- United States

- /

- Biotech

- /

- NasdaqGS:AMGN

Amgen (AMGN): Evaluating Valuation After TEZSPIRE Approval and AmgenNow Patient Access Launch

Reviewed by Kshitija Bhandaru

The FDA’s recent approval of TEZSPIRE for chronic rhinosinusitis with nasal polyps marks a high-impact win for Amgen (AMGN). This approval strengthens its respiratory portfolio and signals broader market opportunities ahead.

At the same time, Amgen rolled out AmgenNow, giving U.S. patients access to Repatha at a much lower price. This move could boost uptake and reduce barriers for those without comprehensive insurance. Both announcements highlight the company’s focus on expanding access and addressing unmet treatment needs, a strategy that continues to draw investor attention.

See our latest analysis for Amgen.

Amgen’s recent FDA win for TEZSPIRE and the launch of AmgenNow have fed renewed momentum into the stock, with a 1-month share price return of nearly 9% and a healthy year-to-date gain of 15%. Despite these short-term moves, the 1-year total shareholder return is still negative, though longer-term investors have seen solid rewards. There has been a 30% total return over three years and almost 54% over five years. The recent news may be helping sentiment improve after a sluggish stretch, and it hints at the company’s growth potential as its pipeline and access strategies play out.

If Amgen’s big moves in healthcare have you curious, it’s a great moment to spot what’s next and discover See the full list for free.

With these catalysts driving short-term gains, the big question remains: does Amgen’s current valuation still offer upside for investors, or is the company’s future growth already reflected in its share price?

Most Popular Narrative: 4.2% Undervalued

The most widely followed narrative values Amgen above its recent close, with calculated fair value driven by confidence in future earnings and margin gains. This suggests investors are being presented with a moderate upside, rooted in key pipeline and revenue growth factors.

Advancements in personalized and targeted therapies, reflected in the robust late-stage pipeline (for example, MariTide for obesity and type 2 diabetes, Repatha and olpasiran for cardiovascular, multiple bispecific T-cell engagers for oncology), position Amgen to launch high-margin, first-in-class products that drive both top-line growth and margin expansion in the coming years.

What powers that optimism? The secret sauce behind this fair value is a blend of expanding therapies, aggressive margin expansion claims, and big-bet earnings projections. Want to know how analysts see these coming together for Amgen’s price target? Uncover the unexpected assumptions driving this bold valuation in the full narrative.

Result: Fair Value of $311.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing drug pricing pressures and expanding biosimilar competition could quickly challenge Amgen’s revenue growth and margin expansion if these issues are not effectively managed.

Find out about the key risks to this Amgen narrative.

Another View: What Do Earnings Ratios Reveal?

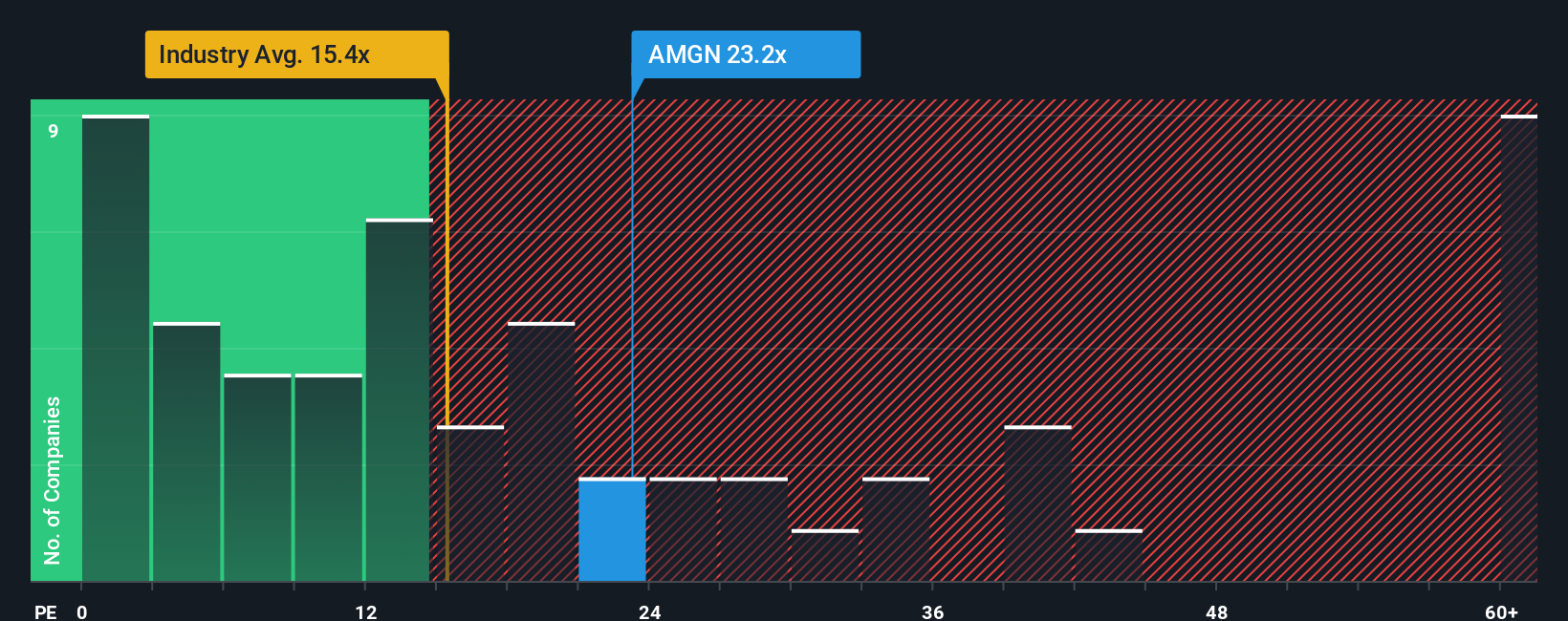

Looking from another angle, Amgen’s price-to-earnings ratio sits at 24.3 times, which is significantly higher than the US Biotechs industry average of 16.4 times, but lower than its peer average of 44 times. It also closely matches the fair ratio of 25.4 times, suggesting less room for upward surprises but potentially mitigating major downside risks. Does this narrower gap mean most positives are already priced in, or could sentiment still shift the story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amgen Narrative

If you see things differently or want to dig into the data yourself, you can craft your personal investment narrative in just a few minutes with Do it your way.

A great starting point for your Amgen research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Ready to seize your next big opportunity? Don’t let a great investment slip through your fingers. Find market standouts backed by proven metrics and innovative trends using these powerful tools:

- Accelerate income potential and secure your portfolio with reliable payers by checking out these 18 dividend stocks with yields > 3% that consistently deliver yields above 3%.

- Capture growth from technological breakthroughs and shape the future by scanning these 24 AI penny stocks where AI-driven companies are making headlines.

- Target tomorrow’s rising stars by uncovering these 3596 penny stocks with strong financials boasting strong financials and resilient fundamentals before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMGN

Amgen

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives