- United States

- /

- Electrical

- /

- NYSE:NRGV

October 2024's US Penny Stocks Poised For Growth

Reviewed by Simply Wall St

As major U.S. stock indexes experience a slight dip from record highs amid a busy earnings season, investors are closely monitoring the economic landscape for signs of stability and growth. In this context, penny stocks—often associated with smaller or newer companies—remain an intriguing investment area despite their somewhat outdated label. These stocks can offer a blend of affordability and potential growth when backed by strong financials, making them worthy of consideration for those looking to explore beyond the market's giants.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7987 | $5.8M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $2.95 | $485.02M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.65 | $2.1B | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.42 | $147.91M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.595 | $52.63M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.76 | $114.05M | ★★★★★★ |

| MIND C.T.I (NasdaqGM:MNDO) | $1.88 | $39.56M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $96.23M | ★★★★★☆ |

Click here to see the full list of 749 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Amylyx Pharmaceuticals (NasdaqGS:AMLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Amylyx Pharmaceuticals, Inc. is a commercial-stage biotechnology company focused on discovering and developing treatments for amyotrophic lateral sclerosis (ALS) and neurodegenerative diseases, with a market cap of approximately $325.43 million.

Operations: The company's revenue segment is primarily derived from researching and developing therapeutics for neurodegenerative disorders, totaling $298.76 million.

Market Cap: $325.43M

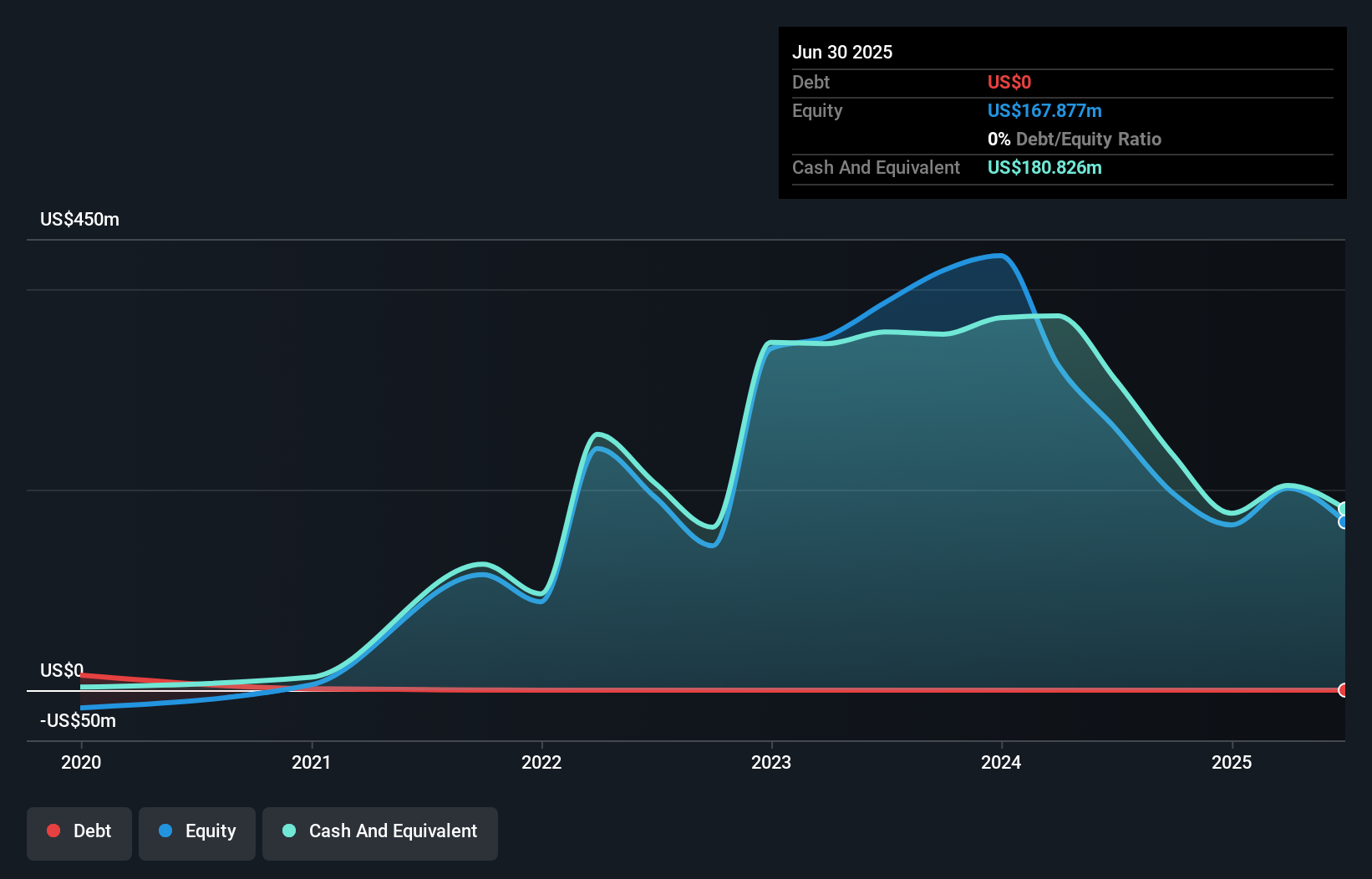

Amylyx Pharmaceuticals, with a market cap of US$325.43 million, remains unprofitable and is not expected to achieve profitability in the next three years. The company has no debt and holds short-term assets of US$326.7 million, surpassing its liabilities. Recent positive data from the Phase 2 HELIOS trial for AMX0035 in Wolfram syndrome demonstrated improvements in pancreatic function and other diabetic measures, contributing to potential long-term value despite current financial losses. Management's average tenure is 3.8 years, indicating an experienced team navigating volatile share prices and exploring innovative treatments for neurodegenerative diseases.

- Click here and access our complete financial health analysis report to understand the dynamics of Amylyx Pharmaceuticals.

- Explore Amylyx Pharmaceuticals' analyst forecasts in our growth report.

Energy Vault Holdings (NYSE:NRGV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Energy Vault Holdings, Inc. develops and sells energy storage solutions with a market cap of $227.23 million.

Operations: The company generates revenue from its Electric Equipment segment, totaling $301.97 million.

Market Cap: $227.23M

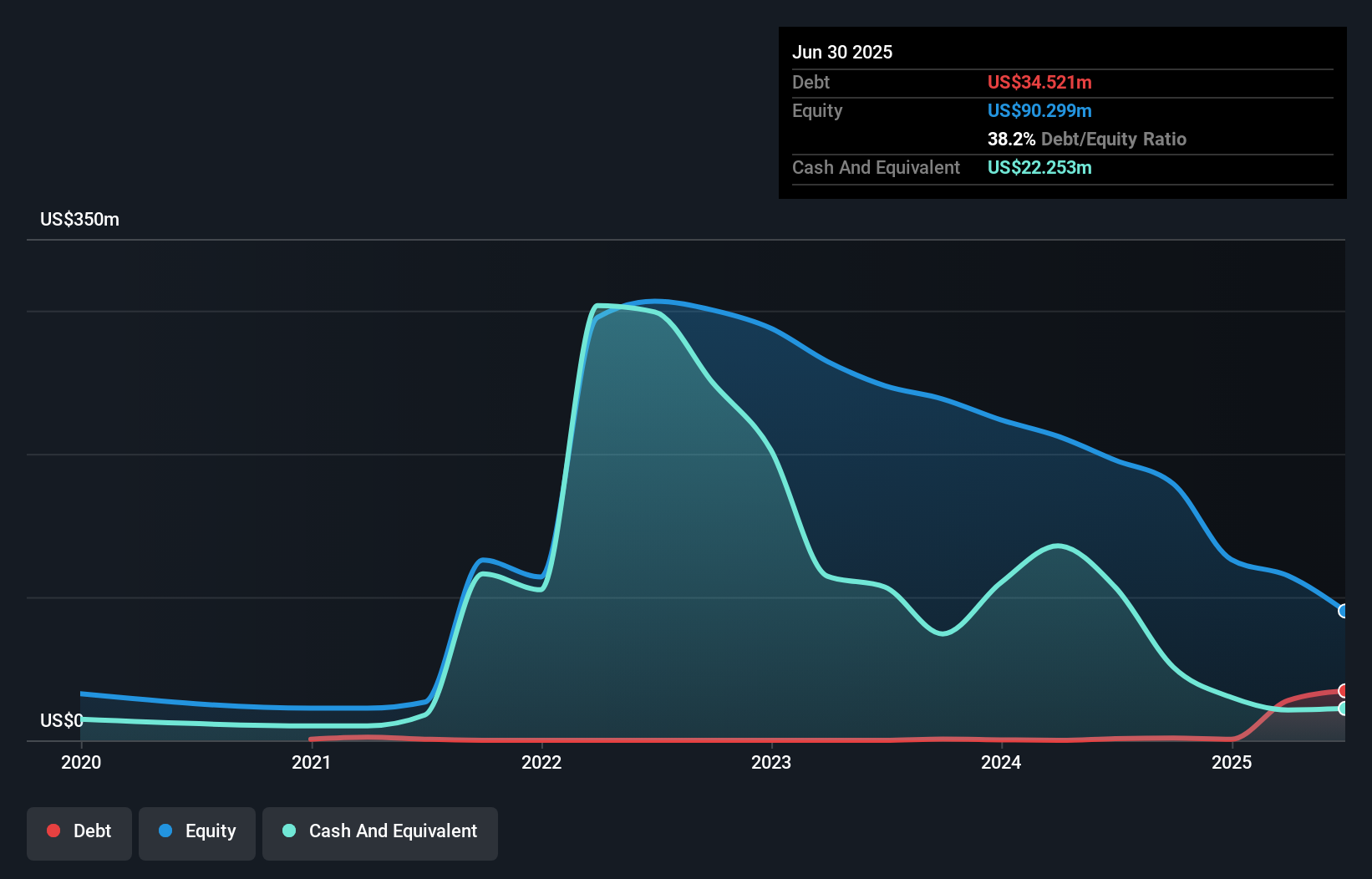

Energy Vault Holdings, with a market cap of US$227.23 million, is navigating challenges typical of penny stocks. Despite generating US$301.97 million in revenue from its Electric Equipment segment, the company remains unprofitable and has faced increased losses over the past five years. Recent developments include a notice from the NYSE regarding non-compliance due to low stock prices, which Energy Vault aims to address within six months through potential shareholder-approved actions. The company is also advancing innovative energy storage solutions, such as its 100MW Hybrid Gravity Energy Storage System in collaboration with Carbosulcis S.p.A., showcasing potential for future growth amidst current volatility and shareholder dilution concerns.

- Jump into the full analysis health report here for a deeper understanding of Energy Vault Holdings.

- Understand Energy Vault Holdings' earnings outlook by examining our growth report.

Super Group (SGHC) (NYSE:SGHC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Super Group (SGHC) Limited is an online sports betting and gaming operator with a market cap of approximately $2.10 billion.

Operations: The company's revenue is primarily generated from two segments: Spin, contributing €631.82 million, and Betway, accounting for €878.98 million.

Market Cap: $2.1B

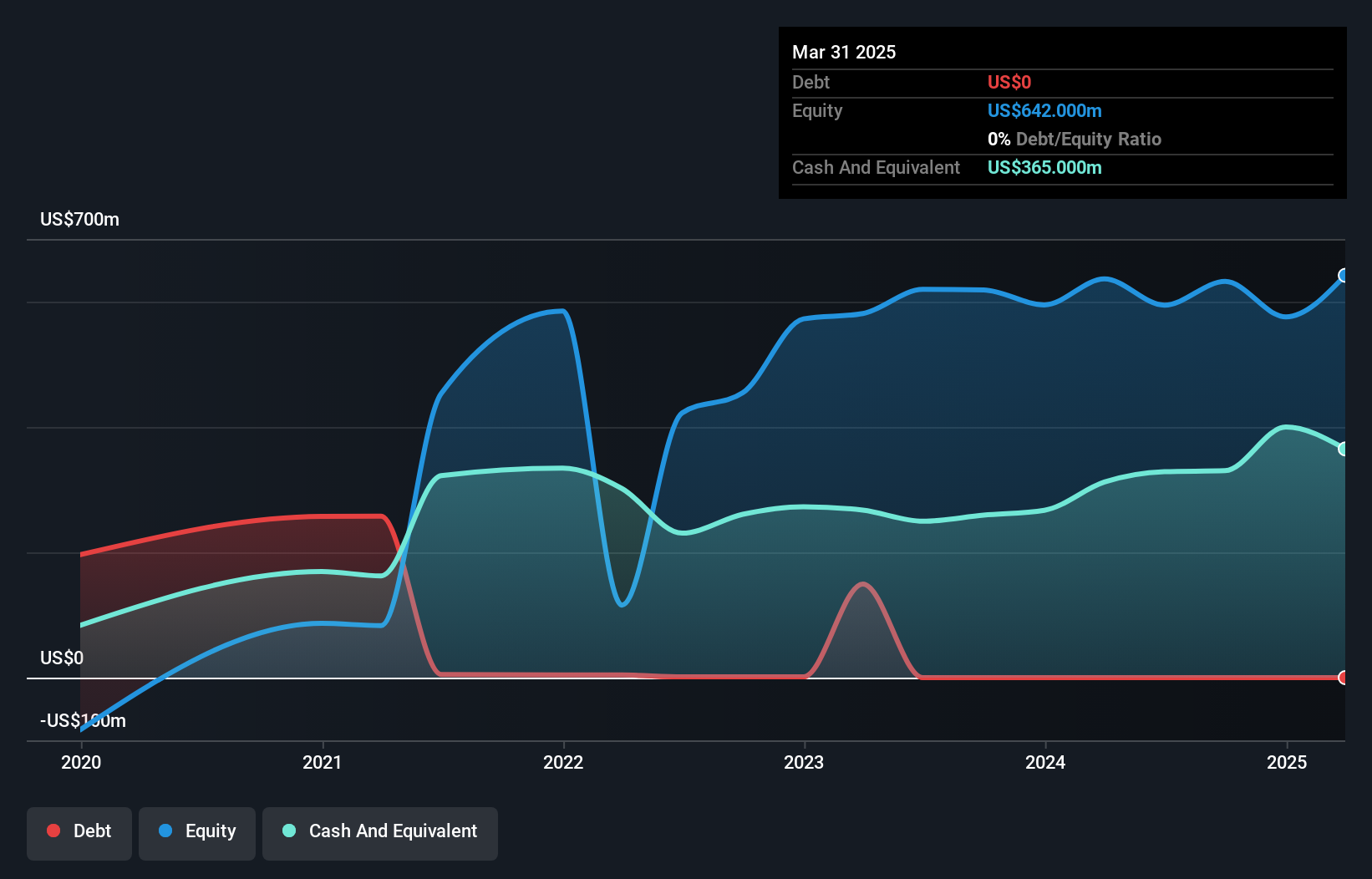

Super Group (SGHC) Limited, with a market cap of €2.10 billion, is navigating the complexities of the penny stock landscape. The company generates substantial revenue from its Spin (€631.82 million) and Betway (€878.98 million) segments, yet faces challenges such as declining profit margins—currently at 0.4% compared to last year's 5.2%. Despite this, SGHC's financial health is supported by assets exceeding liabilities and cash surpassing debt levels. While earnings growth has been negative recently, analysts predict an annual growth rate of 34.81%, reflecting potential for recovery amid its stable management team and acquisition strategies.

- Unlock comprehensive insights into our analysis of Super Group (SGHC) stock in this financial health report.

- Assess Super Group (SGHC)'s future earnings estimates with our detailed growth reports.

Where To Now?

- Unlock more gems! Our US Penny Stocks screener has unearthed 746 more companies for you to explore.Click here to unveil our expertly curated list of 749 US Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Vault Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NRGV

Excellent balance sheet and fair value.