- United States

- /

- Biotech

- /

- NasdaqGS:ALKS

Is Alkermes (NASDAQ:ALKS) Using Debt Sensibly?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Alkermes plc (NASDAQ:ALKS) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Alkermes

How Much Debt Does Alkermes Carry?

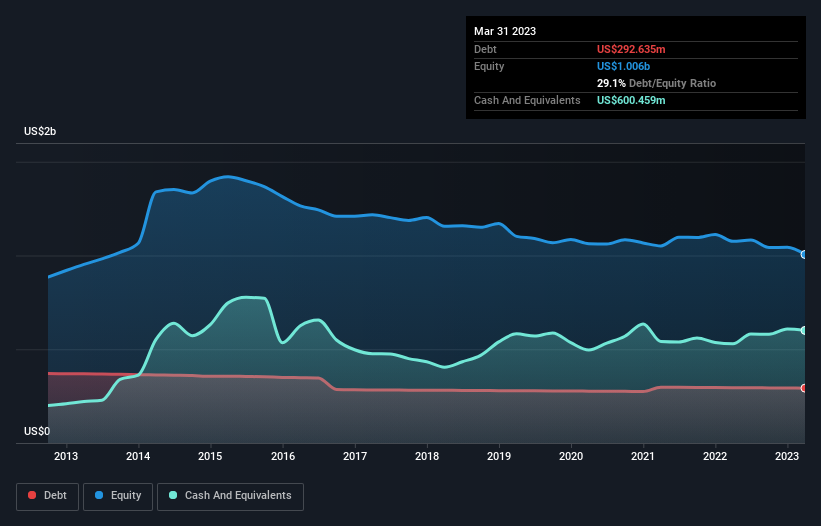

As you can see below, Alkermes had US$292.6m of debt, at March 2023, which is about the same as the year before. You can click the chart for greater detail. However, its balance sheet shows it holds US$600.5m in cash, so it actually has US$307.8m net cash.

How Healthy Is Alkermes' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Alkermes had liabilities of US$492.9m due within 12 months and liabilities of US$424.2m due beyond that. Offsetting these obligations, it had cash of US$600.5m as well as receivables valued at US$277.6m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$39.1m.

Having regard to Alkermes' size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the US$5.06b company is short on cash, but still worth keeping an eye on the balance sheet. While it does have liabilities worth noting, Alkermes also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Alkermes's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Alkermes had a loss before interest and tax, and actually shrunk its revenue by 6.7%, to US$1.1b. That's not what we would hope to see.

So How Risky Is Alkermes?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that Alkermes had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through US$59m of cash and made a loss of US$164m. While this does make the company a bit risky, it's important to remember it has net cash of US$307.8m. That means it could keep spending at its current rate for more than two years. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. For riskier companies like Alkermes I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ALKS

Alkermes

A biopharmaceutical company, engages in the research, development, and commercialization of pharmaceutical products to address unmet medical needs of patients in therapeutic areas in the United States, Ireland, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Circle Internet Group (CRCL): The Programmable Dollar Powerhouse – Post-IPO Momentum and Stablecoin Dominance.

TTM Technologies (TTMI): The Backbone of the AI Tsunami and Defense Modernization.

Bloom Energy Corp (BE): The AI "Bridge-to-Power" – Scaling to 2GW Capacity for the Next-Gen Data Center.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026