- United States

- /

- Biotech

- /

- NasdaqCM:ALDX

High Growth Tech Stocks In The US Market With Promising Potential

Reviewed by Simply Wall St

Amid a backdrop of record highs in major stock indexes and anticipation surrounding the Federal Reserve's interest rate decisions, the U.S. market is witnessing a dynamic phase where tech stocks are capturing significant attention. In this environment, identifying high growth potential often involves looking at companies that can leverage technological advancements like AI to drive innovation and expansion.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 10.51% | 20.66% | ★★★★★☆ |

| Palantir Technologies | 25.12% | 31.65% | ★★★★★★ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Workday | 11.20% | 32.07% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.92% | 73.80% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

| Circle Internet Group | 27.53% | 82.41% | ★★★★★☆ |

| Zscaler | 15.74% | 40.94% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Aldeyra Therapeutics (ALDX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aldeyra Therapeutics, Inc. is a biotechnology company focused on discovering and developing therapies for immune-mediated and metabolic diseases, with a market cap of $314.64 million.

Operations: Aldeyra Therapeutics focuses on developing therapies for immune-mediated and metabolic diseases. The company operates within the biotechnology sector, with a market capitalization of $314.64 million.

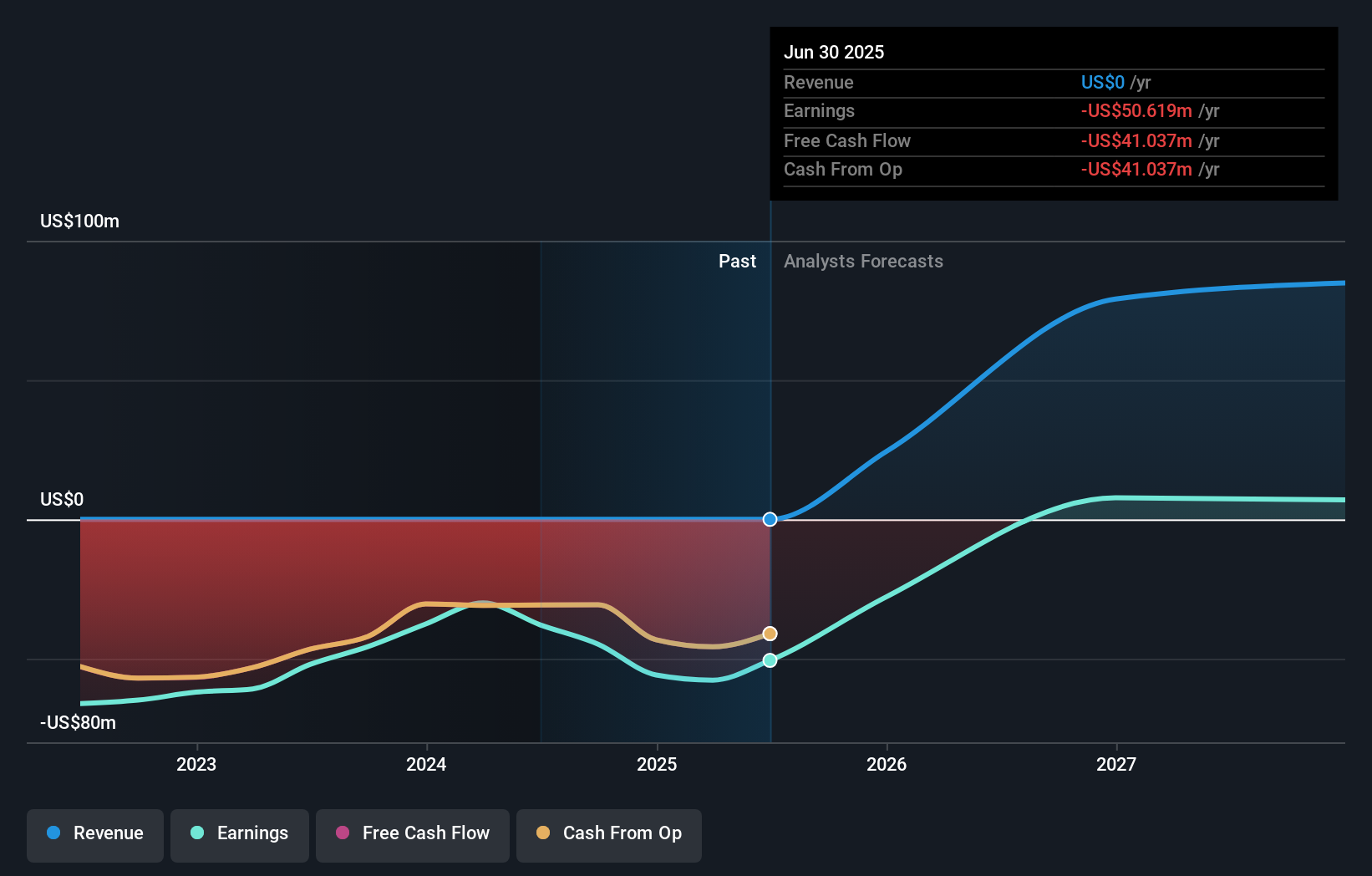

Aldeyra Therapeutics, a biotech firm focusing on novel therapeutic approaches, recently showcased its RASP modulator's potential in treating alcohol-associated hepatitis and dry AMD, with promising Phase 2 results and updates on IND applications slated for 2026. This progress highlights the company's strategic pivot towards addressing complex diseases through protein system modulation, aiming to optimize treatment efficacy while minimizing toxicity. Despite being unprofitable currently, Aldeyra is anticipated to transition into profitability within three years, driven by an aggressive R&D strategy that aligns with its revenue growth forecast of 42.9% annually and earnings growth expected at 73.8% per year. This positions Aldeyra uniquely within the high-stakes biotech sector as it navigates from clinical trials to potential market breakthroughs.

Canaan (CAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Canaan Inc. is involved in the research, development, design, and sale of integrated circuits (IC) and leases mining equipment for bitcoin mining in China, with a market cap of approximately $886.42 million.

Operations: The company generates revenue primarily through the sale of semiconductors, which amounted to $345.36 million. The business model focuses on integrating IC products for bitcoin mining and related components in China.

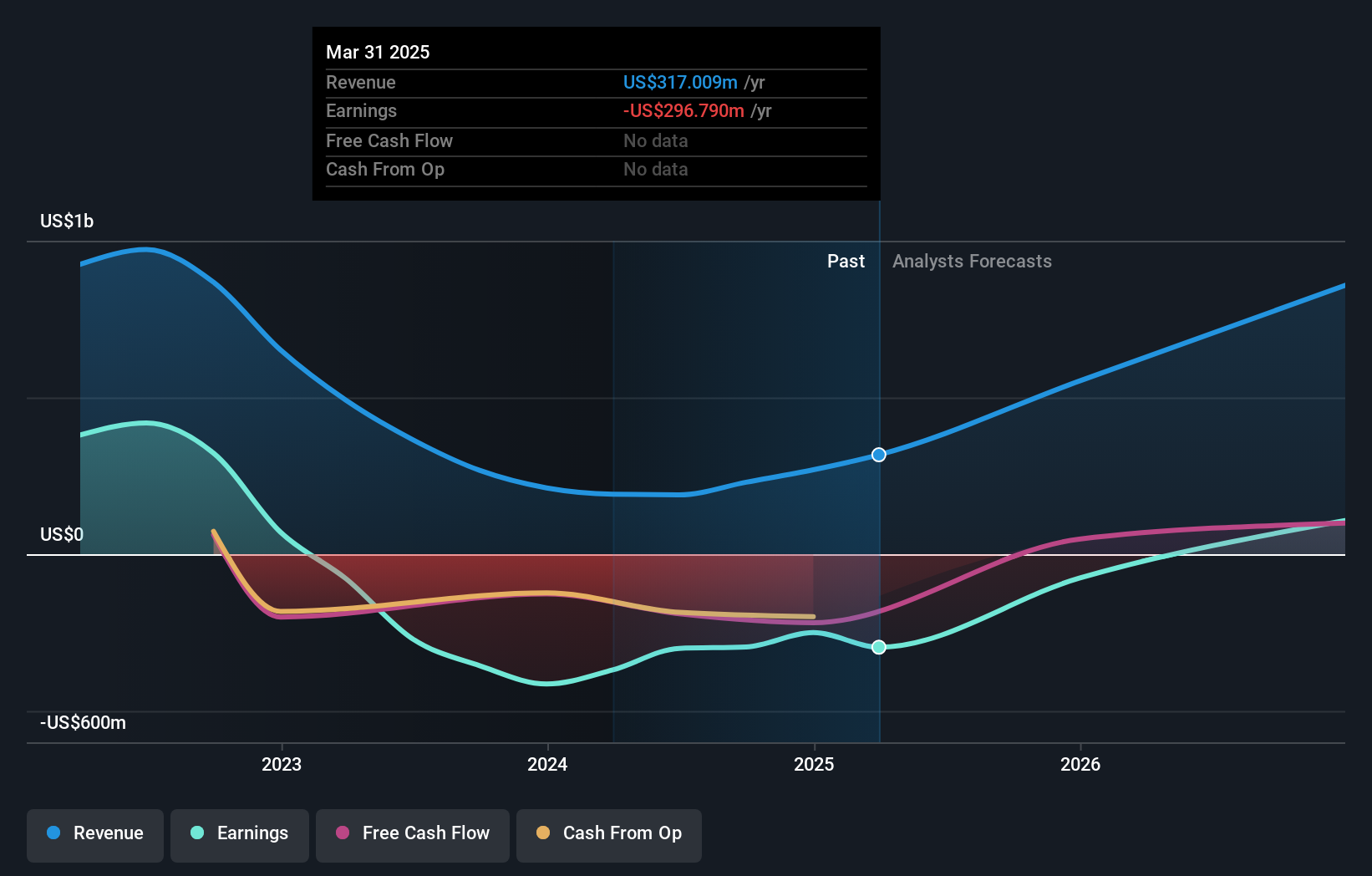

Canaan Inc., a trailblazer in the blockchain and AI sector, recently spotlighted its innovative strides with the launch of the Avalon A16 series at the Blockchain Life 2025 summit. This new model, boasting a hash rate of 300 TH/s and power efficiency of 12.8 J/TH, sets a new benchmark in mining technology. Further solidifying its market position, Canaan announced a significant equity offering aimed at raising $270 million to fuel its expansion plans. These strategic moves underscore Canaan's robust growth trajectory in tech innovation, with an annual revenue surge anticipated at 37% and earnings expected to skyrocket by approximately 138.6% annually. Amidst these advancements, Canaan remains committed to enhancing its global footprint and operational agility through strategic partnerships and product diversification.

- Click to explore a detailed breakdown of our findings in Canaan's health report.

Explore historical data to track Canaan's performance over time in our Past section.

AvePoint (AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AvePoint, Inc. offers a cloud-native data management software platform across North America, Europe, the Middle East, Africa, and the Asia Pacific with a market capitalization of $3.16 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to $373.07 million.

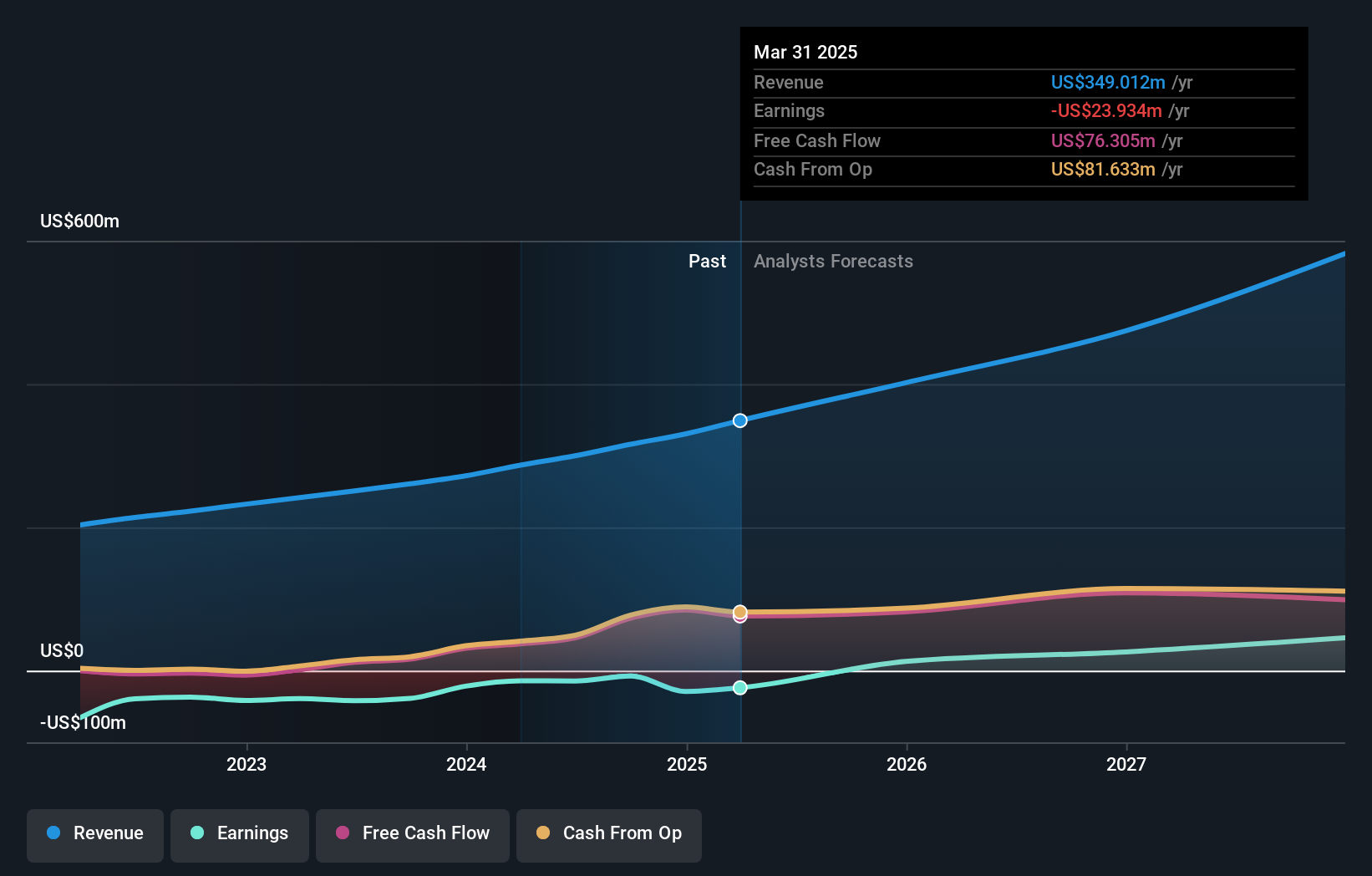

AvePoint's strategic partnership with the International Association of Microsoft Channel Partners (IAMCP) marks a significant step in expanding its service capabilities across a global network, enhancing its position in the tech industry. This alliance not only broadens AvePoint’s reach but also leverages its innovative AvePoint Elements and Partner Program to meet growing demands for IT services and AI-driven solutions. Additionally, the recent enhancements to AvePoint’s Confidence Platform, including new data protection solutions and an Operational Efficiency Command Center, underscore its commitment to advancing data governance and security. These developments are pivotal as they align with trends towards increased SaaS application usage and multi-cloud environments, positioning AvePoint at the forefront of addressing complex IT challenges while fostering substantial growth in operational efficiency and partner engagement.

- Delve into the full analysis health report here for a deeper understanding of AvePoint.

Gain insights into AvePoint's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 69 more companies for you to explore.Click here to unveil our expertly curated list of 72 US High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ALDX

Aldeyra Therapeutics

A biotechnology company, discovers and develops therapies designed to treat immune-mediated and metabolic diseases.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives