- United States

- /

- Biotech

- /

- NasdaqGS:AMGN

Will FDA Approval of TEZSPIRE for CRSwNP Expand Amgen's (AMGN) Treatment Portfolio and Market Reach?

Reviewed by Sasha Jovanovic

- On October 17, 2025, AstraZeneca and Amgen announced that the US FDA approved TEZSPIRE (tezepelumab-ekko) as the first and only biologic targeting TSLP for add-on maintenance treatment of chronic rhinosinusitis with nasal polyps (CRSwNP) in patients aged 12 and older.

- This milestone broadens TEZSPIRE’s reach beyond severe asthma, addressing a large unmet need for CRSwNP patients who have limited effective long-term options and highlighting ongoing reviews for additional global approvals.

- We’ll explore how expanding TEZSPIRE’s indications could influence Amgen’s portfolio growth and future earnings outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Amgen Investment Narrative Recap

To own Amgen, investors need to believe in its ability to expand through innovation in targeted biologics and pipeline execution, while navigating pricing pressure and biosimilar competition. The recent US approval of TEZSPIRE for CRSwNP highlights new revenue opportunities outside severe asthma, but is unlikely to affect the most immediate risk: mounting biosimilar competition in core franchises and sustained margin pressure from heavy R&D investment.

Among recent announcements, the VESALIUS-CV trial results for Repatha, showing a significant reduction in MACE in high-risk patients, stand out. This reinforces Amgen’s pipeline strength and role in personalized therapies, both of which are critical catalysts supporting the case for future portfolio-driven growth and margin stabilization as the company faces patent losses elsewhere.

However, investors should be aware that while TEZSPIRE's win signals progress, the growing impact of biosimilars remains a risk that could...

Read the full narrative on Amgen (it's free!)

Amgen's narrative projects $37.4 billion in revenue and $8.2 billion in earnings by 2028. This requires 2.3% yearly revenue growth and a $1.6 billion earnings increase from $6.6 billion currently.

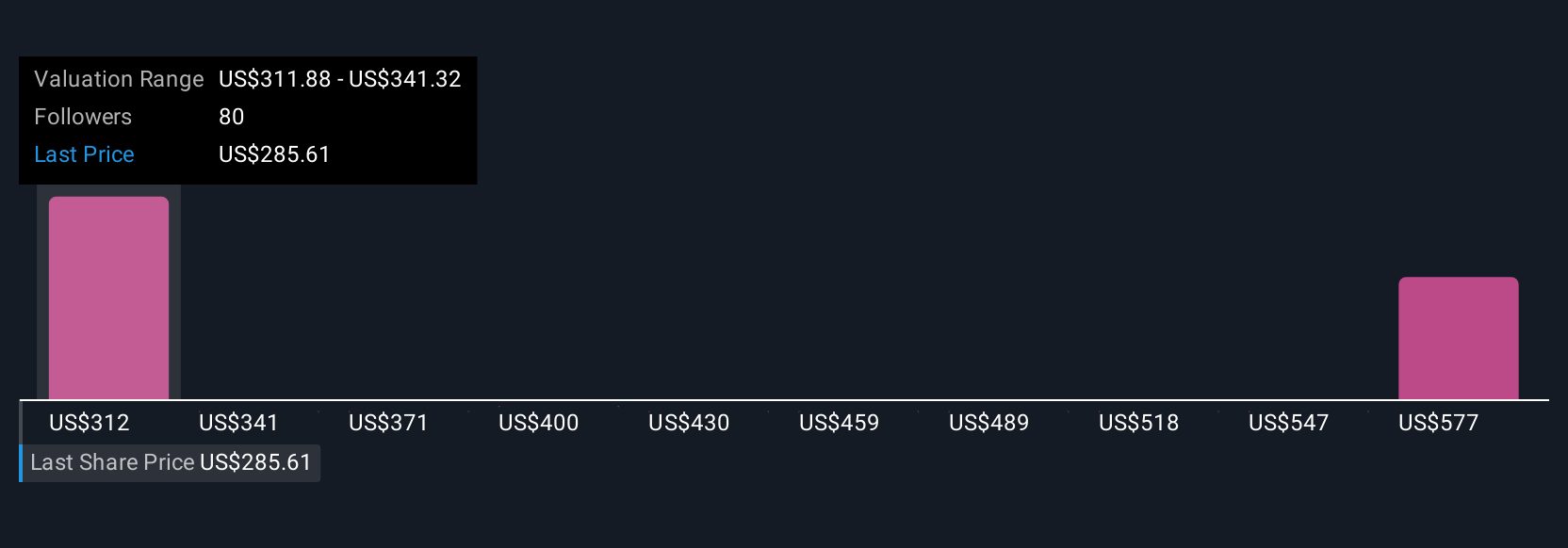

Uncover how Amgen's forecasts yield a $311.88 fair value, a 4% upside to its current price.

Exploring Other Perspectives

While consensus analysts see slow revenue growth ahead, top analysts were forecasting US$42.8 billion in revenue by 2028, anticipating stronger volume-driven gains and margin expansion. Bulls argue Amgen’s global reach and rapid product launches through AI-driven R&D could far outpace today's expectations. These optimistic forecasts show how beliefs about pricing power and biosimilar threats can shift projected outcomes, especially as fresh approvals like TEZSPIRE aren’t yet factored in.

Explore 6 other fair value estimates on Amgen - why the stock might be worth over 2x more than the current price!

Build Your Own Amgen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amgen research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amgen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amgen's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMGN

Amgen

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives