- United States

- /

- Biotech

- /

- NasdaqGS:SYRE

If You Had Bought Aeglea BioTherapeutics Stock A Year Ago, You Could Pocket A 29% Gain Today

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can significantly boost your returns by picking above-average stocks. To wit, the Aeglea BioTherapeutics, Inc. (NASDAQ:AGLE) share price is 29% higher than it was a year ago, much better than the market return of around 4.3% in the same period. If it can keep that out-performance up over the long term, investors will do very well! Note that businesses generally develop over the long term, so it the returns over the last year might not reflect a long term trend.

View our latest analysis for Aeglea BioTherapeutics

Aeglea BioTherapeutics isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't yet make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Aeglea BioTherapeutics saw its revenue grow by 8.0%. That's not great considering the company is losing money. In keeping with the revenue growth, the share price gained 29% in that time. While not a huge gain tht seems pretty reasonable. It could be worth keeping an eye on this one, especially if growth accelerates.

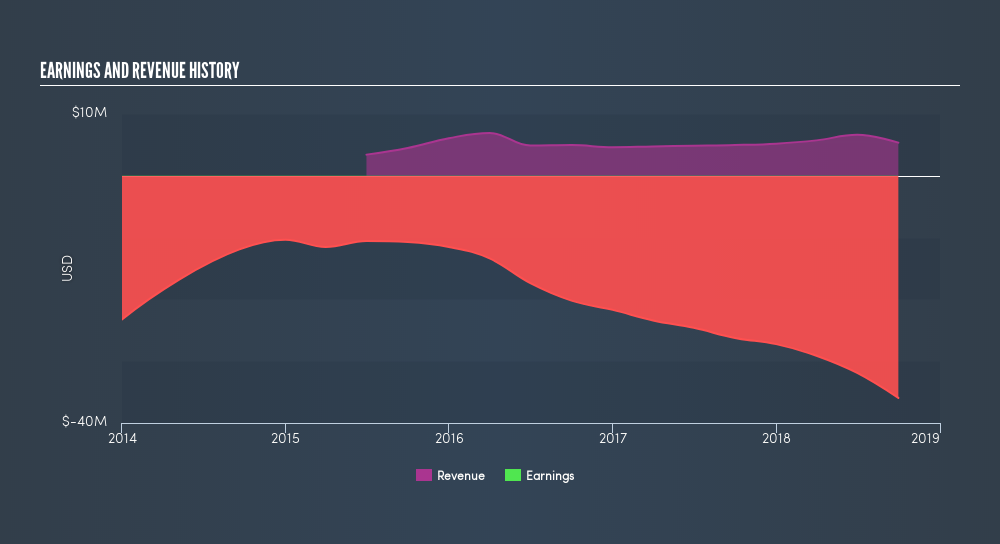

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

A Different Perspective

It's nice to see that Aeglea BioTherapeutics shareholders have gained 29% over the last year. That's better than the more recent three month gain of 2.5%, implying that share price has plateaued recently. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). If you would like to research Aeglea BioTherapeutics in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: Aeglea BioTherapeutics may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:SYRE

Spyre Therapeutics

A clinical stage biotechnology company, focuses on developing therapeutics for patients living with inflammatory bowel disease (IBD).

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026