- United States

- /

- Biotech

- /

- NasdaqGM:ACIU

The AC Immune (NASDAQ:ACIU) Share Price Is Down 47% So Some Shareholders Are Getting Worried

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in AC Immune SA (NASDAQ:ACIU) have tasted that bitter downside in the last year, as the share price dropped 47%. That's well bellow the market return of -0.05%. AC Immune may have better days ahead, of course; we've only looked at a one year period. And the share price decline continued over the last week, dropping some 6.6%. But this could be related to the soft market, which is down about 5.8% in the same period.

See our latest analysis for AC Immune

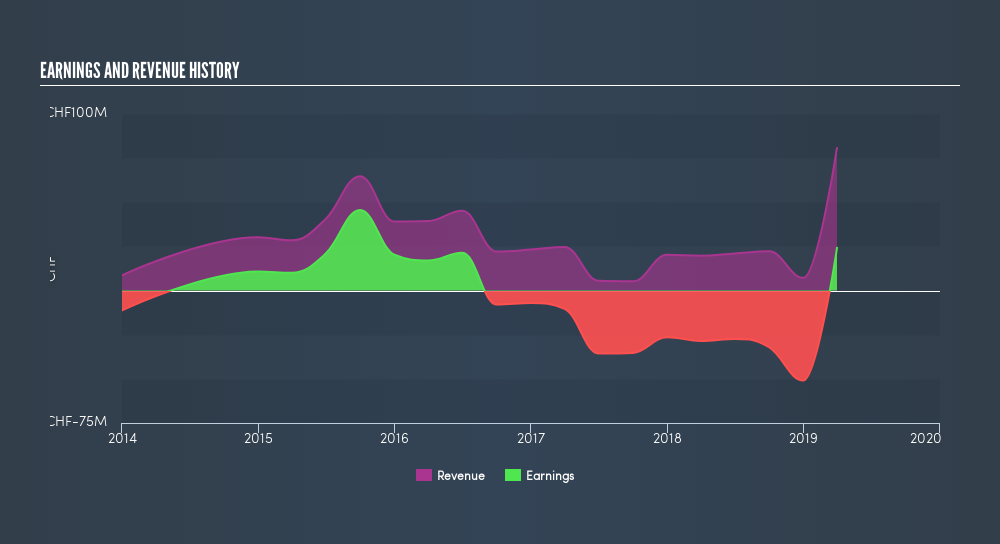

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year AC Immune grew its earnings per share, moving from a loss to a profit. Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. So it makes sense to check out some other factors.

AC Immune managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

We know that AC Immune has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think AC Immune will earn in the future (free profit forecasts).

A Different Perspective

AC Immune shareholders are down 47% for the year, even worse than the market loss of 0.05%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's great to see a nice little 2.9% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. Is AC Immune cheap compared to other companies? These 3 valuation measures might help you decide.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:ACIU

AC Immune

A clinical stage biopharmaceutical company, discovers, designs, and develops medicines, and therapeutic and diagnostic products for the prevention and treatment of neurodegenerative diseases associated with protein misfolding.

Flawless balance sheet and good value.

Market Insights

Community Narratives