- United States

- /

- Life Sciences

- /

- NasdaqGS:ADPT

Adaptive Biotechnologies (ADPT) Is Down 11.2% After Earnings Beat And CFO Share Sale - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

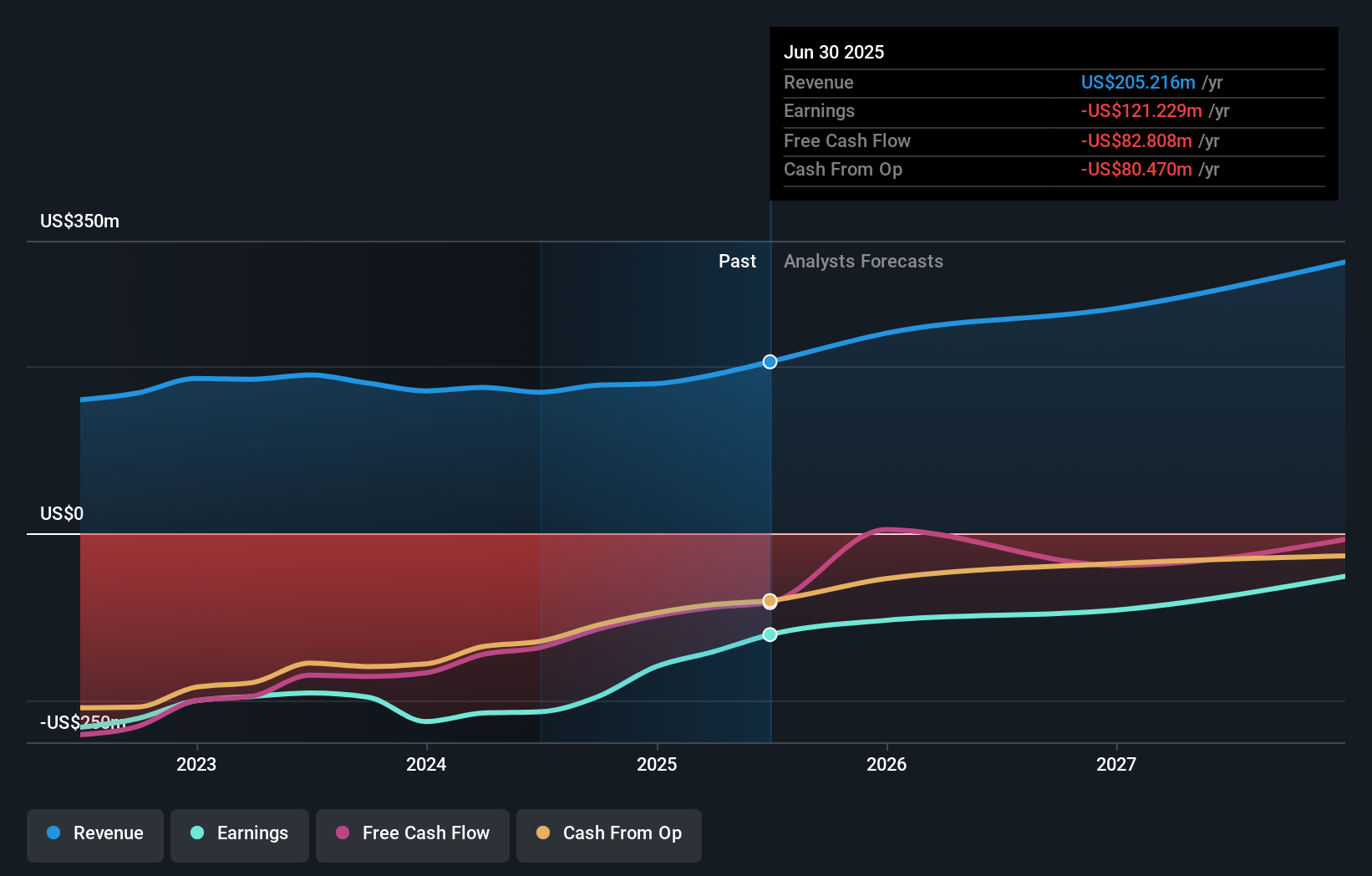

- Recently, Adaptive Biotechnologies reported third-quarter 2025 results that surpassed market expectations, posting earnings per share of US$0.06 on US$94 million in revenue and year-on-year revenue growth of 42.6%, while CFO Kyle Piskel sold 162,820 shares for roughly US$3.17 million.

- The combination of strong revenue momentum despite ongoing unprofitability and a sizable insider sale raises important questions about how investors assess Adaptive’s growth trajectory versus execution risk.

- With this backdrop of earnings outperformance and continued losses, we’ll now examine how the latest quarter might reshape Adaptive’s investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Adaptive Biotechnologies Investment Narrative Recap

To own Adaptive Biotechnologies, you need to believe its clonoSEQ MRD platform and immune medicine tools can grow into a durable, high‑value diagnostics and pharma partner. The latest earnings beat supports that view, while the CFO’s US$3.17 million share sale does not appear to alter the key near term catalyst, which remains execution on profitable MRD scale up, or the main risk around the company’s ability to control cash burn and avoid future dilution.

The raised 2025 MRD revenue guidance to US$202 million to US$207 million is most relevant here, as it directly connects to both the earnings surprise and the growth versus risk trade off. Stronger MRD expectations help underpin the investment case around recurring testing and pharma partnerships, but they also heighten the importance of maintaining payer support and reimbursement trends as Adaptive leans more heavily on MRD to fund the path toward sustainable profitability.

Yet investors should still be aware of the possibility that prolonged unprofitability and ongoing cash burn could eventually require...

Read the full narrative on Adaptive Biotechnologies (it's free!)

Adaptive Biotechnologies' narrative projects $350.6 million revenue and $49.8 million earnings by 2028. This requires 19.5% yearly revenue growth and an earnings increase of about $171 million from -$121.2 million today.

Uncover how Adaptive Biotechnologies' forecasts yield a $19.57 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$7.88 to US$19.57 per share, highlighting sharply different views. You can weigh those against the raised MRD revenue guidance, which puts even more focus on how effectively Adaptive turns growing test volumes into lasting earnings power.

Explore 2 other fair value estimates on Adaptive Biotechnologies - why the stock might be worth as much as 12% more than the current price!

Build Your Own Adaptive Biotechnologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adaptive Biotechnologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Adaptive Biotechnologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adaptive Biotechnologies' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADPT

Adaptive Biotechnologies

A commercial-stage company, develops an immune medicine platform for the diagnosis and treatment of various diseases.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026