Affimed N.V. (NASDAQ:AFMD) shareholders might be concerned after seeing the share price drop 20% in the last quarter. But looking back over the last year, the returns have actually been rather pleasing! After all, the share price is up a market-beating 90% in that time.

View our latest analysis for Affimed

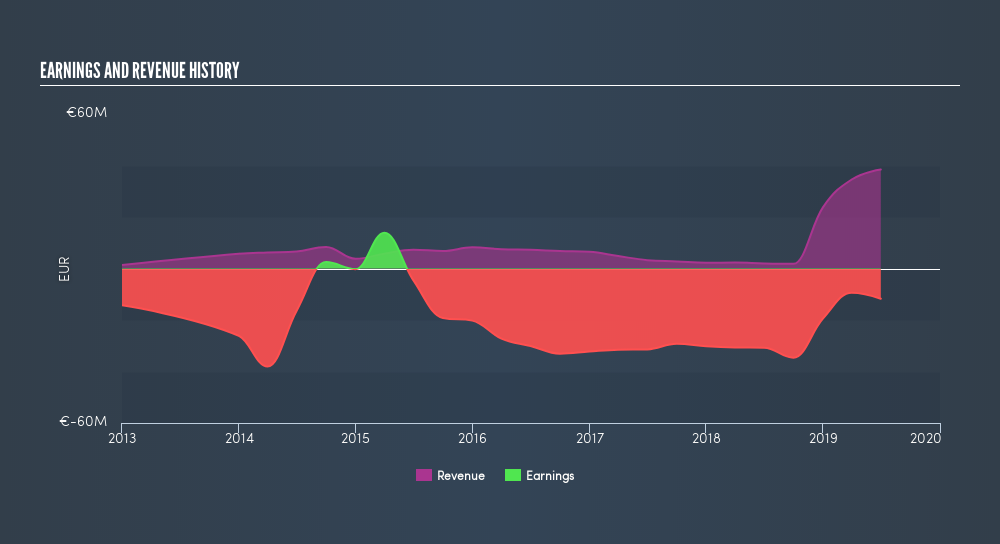

Given that Affimed didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Affimed grew its revenue by 1841% last year. That's well above most other pre-profit companies. The solid 90% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. If that's the case, now might be the time to take a close look at Affimed. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that Affimed rewarded shareholders with a total shareholder return of 90% over the last year. What is absolutely clear is that is far preferable to the dismal 0.4% average annual loss suffered over the last three years. It could well be that the business has turned around -- or else regained the confidence of investors. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Affimed may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OTCPK:AFMD.Q

Affimed

A clinical-stage biopharmaceutical company, focuses on discovering and developing cancer immunotherapies in the United States and Germany.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.