- United States

- /

- Biotech

- /

- NasdaqGS:ALNY

A Fresh Look at Alnylam Pharmaceuticals (ALNY) Valuation Following Strong Pipeline Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Alnylam Pharmaceuticals.

Alnylam Pharmaceuticals’ share price has nearly doubled year-to-date, gaining 106% as investors respond to a string of positive pipeline updates and renewed optimism around RNA-based therapies. Momentum has built rapidly, with a 50% share price return over the past three months. The one-year total shareholder return stands at 63%, indicating strong longer-term performance beyond this recent rally.

If you're intrigued by how quickly sentiment and opportunity can shift in healthcare, it might be time to explore See the full list for free.

With Alnylam shares riding a dramatic wave higher, investors must now ask whether the remarkable run is justified by fundamentals or if future growth is already reflected in the lofty valuation, leaving little room for upside.

Most Popular Narrative: 6.6% Overvalued

With Alnylam Pharmaceutical’s fair value set at $451.68 compared to the last close of $481.67, the most popular narrative sees the shares recently surpassing what consensus considers a justifiable price.

*Advancements in Alnylam's pipeline (e.g., fast-tracked nucresiran for ATTR-CM, mivelsiran in Alzheimer's, new programs in diabetes and bleeding disorders) demonstrate increasing R&D efficiency and accelerate time to market, potentially driving future step-function increases in both revenue and operational leverage as more assets advance or launch.*

What radical financial projections are hiding behind this bold price? This narrative is betting on rapid pipeline breakthroughs and profits to rival industry leaders. Curious what numbers support such a premium? Dive in to discover how the story unfolds beneath the surface.

Result: Fair Value of $451.68 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competitive pressures and potential declines in gross margin could quickly challenge the bullish outlook and test whether Alnylam’s projected growth is truly sustainable.

Find out about the key risks to this Alnylam Pharmaceuticals narrative.

Another View: Discounted Cash Flow Contradicts Multiples

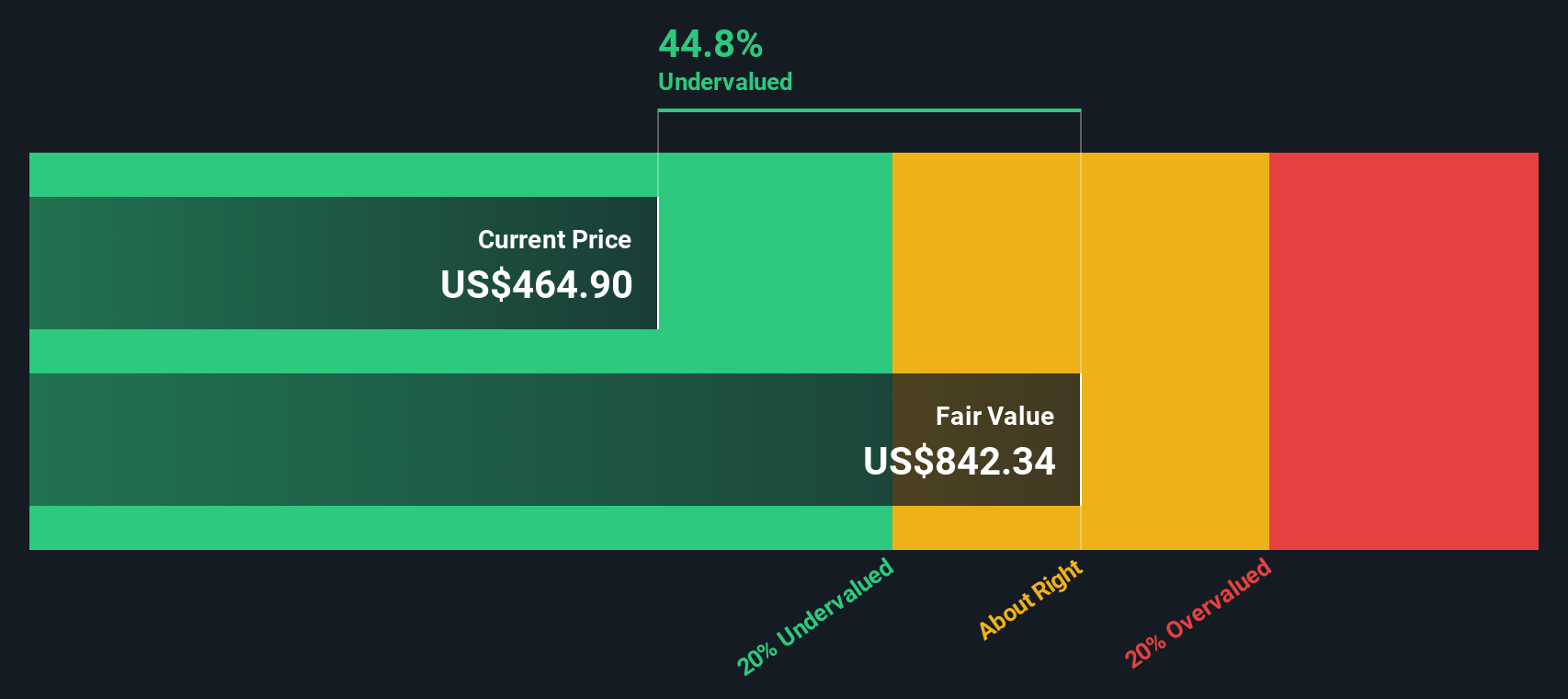

While the most common valuation approach suggests Alnylam is overvalued based on consensus price targets and traditional multiples, our SWS DCF model tells a very different story. According to these cash flow projections, Alnylam is actually trading well below its estimated fair value of $891.04, which points to deep undervaluation.

Look into how the SWS DCF model arrives at its fair value.

Which approach will ultimately carry more weight as results unfold and the market reassesses? The contrast leaves investors with more questions to explore.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alnylam Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alnylam Pharmaceuticals Narrative

If you find yourself questioning these conclusions or want to interpret the story through your own lens, you can craft your personal analysis in just a few minutes. Do it your way

A great starting point for your Alnylam Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never put all their eggs in one basket. Move quickly to pinpoint fresh opportunities before the crowd catches up by using these unique stock screens:

- Target steady returns by scanning these 18 dividend stocks with yields > 3% with yields above 3%. This approach helps ensure your portfolio benefits from consistent income in any market environment.

- Ride the next wave of innovation and gain unique exposure to disruptive tech by checking out these 24 AI penny stocks, a selection of companies powering the future of artificial intelligence.

- Uncover potential hidden gems by evaluating these 3592 penny stocks with strong financials with robust financials. These companies may deliver outsized growth as they gain wider attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALNY

Alnylam Pharmaceuticals

Alnylam Pharmaceuticals, Inc. discovers, develops, and commercializes therapeutics based on ribonucleic acid interference.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives