- United States

- /

- Life Sciences

- /

- NasdaqGS:ADPT

Adaptive Biotechnologies (ADPT): A Fresh Analyst Spotlight Prompts a Closer Look at Valuation and Growth Potential

Reviewed by Kshitija Bhandaru

Adaptive Biotechnologies (ADPT) drew new attention after a major investment firm began covering the stock. The firm cited potential for growth within the biotech space. Such analyst initiations often spark increased investor curiosity.

See our latest analysis for Adaptive Biotechnologies.

The upbeat analyst coverage has come alongside modest price gains for Adaptive Biotechnologies. With a year-to-date share price return of 1.3% and one-year total shareholder return of 1.7%, investors have seen steady progress rather than explosive movement. This suggests momentum is starting to build around the company’s growth story.

If recent analyst attention has you curious about what else is attracting interest, now is a perfect moment to discover more opportunities via our healthcare stocks screener: See the full list for free.

This leaves investors with a key question: Is Adaptive Biotechnologies trading at an appealing value given its growth outlook, or has the market already recognized and priced in its future potential?

Most Popular Narrative: 3% Undervalued

Adaptive Biotechnologies' latest fair value estimate comes in slightly above the last close price, implying a modest edge for buyers ahead of upcoming milestones. The narrative’s higher valuation reflects increasingly optimistic growth assumptions and premium expectations compared to recent trading levels.

Substantial expansion in the MRD clinical pharma pipeline, evidenced by a growing clinical trial backlog (now at $218 million, up 21% over prior year) and increased use of clonoSEQ as a primary endpoint, forecasts future milestone payments and a high-quality revenue stream as regulatory momentum globally accelerates MRD adoption in drug development.

Curious how such a rich valuation is justified? The narrative hinges on lightning-fast top line growth, bullish operating leverage, and financial targets that would raise eyebrows in any sector. Eager to see the full earnings roadmap and the quantitative leaps analysts are betting on? Unlock the details driving this bold projection.

Result: Fair Value of $14.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued operating losses or setbacks in key partnerships could quickly challenge the optimism that supports Adaptive Biotechnologies' current growth expectations.

Find out about the key risks to this Adaptive Biotechnologies narrative.

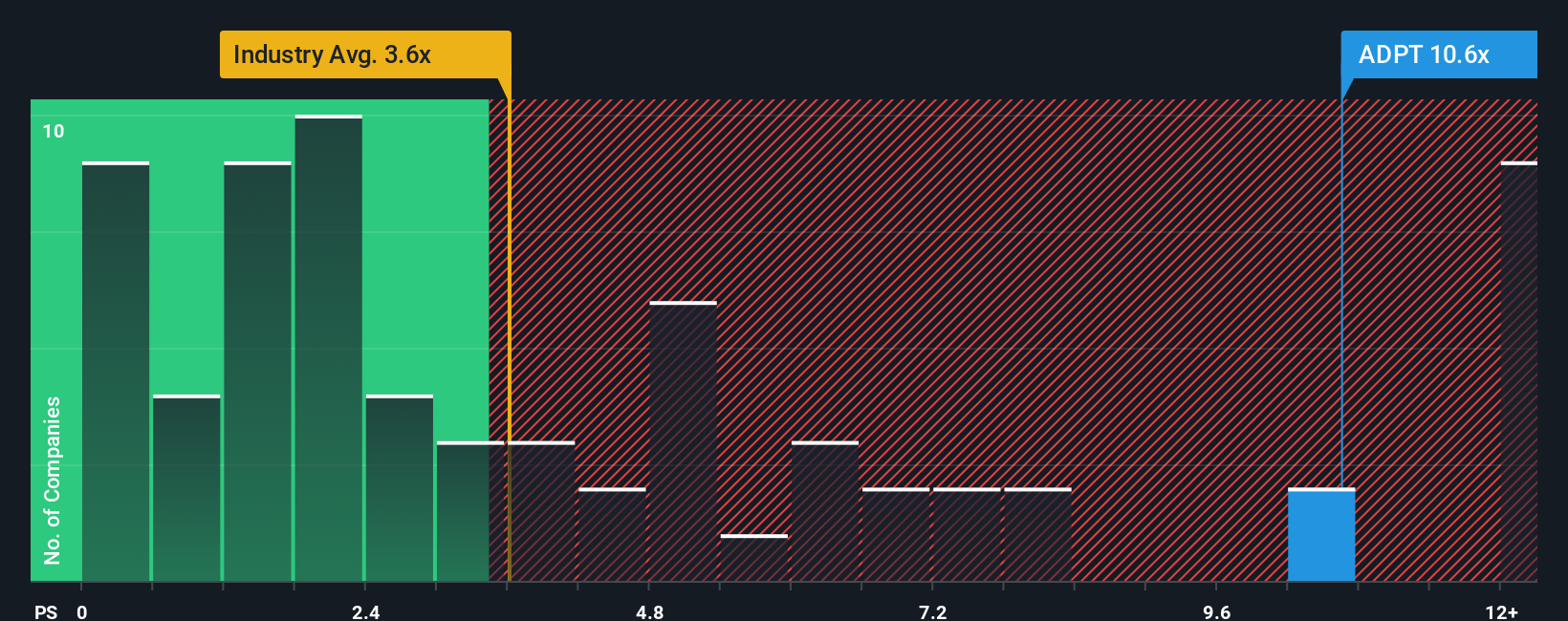

Another View: Multiples Cloud the Picture

While analyst consensus sees Adaptive Biotechnologies as slightly undervalued, a look through the lens of its price-to-sales ratio complicates matters. The company trades at 10.7 times sales, much higher than the US Life Sciences industry average of 3.8 and the peer average of 2.3. Compared to the fair ratio of 5.1, the current level suggests investors are paying a significant premium. This could mean there may be valuation risk if market expectations aren’t met. Does this gap signal justified optimism, or a setup for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Adaptive Biotechnologies Narrative

If you want a different perspective or like digging into the numbers on your own, it only takes a few minutes to build your own narrative. Do it your way

A great starting point for your Adaptive Biotechnologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your portfolio by jumping on powerful trends investors are watching right now. Fresh opportunities await if you know where to look. Don’t risk missing these market movers.

- Capitalize on tomorrow’s AI leaders making headlines with these 25 AI penny stocks that are changing how entire industries operate.

- Boost your passive income with these 19 dividend stocks with yields > 3% boasting solid yields, ideal for anyone focused on steady returns and financial growth.

- Be part of the quantum leap in technology by spotting potential standouts among these 26 quantum computing stocks, where innovation meets real-world results.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADPT

Adaptive Biotechnologies

A commercial-stage company, develops an immune medicine platform for the diagnosis and treatment of various diseases.

Adequate balance sheet with concerning outlook.

Similar Companies

Market Insights

Community Narratives