- United States

- /

- Biotech

- /

- NasdaqCM:ALGS

Aligos Therapeutics, Inc.'s (NASDAQ:ALGS) 27% Dip In Price Shows Sentiment Is Matching Revenues

Aligos Therapeutics, Inc. (NASDAQ:ALGS) shares have had a horrible month, losing 27% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 45% share price drop.

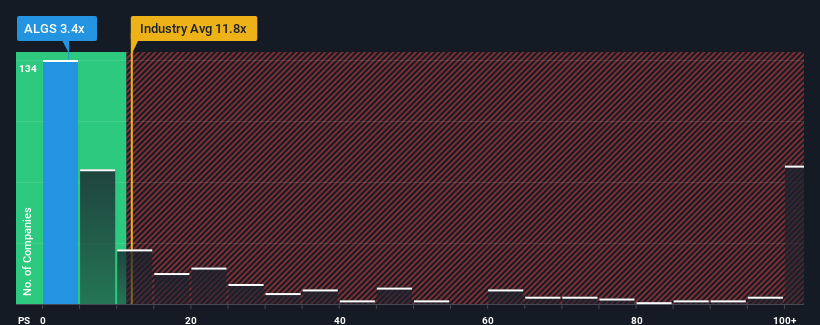

After such a large drop in price, Aligos Therapeutics' price-to-sales (or "P/S") ratio of 3.4x might make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 11.8x and even P/S above 67x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Aligos Therapeutics

How Has Aligos Therapeutics Performed Recently?

Aligos Therapeutics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Aligos Therapeutics.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Aligos Therapeutics' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 1.9% decrease to the company's top line. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Turning to the outlook, the next three years should generate growth of 2.9% per year as estimated by the two analysts watching the company. With the industry predicted to deliver 209% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Aligos Therapeutics' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Having almost fallen off a cliff, Aligos Therapeutics' share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Aligos Therapeutics maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

You need to take note of risks, for example - Aligos Therapeutics has 4 warning signs (and 1 which is significant) we think you should know about.

If these risks are making you reconsider your opinion on Aligos Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ALGS

Aligos Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development of novel therapeutics to address unmet medical needs in viral and liver diseases.

Flawless balance sheet moderate.

Market Insights

Community Narratives