- United States

- /

- Life Sciences

- /

- NasdaqGS:ABCL

Assessing AbCellera Biologics (ABCL) Valuation as It Shifts Toward Proprietary Clinical Assets and Phase 1 Trials

Reviewed by Simply Wall St

AbCellera Biologics (ABCL) just added another twist to its evolving story, as the board moved to replace long time auditor KPMG with Ernst and Young starting with the 2026 fiscal year.

See our latest analysis for AbCellera Biologics.

The auditor change lands amid a choppy stretch for the stock, with a roughly 24 percent 1 month share price return decline and a still negative 3 year total shareholder return, even though year to date and 1 year total shareholder returns have turned positive as investors reassess AbCellera's shift toward proprietary clinical assets.

If this kind of strategic pivot has your attention, it might be a good time to explore other innovative biotech names using our curated screen of healthcare stocks.

With the shares now trading at a steep discount to analyst targets despite double digit revenue growth and a maturing pipeline, is AbCellera a misunderstood value in early stage biotech, or is the market already pricing in its future growth?

Most Popular Narrative: 63.8% Undervalued

With AbCellera Biologics last closing at $3.56 versus a most popular narrative fair value of $9.83, expectations for a sharp rerating are clear and ambitious.

The initiation of Phase I clinical trials for ABCL635 and ABCL575, with promising differentiation factors such as a unique dosing regimen and improved safety profile for ABCL635, is expected to position the company to capture a significant market opportunity in an underserved area, potentially boosting future revenue.

Want to see the math behind this bold upside case? The narrative leans on rapid revenue expansion, a dramatic margin shift, and a future earnings multiple rarely seen in this sector. Curious how those moving parts combine into that fair value? Read on and unpack the full story powering this valuation call.

Result: Fair Value of $9.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, clinical setbacks or prolonged partner revenue declines could quickly undercut this upside case and force investors to reset expectations on margins and growth.

Find out about the key risks to this AbCellera Biologics narrative.

Another Angle on Valuation

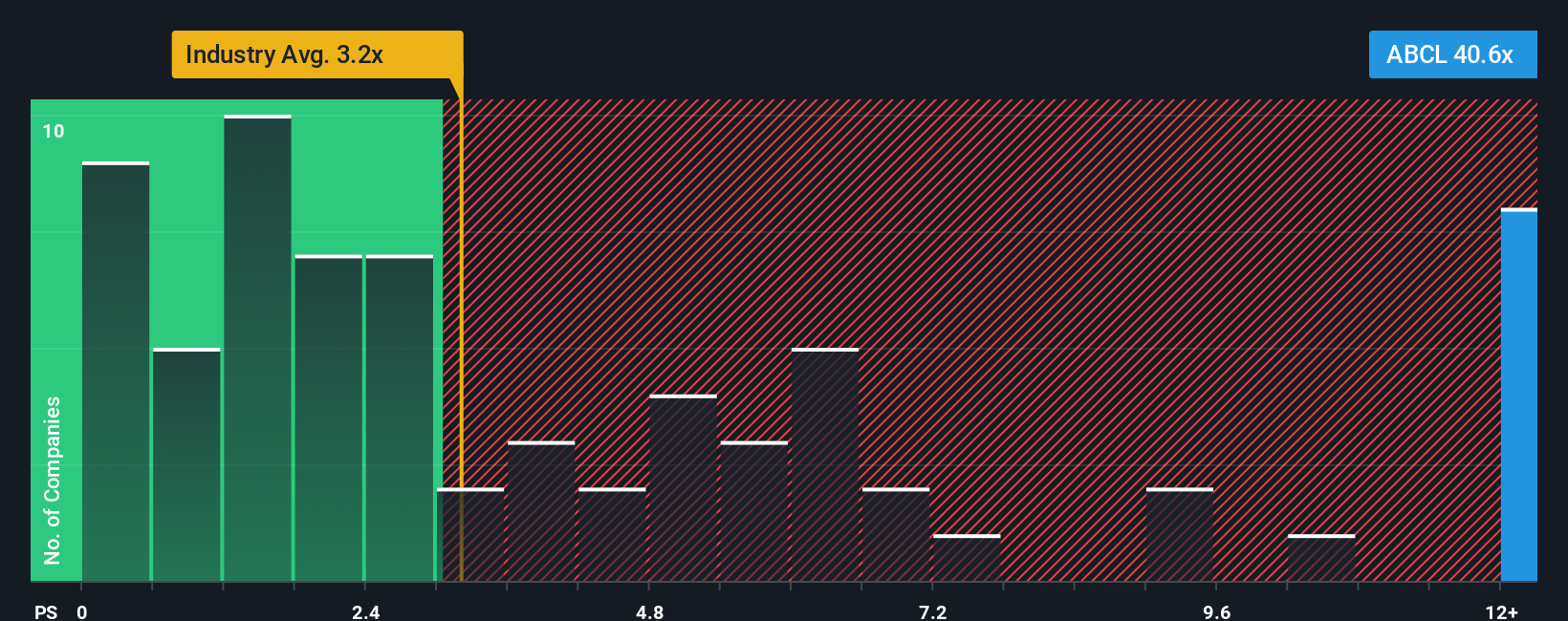

While narratives and analyst targets frame AbCellera as deeply undervalued, our price to sales lens adds tension. The stock trades on a rich 30.2 times sales, versus 3.4 times for the US Life Sciences industry and 4.6 times for peers. This suggests there could be meaningful downside if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AbCellera Biologics Narrative

If you see the numbers differently or want to stress test your own thesis, you can build a personalized narrative in just a few minutes: Do it your way.

A great starting point for your AbCellera Biologics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

If you stop at AbCellera, you could miss standout opportunities our screeners reveal across different themes, sectors, and risk profiles that suit your goals.

- Capture early stage momentum by reviewing these 3576 penny stocks with strong financials that pair tiny market caps with improving fundamentals and room for meaningful upside.

- Put structural growth to work through these 26 AI penny stocks that are reshaping everything from automation to analytics with accelerating revenue and powerful long term tailwinds.

- Explore income potential via these 15 dividend stocks with yields > 3% that offer yields above 3 percent with room for steady dividend growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABCL

AbCellera Biologics

Engages in discovering and developing antibody-based medicines for indications with unmet medical need in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026