- United States

- /

- Biotech

- /

- NasdaqGS:ACLX

A Fresh Look at Arcellx (ACLX) Valuation Following Scotiabank’s Regulatory Optimism and CAR-T Therapy Developments

Reviewed by Kshitija Bhandaru

Arcellx (ACLX) is drawing fresh attention after Scotiabank highlighted improved regulatory prospects and reaffirmed its positive stance. Investors are now closely watching the company’s anito-cel therapy as competition in CAR-T treatments increases.

See our latest analysis for Arcellx.

Momentum has been steady for Arcellx lately, with investors encouraged by regulatory tailwinds and ongoing advances in its therapy pipeline. While the company’s Chief Medical Officer recently sold shares under a pre-arranged plan, the spotlight remains on Arcellx’s positioning in the CAR-T therapy space. Over the past year, total shareholder return stands at 0.08%, reflecting a wait-and-see approach. Growing attention to regulatory progress could set the stage for stronger moves ahead.

If regulatory breakthroughs in biotech are on your radar, take the next step and discover See the full list for free.

With robust annual growth and shares still trading at a notable discount to analyst targets, the question remains: is Arcellx’s current valuation overlooking its future potential, or is all the upside already factored in?

Price-to-Book Ratio of 11.6x: Is it justified?

Arcellx trades at a price-to-book ratio of 11.6 times, placing it well above both industry peers and the sector average, despite the recent momentum in its share price.

The price-to-book ratio compares the company's current market value to its accounting book value and is often used for biotech stocks that lack consistent earnings. For Arcellx, this high ratio indicates that the market is factoring in exceptional growth or future profitability, even though the company is currently unprofitable.

Compared to the US Biotechs industry average of 2.4 times and a peer group average of 8.7 times, Arcellx appears expensive on this metric. The market may be expecting strong advancements in its therapy pipeline or a regulatory breakthrough to support this premium.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 11.6x (OVERVALUED)

However, ongoing net losses and reliance on regulatory milestones remain key risks that could challenge Arcellx’s growth narrative in the coming quarters.

Find out about the key risks to this Arcellx narrative.

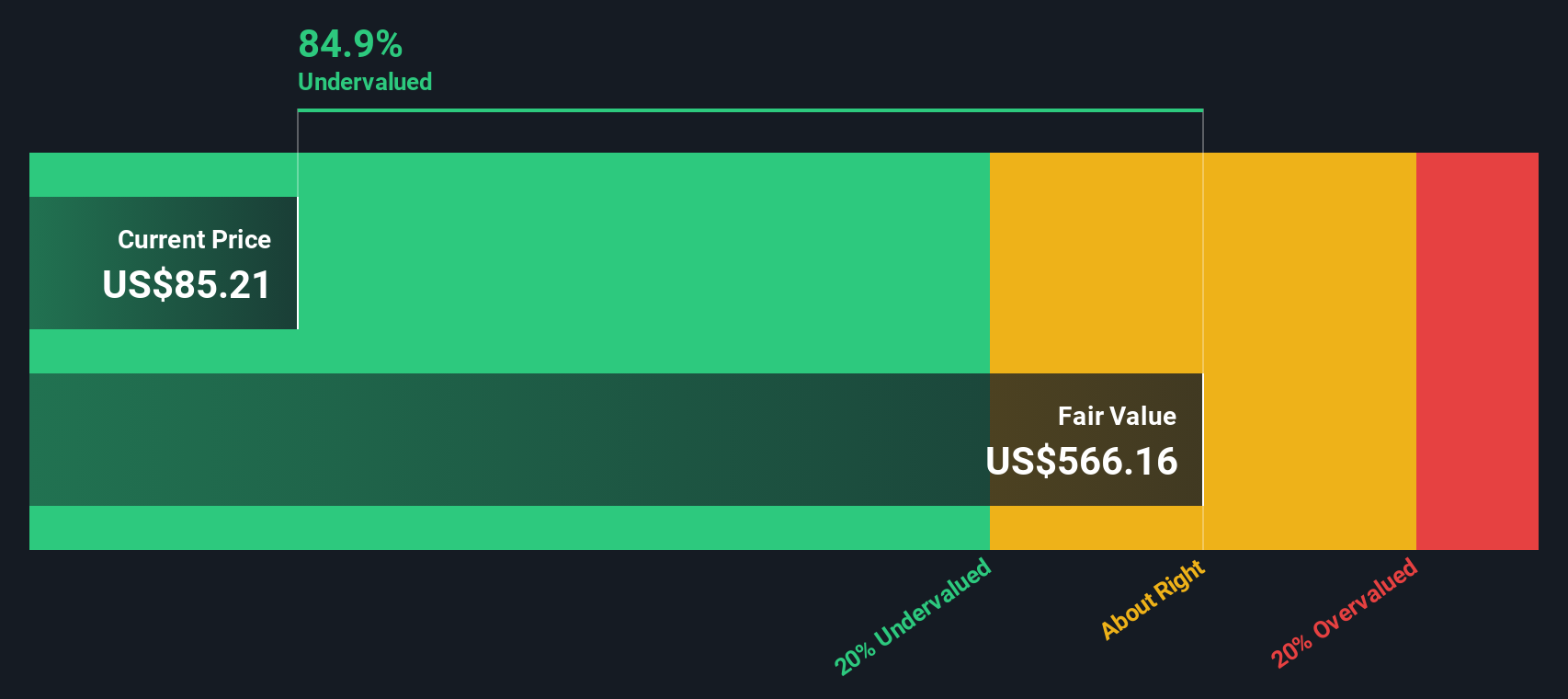

Another View: The SWS DCF Model Suggests Deep Undervaluation

While the price-to-book ratio paints Arcellx as overvalued, a different picture emerges from our DCF model. According to this approach, Arcellx trades well below its estimated fair value, which implies the market may be underpricing its long-term potential. Which story will the market ultimately believe?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arcellx for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arcellx Narrative

If you see things differently or want to dig deeper into the numbers yourself, crafting your own perspective on Arcellx can take just a few minutes. Do it your way.

A great starting point for your Arcellx research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that the best opportunities often go beyond the obvious, so don’t limit yourself. See what’s on the rise before the crowd catches on.

- Tap into growth by checking out these 904 undervalued stocks based on cash flows, which is packed with companies trading below their intrinsic worth and primed for potential upside.

- Spot future breakthroughs by searching these 24 AI penny stocks, where innovative players are leading advances in artificial intelligence sectors.

- Boost your income stream with these 19 dividend stocks with yields > 3%, featuring stocks offering yields above 3 percent and the fundamentals to sustain payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLX

Arcellx

Together with its subsidiary, engages in the development of various immunotherapies for patients with cancer and other incurable diseases in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives