- United States

- /

- Biotech

- /

- NasdaqGS:ACLX

A Look at Arcellx (ACLX) Valuation Following Analyst Coverage and Shifting Regulatory Landscape

Reviewed by Kshitija Bhandaru

Arcellx (ACLX) has found itself in the spotlight as recent analyst commentary points to a more favorable regulatory setting and increased investor attention on its anti-cel therapy compared with Johnson & Johnson’s Carvykti. The conversation around these therapies continues to shape how investors assess the stock’s potential.

See our latest analysis for Arcellx.

Momentum around Arcellx has picked up lately as renewed confidence in its regulatory footing and therapy pipeline keeps the spotlight on its future growth story. While the latest share price sits at $82.24, the 1-year total shareholder return of 7.9% points to long-term optimism building in the background, even as short-term price moves remain steady and the broader biotech narrative gains pace.

If Arcellx’s recent buzz got you thinking about other innovators, there’s a whole world of discovery in the healthcare space. See the full list for free.

With analyst upgrades, strong pipeline growth, and a share price still trailing average price targets, the question now is whether Arcellx is undervalued or if the market has already priced in the promise of future growth.

Price-to-Book Ratio of 11.6x: Is it justified?

Arcellx trades at a price-to-book ratio of 11.6x, putting it well above both its industry peers and the wider biotech sector. The last close price of $82.24 highlights a premium investors are currently assigning compared to assets on the company’s balance sheet.

The price-to-book ratio measures how much investors are willing to pay for each dollar of net assets. In biotech, this multiple can reflect optimism about future discoveries, pipeline potential, or strategic partnerships, but sticker shock can be a red flag if near-term profitability is uncertain.

Here, Arcellx is valued more than four times above the US biotechs industry average of 2.4x and trades higher than the peer group (8.7x). This extreme premium could be interpreted as robust confidence in future growth, but it also sets a high hurdle for performance. If the fair ratio were known, it would offer a benchmark for where this multiple could recalibrate over time.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 11.6x (OVERVALUED)

However, slowing revenue growth or wider than expected losses could quickly shift sentiment and challenge the optimism currently priced into Arcellx shares.

Find out about the key risks to this Arcellx narrative.

Another View: Discounted Cash Flow Tells a Different Story

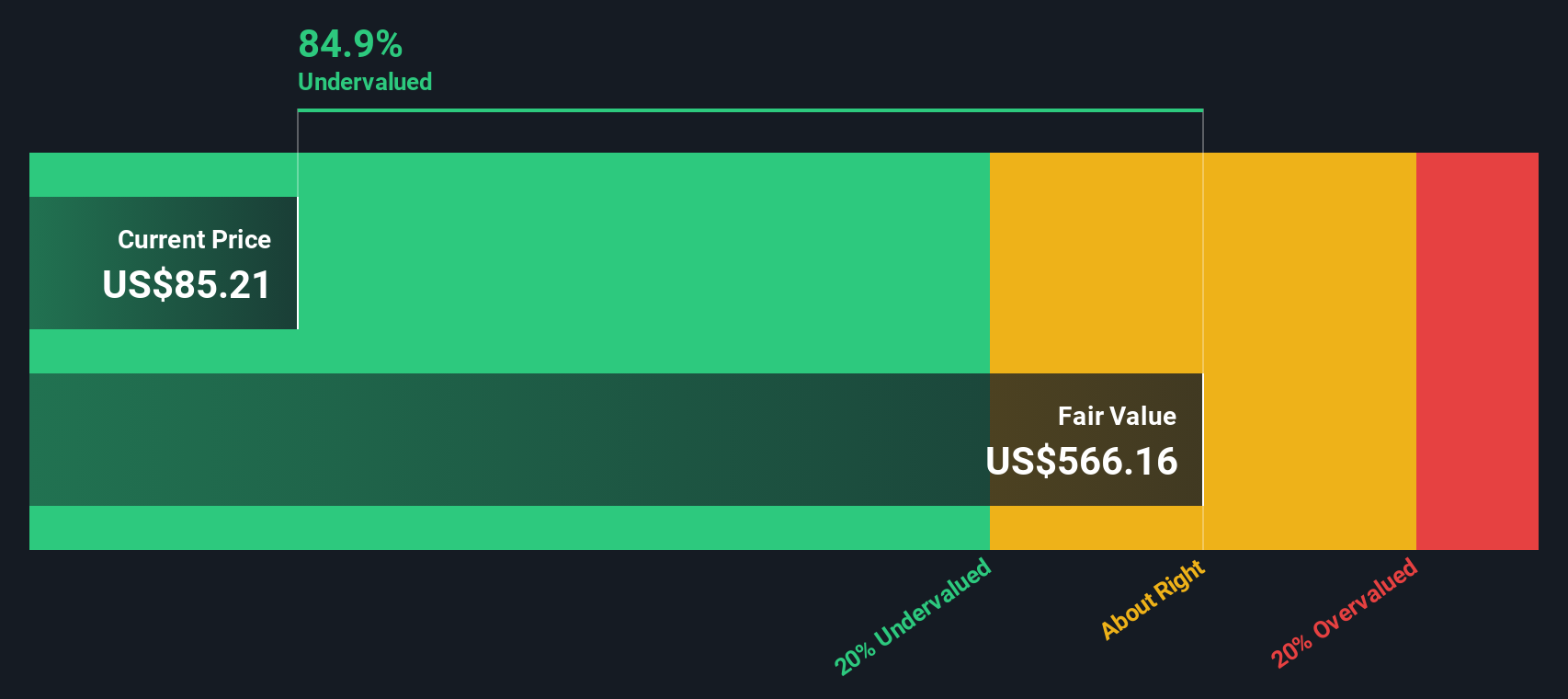

While the price-to-book multiple presents Arcellx as expensive, our DCF model offers a sharply different perspective. The SWS DCF model estimates fair value at $568.31 per share, which is 85.5% above the current price. Does this suggest the market may be underpricing Arcellx, or are there risks not reflected in the model?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arcellx for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arcellx Narrative

If the current analysis raises more questions for you, keep in mind that you can dig into the figures and build your own perspective on Arcellx's outlook in just a few minutes. Do it your way.

A great starting point for your Arcellx research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart opportunities are just a click away. Give yourself an edge by checking out targeted screens for stocks with unique potential that many other investors might miss.

- Uncover growth stories among companies pioneering artificial intelligence by reviewing these 24 AI penny stocks to see who is positioned for breakthroughs.

- Tap into hidden bargains with strong free cash flow and solid business fundamentals by exploring these 910 undervalued stocks based on cash flows, which smart investors are adding to their watchlists.

- Capitalize on reliable income with these 19 dividend stocks with yields > 3%, featuring businesses offering robust dividends above 3% for those seeking more than just price appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLX

Arcellx

Together with its subsidiary, engages in the development of various immunotherapies for patients with cancer and other incurable diseases in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives