- United States

- /

- Biotech

- /

- NasdaqCM:AMRN

Announcing: Amarin Stock Rocketed An Astounding 1359% In The Last Three Years

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. Not every pick can be a winner, but when you pick the right stock, you can win big. One bright shining star stock has been Amarin Corporation plc (NASDAQ:AMRN), which is 1359% higher than three years ago. And in the last month, the share price has gained 12%. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report.

It really delights us to see such great share price performance for investors.

View our latest analysis for Amarin

Amarin isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years Amarin saw its revenue grow at 31% per year. That's much better than most loss-making companies. And it's not just the revenue that is taking off. The share price is up 144% per year in that time. It's always tempting to take profits after a share price gain like that, but high-growth companies like Amarin can sometimes sustain strong growth for many years. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

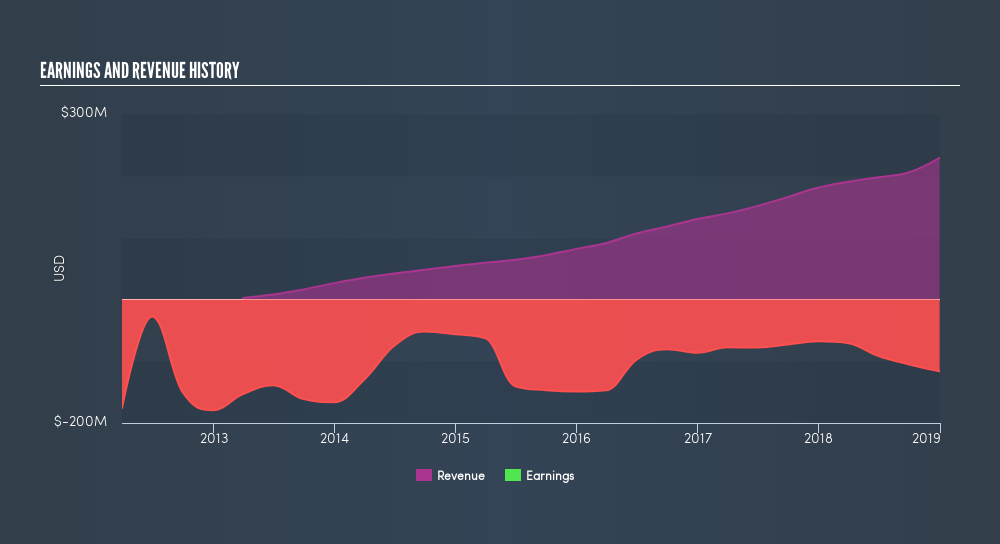

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So we recommend checking out this freereport showing consensus forecasts

A Different Perspective

It's nice to see that Amarin shareholders have received a total shareholder return of 565% over the last year. That's better than the annualised return of 65% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:AMRN

Amarin

A pharmaceutical company, engages in the commercialization and development of therapeutics for the treatment of cardiovascular diseases in the United States, Europe, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives