- United States

- /

- Biotech

- /

- NasdaqGS:ACAD

Does the Halted Carbetocin Trial and Investigation Shift the Growth Outlook for ACADIA Pharmaceuticals (ACAD)?

Reviewed by Sasha Jovanovic

- In September 2025, ACADIA Pharmaceuticals announced that its Phase 3 COMPASS PWS trial for intranasal carbetocin failed to meet primary or secondary endpoints in Prader-Willi syndrome, resulting in the discontinuation of further investigation into the drug and triggering an investor-led securities fraud investigation.

- This outcome has intensified scrutiny of ACADIA’s business practices and brought additional attention to the risks linked with clinical trial failures in its rare disease pipeline.

- We’ll examine how the halted carbetocin trial and resulting legal review challenge ACADIA’s pipeline-driven growth and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ACADIA Pharmaceuticals Investment Narrative Recap

To be a shareholder in ACADIA Pharmaceuticals, you need to believe in the company's ability to expand and diversify beyond NUPLAZID, with its pipeline programs delivering new revenue streams. The recent failure of the COMPASS PWS trial and associated legal probe highlight the volatility of clinical development, but since NUPLAZID and DAYBUE remain the primary short-term growth drivers, near-term catalysts are mostly unchanged, while the trial setback makes pipeline risk more immediate.

One recent announcement that stands out is the upcoming Q3 2025 earnings release on November 5. This report will give new insights into the ongoing commercial momentum for NUPLAZID and DAYBUE, which is especially important as pipeline setbacks place more pressure on these flagship products to support revenue targets and mitigate concentration risk. In contrast, investors should be aware of...

Read the full narrative on ACADIA Pharmaceuticals (it's free!)

ACADIA Pharmaceuticals' outlook anticipates $1.4 billion in revenue and $306.0 million in earnings by 2028. This scenario assumes an 11.6% annual revenue growth rate and a $83.8 million increase in earnings from the current $222.2 million.

Uncover how ACADIA Pharmaceuticals' forecasts yield a $29.32 fair value, a 38% upside to its current price.

Exploring Other Perspectives

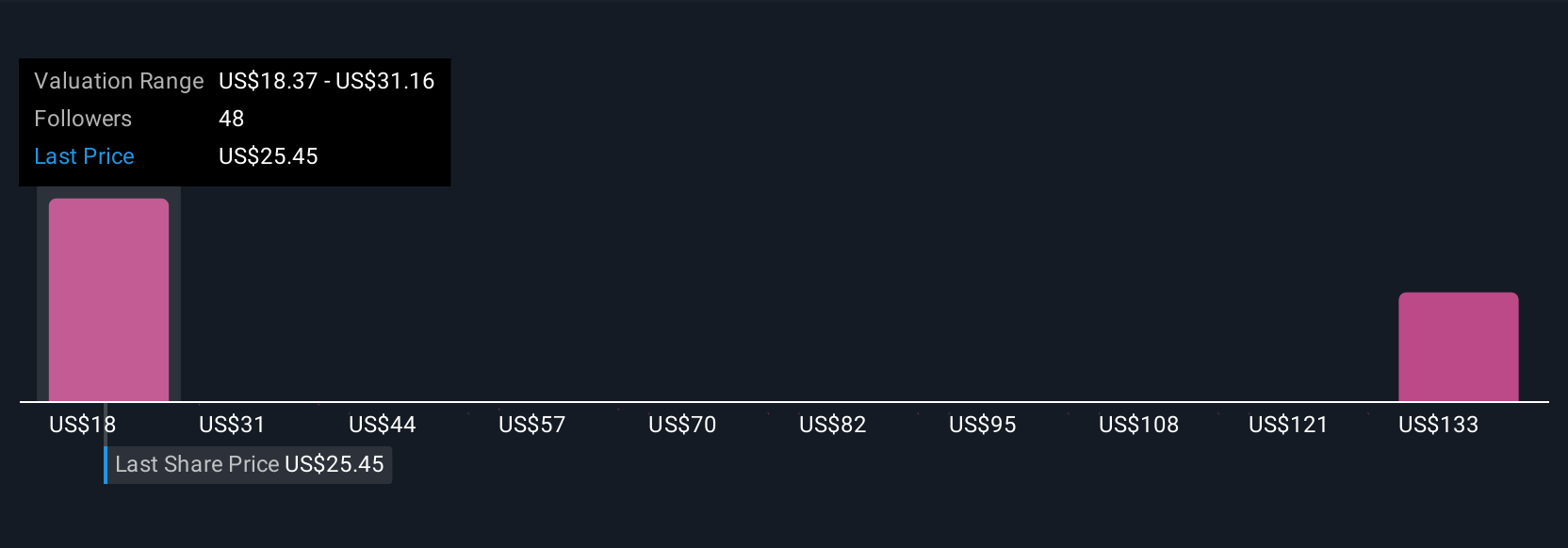

Six fair value estimates from the Simply Wall St Community span from US$18.12 to US$142.92 per share, reflecting wide-ranging views. While consensus sees pipeline risks mounting, these diverse perspectives remind you to weigh multiple scenarios for ACADIA’s outlook.

Explore 6 other fair value estimates on ACADIA Pharmaceuticals - why the stock might be worth 15% less than the current price!

Build Your Own ACADIA Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ACADIA Pharmaceuticals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ACADIA Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ACADIA Pharmaceuticals' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACAD

ACADIA Pharmaceuticals

A biopharmaceutical company, focuses on the development and commercialization of medicines for central nervous system (CNS) disorders and rare diseases in the United States.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives