- United States

- /

- Life Sciences

- /

- NasdaqGS:AKYA

Investors Continue Waiting On Sidelines For Akoya Biosciences, Inc. (NASDAQ:AKYA)

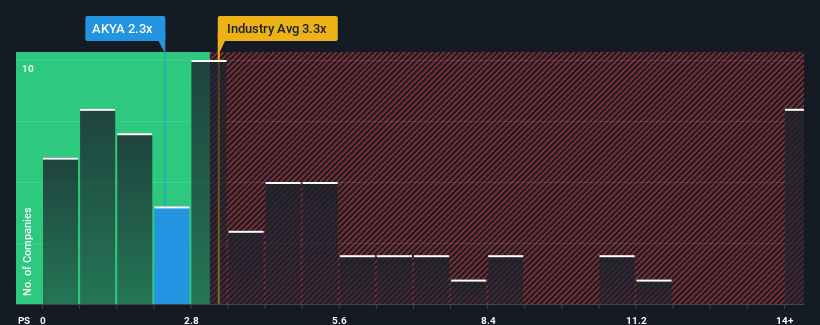

With a price-to-sales (or "P/S") ratio of 2.3x Akoya Biosciences, Inc. (NASDAQ:AKYA) may be sending bullish signals at the moment, given that almost half of all the Life Sciences companies in the United States have P/S ratios greater than 3.3x and even P/S higher than 6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Akoya Biosciences

What Does Akoya Biosciences' P/S Mean For Shareholders?

Akoya Biosciences certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Akoya Biosciences' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Akoya Biosciences?

Akoya Biosciences' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 29% last year. The strong recent performance means it was also able to grow revenue by 128% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 19% per year as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 7.0% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Akoya Biosciences' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Akoya Biosciences' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems Akoya Biosciences currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you take the next step, you should know about the 2 warning signs for Akoya Biosciences that we have uncovered.

If these risks are making you reconsider your opinion on Akoya Biosciences, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AKYA

Akoya Biosciences

A life sciences technology company, provides spatial biology solutions for transforming discovery, clinical research, and diagnostics in North America, the Asia-Pacific, Europe, the Middle East, and Africa.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives