- United States

- /

- Biotech

- /

- NasdaqGS:AMGN

A Closer Look at Amgen (AMGN) Valuation After Its 12-Month 28% Share Price Gain

Reviewed by Simply Wall St

Amgen (AMGN) has quietly delivered a strong year, with the stock up roughly 28% over the past 12 months and about 20% in the past 3 months, outpacing many large-cap healthcare peers.

See our latest analysis for Amgen.

That steady climb in Amgen’s 1 month share price return, up 14.65 percent, and 90 day share price return of 19.93 percent, alongside a 1 year total shareholder return of 28.03 percent, suggests positive momentum is building as investors warm to its growth and earnings outlook.

If Amgen’s run has you thinking more broadly about opportunities in healthcare, it could be a good moment to explore other healthcare stocks that the market may be overlooking.

With the shares near record highs and trading above some analyst targets but still showing a hefty intrinsic discount, the key question now is whether Amgen is genuinely undervalued or whether the market has already priced in its next leg of growth.

Most Popular Narrative Narrative: 5.4% Overvalued

Compared with the most followed fair value estimate of about $322.88, Amgen’s last close at $340.16 implies investors are already paying a premium for its future growth path.

Advancements in personalized and targeted therapies, reflected in the robust late-stage pipeline (e.g., MariTide for obesity/type 2 diabetes, Repatha and olpasiran for cardiovascular, multiple bispecific T cell engagers for oncology), position Amgen to launch high margin, first in class products that drive both top line growth and margin expansion in the coming years.

Curious which future revenue mix, margin uplift, and earnings power justify paying above today’s price? The narrative hinges on a bold, tightly modeled profit roadmap.

Result: Fair Value of $322.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting drug pricing pressure and accelerating biosimilar competition could quickly erode margins and challenge the optimistic profit roadmap that underpins this valuation.

Find out about the key risks to this Amgen narrative.

Another View: Multiples Point to More Room

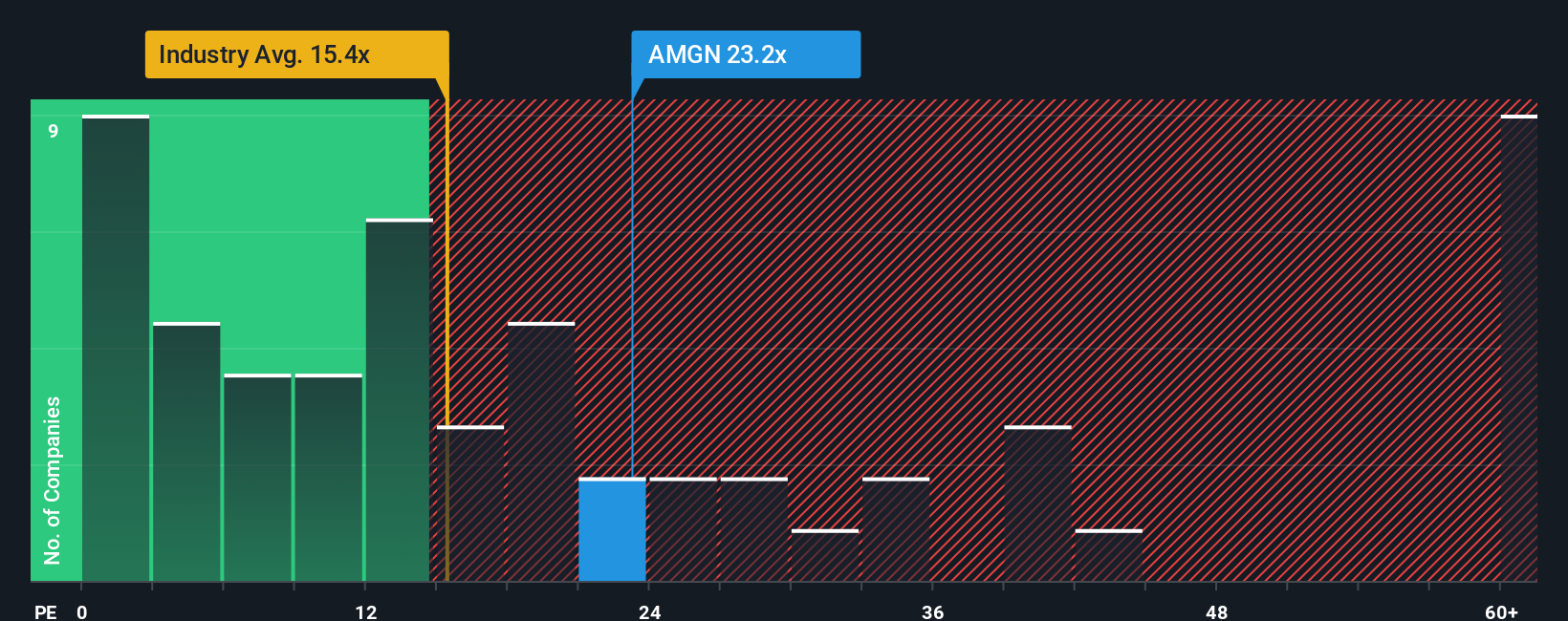

While the popular narrative calls Amgen around 5 percent overvalued, its 26.1 times earnings looks cheaper than the peer average of 59.7 times and below a 29.6 times fair ratio, even if it is richer than the 19.3 times industry level. Is that a justified premium or creeping risk?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amgen for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amgen Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a personalized perspective in just minutes: Do it your way.

A great starting point for your Amgen research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Put your research momentum to work now, or risk missing the next opportunity, by scanning targeted stock ideas tailored to different strategies and risk levels.

- Capitalize on potential mispricings by reviewing these 907 undervalued stocks based on cash flows that may be trading below their intrinsic worth based on future cash flows.

- Target income and stability by focusing on these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash generation.

- Ride high growth themes by zeroing in on these 26 AI penny stocks positioned at the forefront of transformative innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMGN

Amgen

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026