- United States

- /

- Biotech

- /

- NasdaqGM:ADMA

Does ADMA Biologics’ Margin Expansion and Revenue Targets Signal a New Phase for ADMA?

Reviewed by Sasha Jovanovic

- ADMA Biologics has reaffirmed its multi-year growth outlook, projecting total revenues to exceed US$500 million in 2025 and reach at least US$625 million in 2026, with plans for margin expansion supported by its Boca Raton facility and FDA-approved manufacturing process improvements.

- Initial production upgrades have resulted in more than 20% higher immunoglobulin output, signaling a meaningful advancement in operational scalability from early 2026 onward.

- We'll now examine how these manufacturing enhancements and multi-year targets may shape ADMA Biologics' investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ADMA Biologics Investment Narrative Recap

To see long-term upside in ADMA Biologics, investors need confidence in the company’s ability to consistently scale immunoglobulin output and convert manufacturing enhancements into profitable growth. The latest news reaffirms ambitious revenue targets and documents initial output gains, which support the key short-term catalyst, commercial execution of the FDA-approved yield enhancement process. However, this also sharpens focus on operational risks at their Boca Raton facility, as any disruption here could still materially affect margin expansion plans.

Among recent announcements, the April 2025 FDA approval for ADMA’s yield enhancement process ties directly to the company’s projected margin improvements and revenue expansion. This regulatory milestone, and implementation of related upgrades, may help ADMA deliver on its multi-year growth outlook by boosting efficiency and sustaining competitive advantage, especially as higher output begins to take effect from early 2026.

Yet, despite these production milestones, the risk that unexpected manufacturing or regulatory delays could impact upcoming results is something investors should keep in mind if...

Read the full narrative on ADMA Biologics (it's free!)

ADMA Biologics' outlook projects $904.6 million in revenue and $350.9 million in earnings by 2028. This scenario assumes a 24.0% annual revenue growth rate and a $142.0 million increase in earnings from current earnings of $208.9 million.

Uncover how ADMA Biologics' forecasts yield a $27.81 fair value, a 91% upside to its current price.

Exploring Other Perspectives

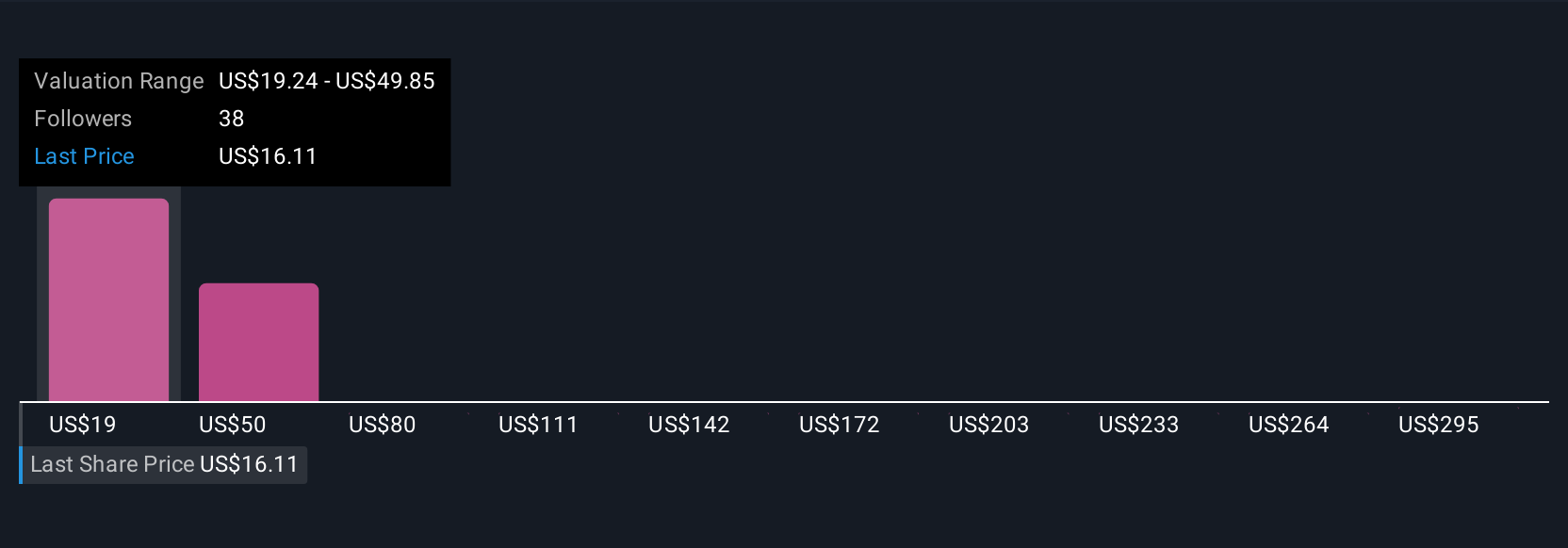

The Simply Wall St Community shared eight distinct fair value estimates for ADMA Biologics, ranging from US$19.24 to US$325.32 per share. Against this wide spectrum of expectations, the ability to successfully scale new manufacturing processes could prove pivotal, consider the full array of investor viewpoints before making any assumptions about future performance.

Explore 8 other fair value estimates on ADMA Biologics - why the stock might be a potential multi-bagger!

Build Your Own ADMA Biologics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ADMA Biologics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ADMA Biologics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ADMA Biologics' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ADMA

ADMA Biologics

A biopharmaceutical company, develops, manufactures, and markets specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives