- United States

- /

- Biotech

- /

- NasdaqGS:AGIO

How Positive CHMP Opinion and European Deal for PYRUKYND May Impact Agios Pharmaceuticals (AGIO) Investors

Reviewed by Sasha Jovanovic

- Agios Pharmaceuticals recently announced that the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency adopted a positive opinion for a new indication of PYRUKYND® (mitapivat) for treating anemia in adults with alpha- or beta-thalassemia, with the final European Commission decision expected by early 2026.

- The company also disclosed an exclusive commercialization agreement with Avanzanite Bioscience to distribute PYRUKYND across the European Economic Area, the United Kingdom, and Switzerland, expanding its reach in the rare disease market pending regulatory approval.

- We'll examine how the positive CHMP opinion for PYRUKYND in thalassemia could shift Agios Pharmaceuticals' investment narrative and growth outlook.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Agios Pharmaceuticals Investment Narrative Recap

Shareholders in Agios Pharmaceuticals are typically focused on the commercial trajectory of PYRUKYND, particularly as it expands into new indications such as thalassemia. The recent positive CHMP opinion for PYRUKYND in Europe marks an encouraging regulatory step, but short-term catalysts remain linked to U.S. FDA actions and commercial uptake, while revenue and earnings are still vulnerable to regulatory and adoption risks across markets.

Among recent developments, the FDA's decision in September to extend the review period for PYRUKYND in thalassemia is most relevant. Although this decision is not based on new safety or efficacy data, it adds a degree of timing uncertainty around a key growth catalyst in the U.S. and may influence expectations for near-term revenue acceleration.

However, investors should not overlook the challenges around persistent operating losses and the impact of...

Read the full narrative on Agios Pharmaceuticals (it's free!)

Agios Pharmaceuticals' narrative projects $416.9 million revenue and $67.0 million earnings by 2028. This requires 116.9% yearly revenue growth and a $583.1 million decrease in earnings from $650.1 million today.

Uncover how Agios Pharmaceuticals' forecasts yield a $47.50 fair value, a 12% upside to its current price.

Exploring Other Perspectives

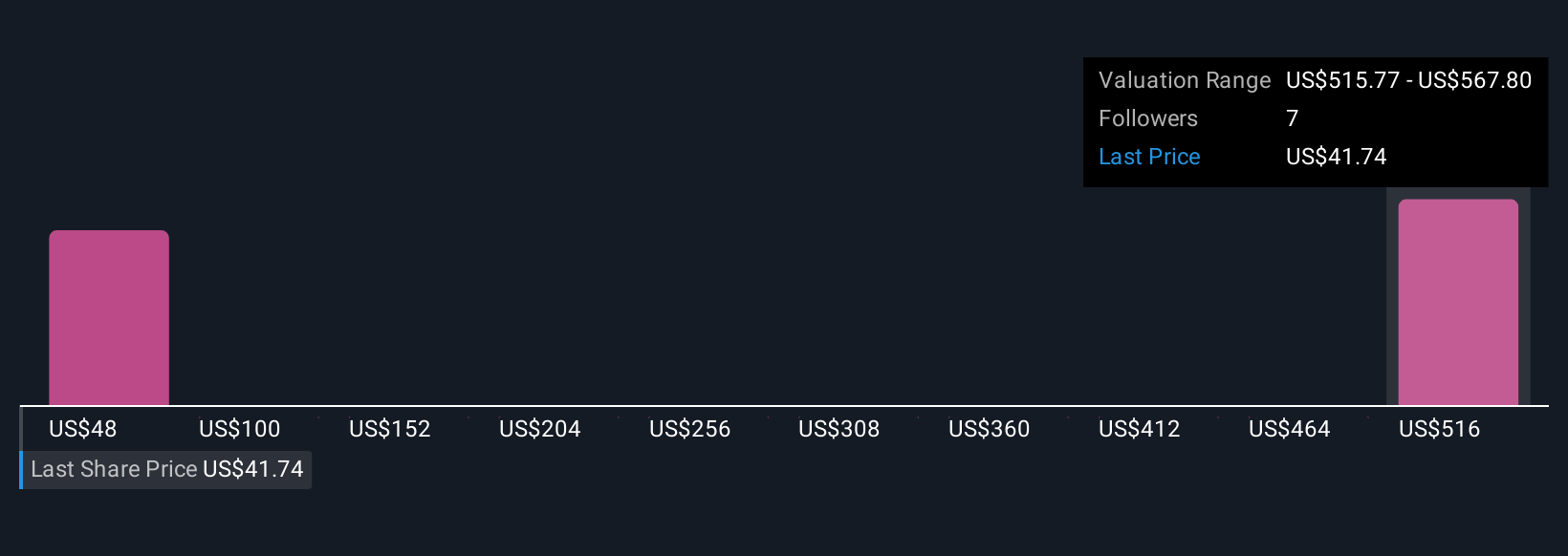

Simply Wall St Community valuations for Agios Pharmaceuticals, ranging from US$47.50 to US$568.48 across two views, highlight stark disagreement on fair value. Persistent operating losses due to elevated R&D and SG&A costs remain a key factor for future performance and investor sentiment.

Explore 2 other fair value estimates on Agios Pharmaceuticals - why the stock might be a potential multi-bagger!

Build Your Own Agios Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Agios Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agios Pharmaceuticals' overall financial health at a glance.

No Opportunity In Agios Pharmaceuticals?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AGIO

Agios Pharmaceuticals

A biopharmaceutical company, discovers and develops medicines in the field of cellular metabolism in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives