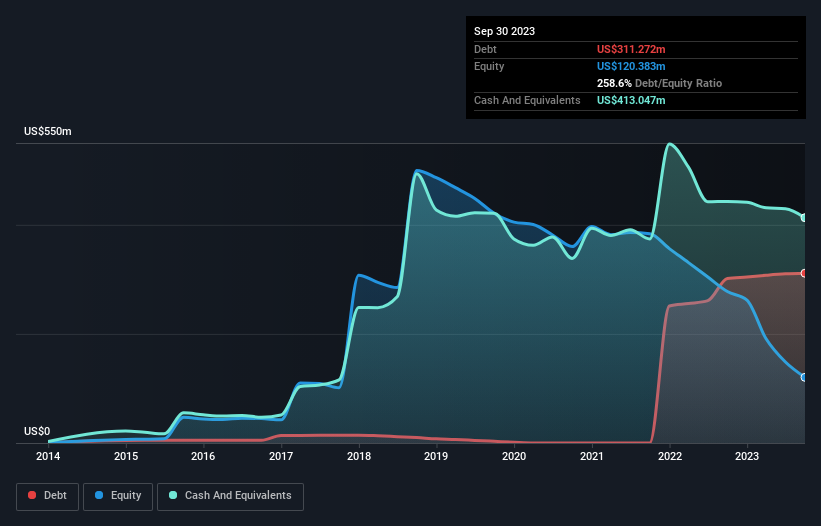

The chart below, which you can click on for greater detail, shows that AnaptysBio had US$311.3m in debt in September 2023; about the same as the year before. But on the other hand it also has US$413.0m in cash, leading to a US$101.8m net cash position.

How Healthy Is AnaptysBio's Balance Sheet?

The latest balance sheet data shows that AnaptysBio had liabilities of US$39.2m due within a year, and liabilities of US$327.8m falling due after that. Offsetting these obligations, it had cash of US$413.0m as well as receivables valued at US$3.27m due within 12 months. So it can boast US$49.4m more liquid assets than total liabilities.

This short term liquidity is a sign that AnaptysBio could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that AnaptysBio has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine AnaptysBio's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year AnaptysBio wasn't profitable at an EBIT level, but managed to grow its revenue by 233%, to US$15m. When it comes to revenue growth, that's like nailing the game winning 3-pointer!

So How Risky Is AnaptysBio?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year AnaptysBio had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through US$98m of cash and made a loss of US$148m. But the saving grace is the US$101.8m on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. Importantly, AnaptysBio's revenue growth is hot to trot. High growth pre-profit companies may well be risky, but they can also offer great rewards. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for AnaptysBio (1 is a bit concerning!) that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ANAB

AnaptysBio

A clinical-stage biotechnology company, focuses in delivering immunology therapeutics.

Slight risk and slightly overvalued.

Market Insights

Community Narratives