- United States

- /

- Biotech

- /

- NasdaqGM:ALVO

EMA Recommendations for AVT03 and Gobivaz Could Be a Game Changer for Alvotech (ALVO)

Reviewed by Sasha Jovanovic

- In September 2025, Alvotech and its partners announced that the European Medicines Agency's CHMP had adopted positive opinions recommending approval for two key biosimilars: AVT03 (denosumab) and Gobivaz (golimumab), which target osteoporosis and inflammatory diseases, respectively.

- These regulatory milestones further solidify Alvotech's expanding network of commercial partnerships across Europe, strengthening its foundation for greater market access and future revenue opportunities in the biosimilar market.

- We'll explore how these EMA recommendations for AVT03 and Gobivaz support Alvotech's broader growth prospects and partnership-driven expansion.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Alvotech Investment Narrative Recap

To be an Alvotech shareholder, you need to believe in the company’s ability to rapidly bring biosimilars to market and secure commercial partnerships that drive approvals, especially in major global regions. The recent EMA committee recommendations for AVT03 and Gobivaz are significant, offering important validation for Alvotech’s portfolio and strengthening its short-term regulatory catalyst; however, the central risk remains the “lumpy” and unpredictable revenue linked to regulatory milestones, which this news helps but does not fully remove.

Of the recent updates, the CHMP positive opinion on AVT03, Alvotech’s proposed biosimilar to Prolia and Xgeva, stands out as particularly relevant. With Alvotech’s network of commercial partners like STADA and Dr. Reddy’s poised to launch the product across Europe, this development reinforces the near-term catalyst for market access, though it also highlights the company’s ongoing reliance on timely regulatory actions to meet revenue forecasts.

However, investors should also keep in mind that if future product approvals are delayed or regulatory timelines change...

Read the full narrative on Alvotech (it's free!)

Alvotech's narrative projects $1.4 billion revenue and $538.9 million earnings by 2028. This requires 36.7% yearly revenue growth and a $475.5 million earnings increase from $63.4 million today.

Uncover how Alvotech's forecasts yield a $17.50 fair value, a 110% upside to its current price.

Exploring Other Perspectives

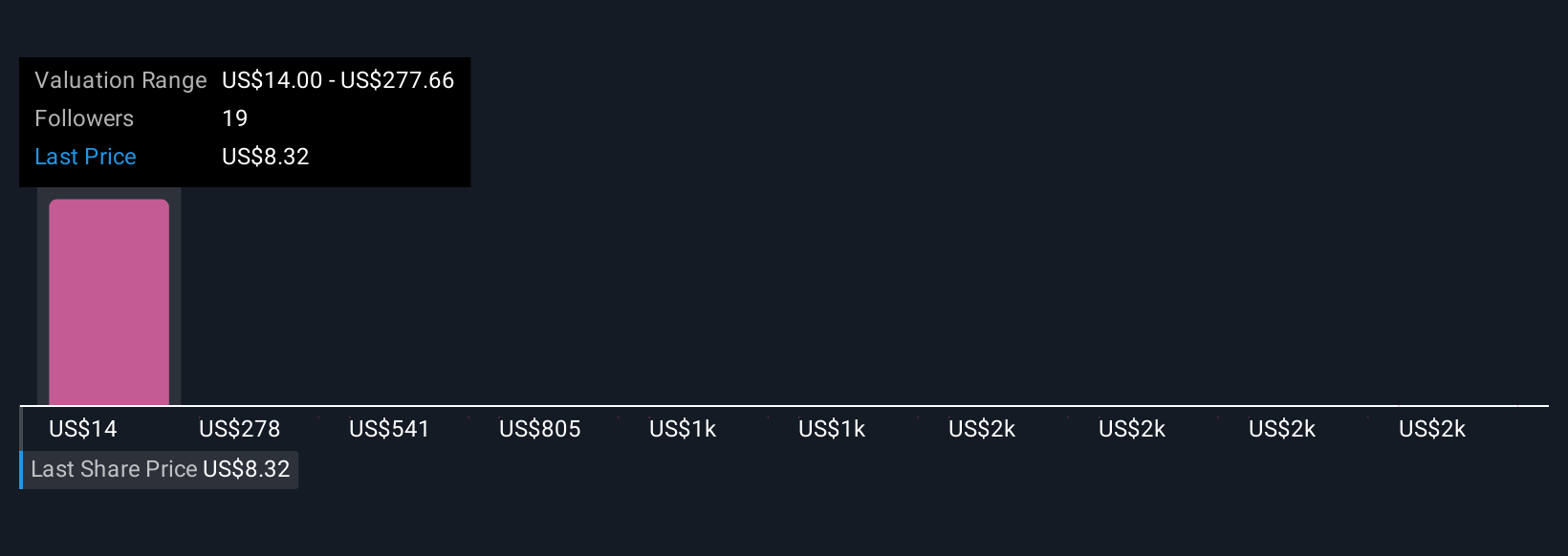

Six members of the Simply Wall St Community placed fair value estimates for Alvotech stock ranging from US$14 to US$2,650.56. Given the company’s revenue still heavily depends on regulatory milestones, it is clear views on Alvotech’s prospects differ significantly, consider reviewing multiple community insights before making any moves.

Explore 6 other fair value estimates on Alvotech - why the stock might be a potential multi-bagger!

Build Your Own Alvotech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alvotech research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Alvotech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alvotech's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ALVO

Alvotech

Through its subsidiaries, develops and manufactures biosimilar medicines for patients worldwide.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives