- United States

- /

- Biotech

- /

- NasdaqGM:ADMA

Could ADMA Biologics’ (ADMA) Conference Spotlight Reveal New Directions for Its Innovation Strategy?

Reviewed by Simply Wall St

- ADMA Biologics presented at the Morgan Stanley 23rd Annual Global Healthcare Conference on September 8, 2025, at the Sheraton New York Times Square, highlighting its latest advancements to a broad healthcare audience.

- This platform often serves as a stage for companies to share important updates and strategic insights, potentially stirring heightened market interest and expectations.

- We'll explore how investor attention surrounding ADMA's participation at this major healthcare conference interacts with its growth outlook and ongoing initiatives.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

ADMA Biologics Investment Narrative Recap

To own ADMA Biologics shares, an investor must believe in the long-term strength of plasma-derived therapies, the reliability of the company’s margin-expanding manufacturing process, and the market’s appetite for its key products. While ADMA’s presence at the Morgan Stanley conference affirms industry interest, this event alone does not materially alter the immediate catalyst, execution of higher-yield production or the key risk of operational disruption at its manufacturing facility.

Among ADMA’s recent announcements, the FDA approval of its innovative yield enhancement process stands out, supporting the company’s financial guidance for accelerating revenue and profit growth. This progress feeds directly into market expectations for better margins and efficiency, underscoring why attention to manufacturing execution remains so critical for near-term results.

In contrast, the one detail that could affect shareholder confidence and is worth knowing relates to the risk of...

Read the full narrative on ADMA Biologics (it's free!)

ADMA Biologics' narrative projects $904.6 million revenue and $350.9 million earnings by 2028. This requires 24.0% yearly revenue growth and a $142 million earnings increase from $208.9 million.

Uncover how ADMA Biologics' forecasts yield a $29.06 fair value, a 84% upside to its current price.

Exploring Other Perspectives

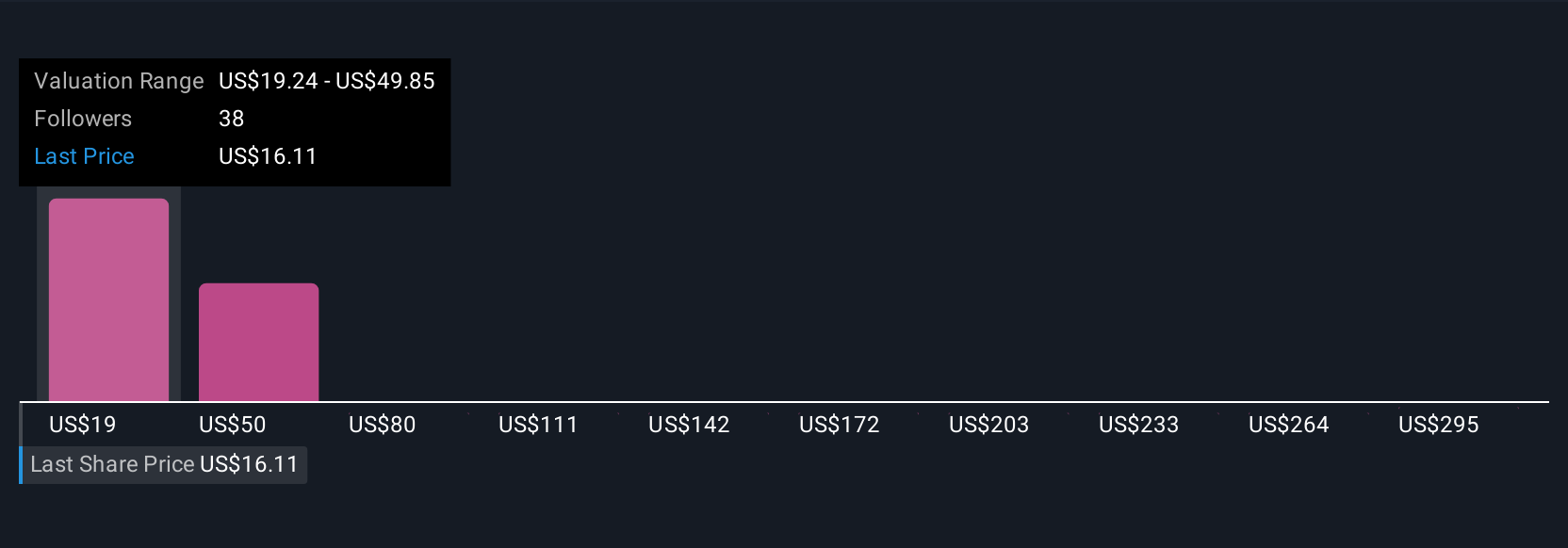

Fair value estimates from 8 Simply Wall St Community members span US$19.24 to US$325.32 per share. Such wide-ranging opinions meet the reality that sustained efficiency at the Boca Raton facility is the linchpin for ADMA’s future performance, see how others weigh these possibilities.

Explore 8 other fair value estimates on ADMA Biologics - why the stock might be a potential multi-bagger!

Build Your Own ADMA Biologics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ADMA Biologics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ADMA Biologics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ADMA Biologics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ADMA

ADMA Biologics

A biopharmaceutical company, develops, manufactures, and markets specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives