- United States

- /

- Pharma

- /

- NasdaqGS:ACRS

Aclaris Therapeutics, Inc. (NASDAQ:ACRS) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Those holding Aclaris Therapeutics, Inc. (NASDAQ:ACRS) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 93% share price drop in the last twelve months.

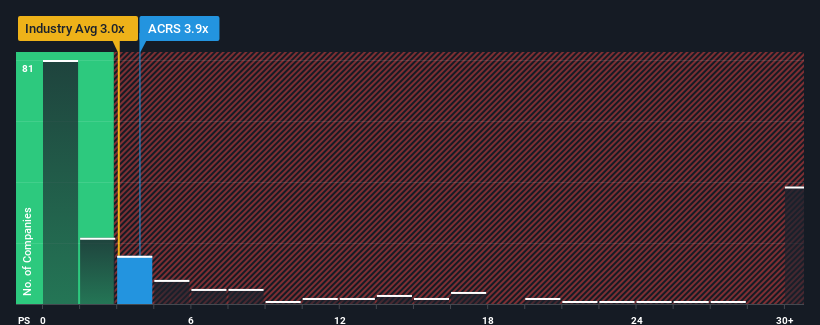

After such a large jump in price, Aclaris Therapeutics may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 3.9x, when you consider almost half of the companies in the Pharmaceuticals industry in the United States have P/S ratios under 3x and even P/S lower than 0.7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Aclaris Therapeutics

What Does Aclaris Therapeutics' Recent Performance Look Like?

Aclaris Therapeutics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Aclaris Therapeutics.Is There Enough Revenue Growth Forecasted For Aclaris Therapeutics?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Aclaris Therapeutics' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 8.8% decrease to the company's top line. Still, the latest three year period has seen an excellent 257% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 13% per year as estimated by the ten analysts watching the company. Meanwhile, the broader industry is forecast to expand by 49% per year, which paints a poor picture.

With this information, we find it concerning that Aclaris Therapeutics is trading at a P/S higher than the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Aclaris Therapeutics' P/S

Aclaris Therapeutics shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Aclaris Therapeutics' analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 5 warning signs for Aclaris Therapeutics you should be aware of, and 2 of them are potentially serious.

If these risks are making you reconsider your opinion on Aclaris Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Aclaris Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ACRS

Aclaris Therapeutics

A clinical-stage biopharmaceutical company, engages in the development of novel drug candidates for immune-inflammatory diseases in the United States.

Flawless balance sheet low.

Market Insights

Community Narratives