- United States

- /

- Biotech

- /

- NasdaqGS:AMGN

Does Amgen’s Recent 8.7% Surge Signal a Sustainable Opportunity for 2025 Investors?

Reviewed by Bailey Pemberton

Thinking about whether to buy, hold, or sell Amgen? You are not alone. Amgen’s stock has seen its share of action lately, and it is no wonder investors are curious. After a robust run, Amgen closed at $297.89, marking an 8.7% jump in the last week and a 5.0% gain over the past month. If you look further back, the stock is up 14.9% for the year but is still shaking off a 3.0% dip over the last twelve months. Long-term investors, though, are sitting on gains of more than 45% over the last five years.

Many are linking the recent uptick to wider market optimism around large-cap healthcare, especially companies that have shown resilience amid shifting drug pricing policies and ongoing advances in biotech research. For Amgen, that means not just weathering uncertainty, but actually coming out stronger, and the market seems to be rewarding that potential with renewed enthusiasm.

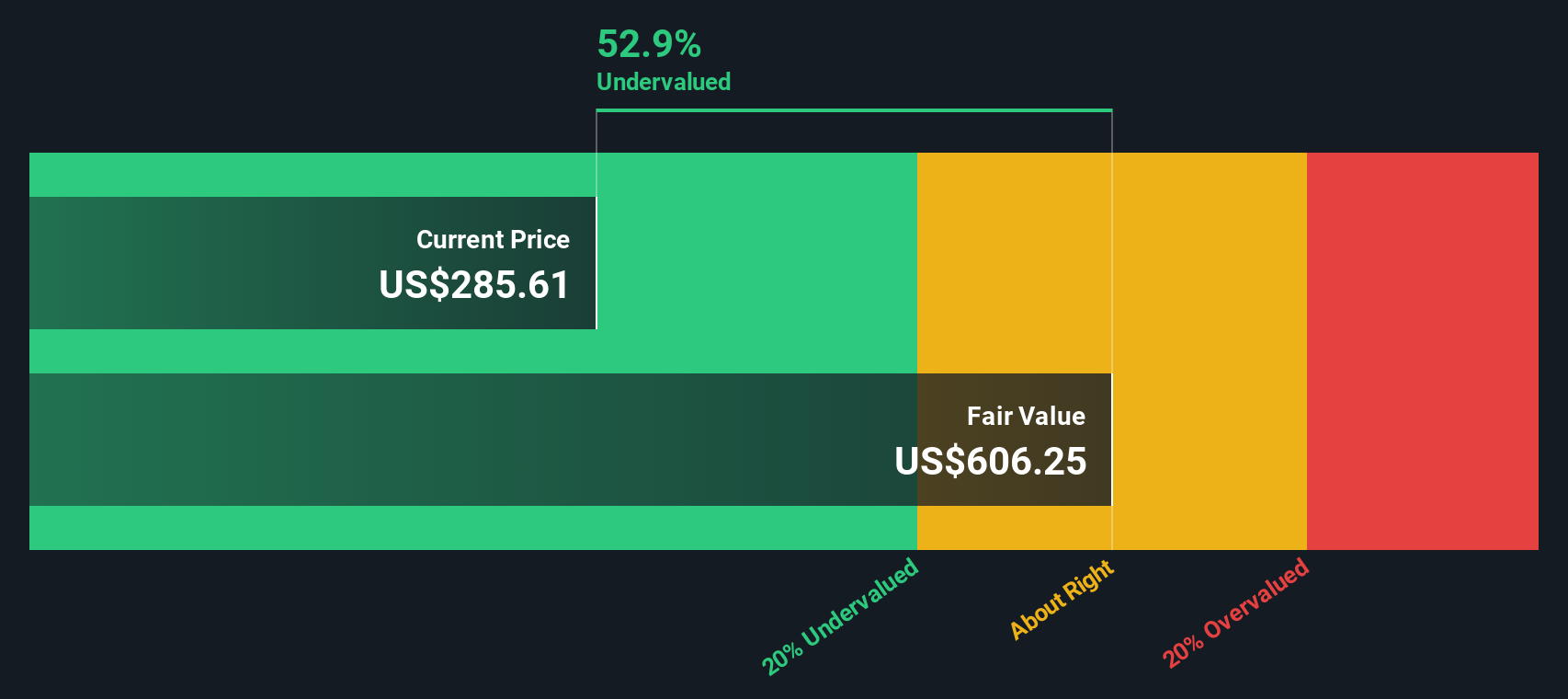

Of course, past performance is only part of the story. Serious investors want to know if Amgen’s current price is actually justified. Is it undervalued, overvalued, or fairly priced compared to its long-term prospects? By crunching the numbers across six recognized valuation checks, Amgen comes away with a value score of 4 out of 6, hinting that it is undervalued in key ways, but not across the board.

Now, let us dig into those valuation methods one by one, and see what they can (and cannot) tell us about Amgen's true worth. Stick around, though, as there is one approach to valuation that might surprise you, and we will get to it after covering the basics.

Why Amgen is lagging behind its peers

Approach 1: Amgen Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular approach for estimating the intrinsic value of a company. It works by taking projections of the company’s future cash flows and discounting them back to today’s dollars, helping investors understand what the business might truly be worth.

For Amgen, the most recent reported Free Cash Flow stands at $10.70 billion. Analysts forecast this figure to keep growing in the coming years, with projections reaching $15.08 billion by the end of 2029. After 2029, further growth estimates are extrapolated to provide a sense of the company’s long-term cash-generating potential. All forecasts are calculated in U.S. dollars.

Based on these projections, the DCF model assigns Amgen a fair value of $586.06 per share. Given that the current share price is $297.89, this signals a notable 49.2% discount and suggests that the stock is significantly undervalued according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amgen is undervalued by 49.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

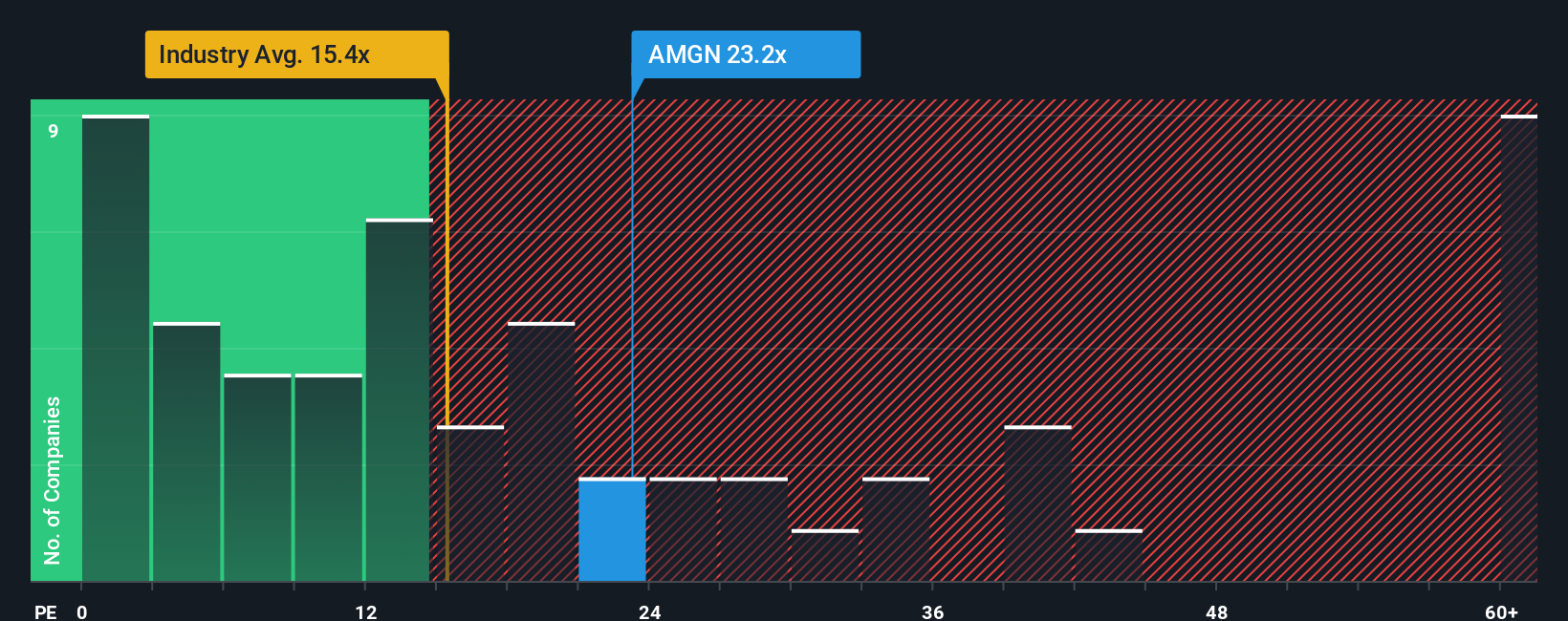

Approach 2: Amgen Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used measure for valuing profitable companies like Amgen because it directly relates the stock price to how much the company earns. Since Amgen consistently generates strong earnings, the PE ratio offers investors a straightforward way to gauge how much they are paying for each dollar of those profits.

What counts as a "normal" or "fair" PE ratio often depends on growth expectations and risk. Companies with higher expected growth or lower risk profiles often justify higher PE ratios. Those facing more uncertainty or slowdowns might trade at lower multiples. For Amgen, the current PE ratio stands at 24.2x, putting it above the average for the Biotechs industry at 16.7x, but below its peer average of 43.9x.

This is where the Simply Wall St "Fair Ratio" comes in. The Fair Ratio, calculated at 25.3x for Amgen, refines conventional metrics by factoring in the company's earnings growth, profit margins, risk profile, industry characteristics, and market cap. Unlike a simple comparison with industry averages or close peers, the Fair Ratio adapts to what matters most for Amgen’s unique standing and prospects.

With Amgen's actual PE ratio of 24.2x sitting just below the Fair Ratio of 25.3x, the stock appears to be trading at about fair value based on this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amgen Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story about a company; it is how you connect the big picture (Amgen's business direction, competitive strengths, and market challenges) with what you believe about future revenues, earnings, and profit margins.

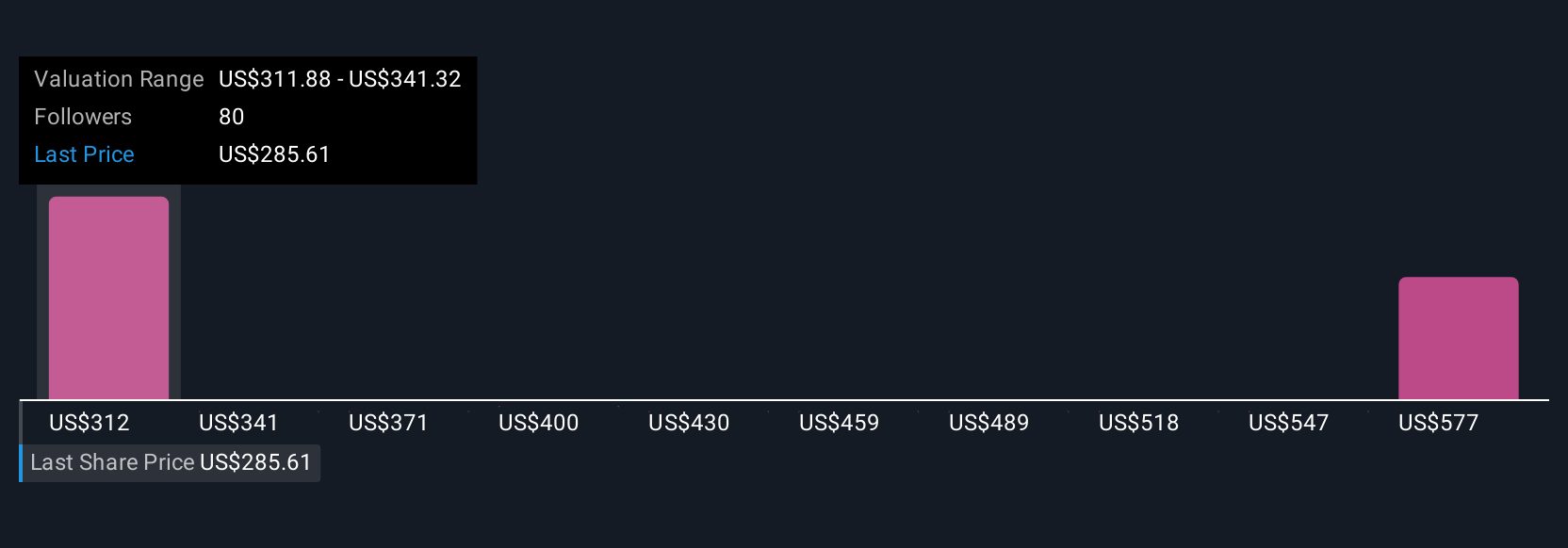

Instead of relying solely on numbers, Narratives help you make sense of a company's financial model by linking your perspective to a concrete financial forecast and then to a fair value estimate. On Simply Wall St’s Community page, millions of investors use Narratives to easily express their assumptions and see how their fair value compares to the current share price, helping them decide whether to buy or sell.

What makes Narratives powerful is that they dynamically update as new news or earnings are reported, so your view stays relevant as conditions change. For example, some investors are optimistic and estimate Amgen’s fair value at $405 if they foresee sustained global growth and margin expansion, while those with a more cautious stance might settle at $219, reflecting concerns about patent expirations and pricing pressure. Narratives make it effortless to see which story about Amgen best matches your view and investment decision.

For Amgen, here are previews of two leading Amgen Narratives:

Fair Value: $404.87

Current Price vs Narrative: 26.4% undervalued

Projected Annual Revenue Growth: 7.1%

- Amgen is positioned to outperform expectations through strong product volume expansion, ongoing AI-driven R&D, and frequent high-impact launches, especially in growth areas like obesity, rare disease, and biosimilars.

- Its resilience to industry pricing pressures, global expansion, and sizable M&A capacity could support sustained earnings growth and a broader market reach.

- Risks include global policy uncertainty, patent expirations, R&D cost escalation, acquisition integration difficulties, and growing biosimilar competition. Analysts with the bullish view consider these factors largely manageable and see upside potential.

Fair Value: $218.89

Current Price vs Narrative: 36.0% overvalued

Projected Annual Revenue Growth: -0.5%

- Amgen's heavy dependence on aging blockbuster drugs and looming patent expirations may lead to ongoing revenue and margin declines, especially as biosimilar and innovative competitor pressures intensify.

- Regulatory scrutiny, global pricing reforms, and rising costs from acquisitions and R&D are expected to limit profitability and challenge the company's ability to generate sustainable long-term growth.

- Even with efforts to grow the late-stage pipeline and improve operational efficiency, the bear case views current market optimism as excessive given the scale of structural headwinds facing Amgen.

Do you think there's more to the story for Amgen? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMGN

Amgen

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives