- United States

- /

- Biotech

- /

- NasdaqCM:ACXP

Here's Why We're Not Too Worried About Acurx Pharmaceuticals' (NASDAQ:ACXP) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given this risk, we thought we'd take a look at whether Acurx Pharmaceuticals (NASDAQ:ACXP) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Acurx Pharmaceuticals

When Might Acurx Pharmaceuticals Run Out Of Money?

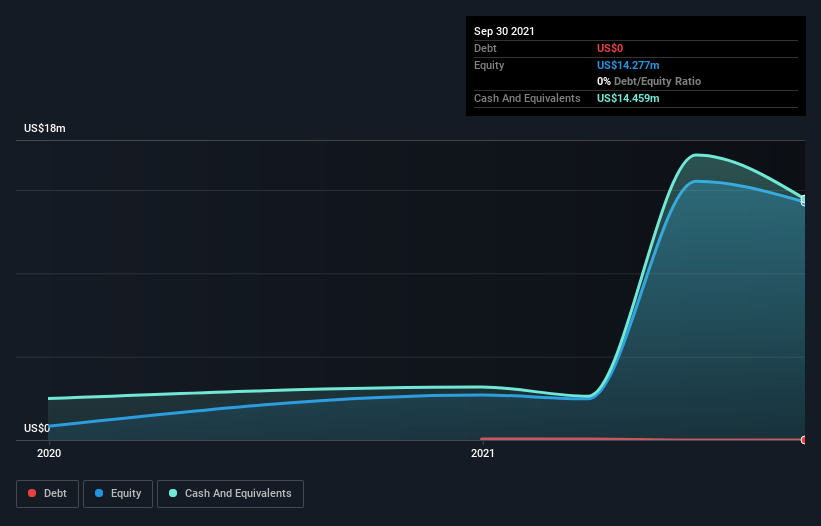

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In September 2021, Acurx Pharmaceuticals had US$14m in cash, and was debt-free. Looking at the last year, the company burnt through US$4.5m. Therefore, from September 2021 it had 3.2 years of cash runway. Importantly, the one analyst we see covering the stock thinks that Acurx Pharmaceuticals will reach cashflow breakeven in 5 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. Depicted below, you can see how its cash holdings have changed over time.

How Is Acurx Pharmaceuticals' Cash Burn Changing Over Time?

Acurx Pharmaceuticals didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Over the last year its cash burn actually increased by 27%, which suggests that management are increasing investment in future growth, but not too quickly. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Acurx Pharmaceuticals Raise More Cash Easily?

While Acurx Pharmaceuticals does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Acurx Pharmaceuticals' cash burn of US$4.5m is about 12% of its US$37m market capitalisation. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

How Risky Is Acurx Pharmaceuticals' Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way Acurx Pharmaceuticals is burning through its cash. For example, we think its cash runway suggests that the company is on a good path. While its increasing cash burn wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. Shareholders can take heart from the fact that at least one analyst is forecasting it will reach breakeven. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. On another note, Acurx Pharmaceuticals has 5 warning signs (and 2 which are potentially serious) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you're looking to trade Acurx Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ACXP

Acurx Pharmaceuticals

A clinical stage biopharmaceutical company, develops antibiotics to treat bacterial infections in the United States.

Flawless balance sheet moderate.

Market Insights

Community Narratives