- United States

- /

- Biotech

- /

- NasdaqCM:ALBO

Some Shareholders May find It Hard To Increase Albireo Pharma, Inc.'s (NASDAQ:ALBO) CEO Compensation This Year

The anaemic share price growth at Albireo Pharma, Inc. (NASDAQ:ALBO) over the past few years has probably not impressed shareholders and may be due to earnings not growing over that period. Some of these issues will occupy shareholders' minds as the AGM rolls around on 17 June 2021. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

View our latest analysis for Albireo Pharma

How Does Total Compensation For Ron Cooper Compare With Other Companies In The Industry?

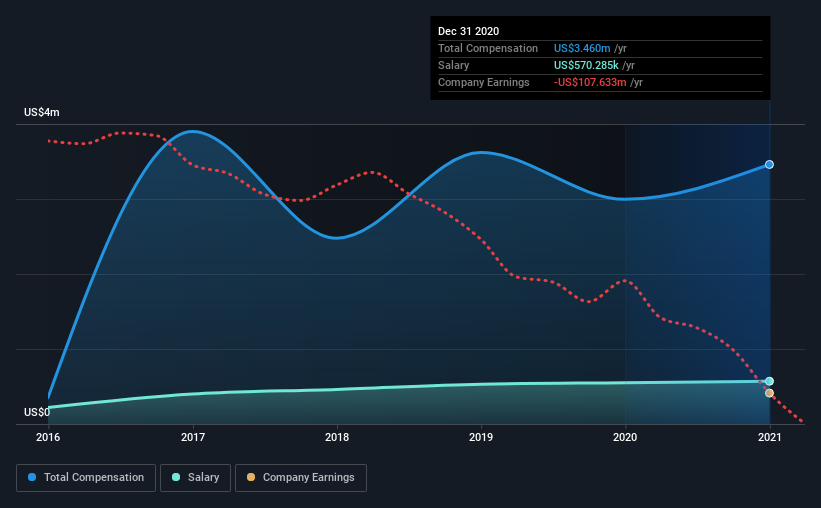

According to our data, Albireo Pharma, Inc. has a market capitalization of US$627m, and paid its CEO total annual compensation worth US$3.5m over the year to December 2020. We note that's an increase of 16% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$570k.

In comparison with other companies in the industry with market capitalizations ranging from US$400m to US$1.6b, the reported median CEO total compensation was US$3.2m. From this we gather that Ron Cooper is paid around the median for CEOs in the industry. What's more, Ron Cooper holds US$326k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$570k | US$551k | 16% |

| Other | US$2.9m | US$2.4m | 84% |

| Total Compensation | US$3.5m | US$3.0m | 100% |

Talking in terms of the industry, salary represented approximately 20% of total compensation out of all the companies we analyzed, while other remuneration made up 80% of the pie. Albireo Pharma pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Albireo Pharma, Inc.'s Growth

Over the last three years, Albireo Pharma, Inc. has shrunk its earnings per share by 30% per year. It saw its revenue drop 18% over the last year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Albireo Pharma, Inc. Been A Good Investment?

Albireo Pharma, Inc. has generated a total shareholder return of 0.5% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

The flat share price growth combined with the the fact that earnings have failed to grow makes us wonder whether the share price will have any further strong momentum. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 2 warning signs for Albireo Pharma that investors should be aware of in a dynamic business environment.

Important note: Albireo Pharma is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Albireo Pharma or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:ALBO

Albireo Pharma

Albireo Pharma, Inc., a commercial-stage biopharmaceutical company, focuses on the development and commercialization of novel bile acid modulators to treat orphan pediatric liver diseases and other liver or gastrointestinal diseases and disorders.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives