- United States

- /

- Life Sciences

- /

- NasdaqGS:ABCL

A Fresh Look at AbCellera Biologics (NasdaqGS:ABCL) Valuation After Launching Phase 1 Study of ABCL575

Reviewed by Simply Wall St

Most Popular Narrative: 54.8% Undervalued

According to the most widely followed narrative, AbCellera Biologics is trading well below its estimated fair value, with significant potential upside projected if clinical progress and business execution continue as anticipated.

The completion of AbCellera's integrated clinical manufacturing capabilities by the end of 2025 is likely to enhance operational efficiency and reduce COGS. This could potentially improve net margins as the company begins utilization of these capabilities.

Curious what is fueling this bold valuation call? This narrative hinges on an aggressive transformation, steeper revenue growth, and future profitability assumptions that defy today's losses. Want to decipher which financial levers and assumptions drive such a steep upside? Unpack the full details for a glimpse at the analyst mindset behind that target.

Result: Fair Value of $9.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing high R&D costs and questions about the clinical translation of early data could quickly challenge the current upbeat outlook.

Find out about the key risks to this AbCellera Biologics narrative.Another View: High Hopes, High Price?

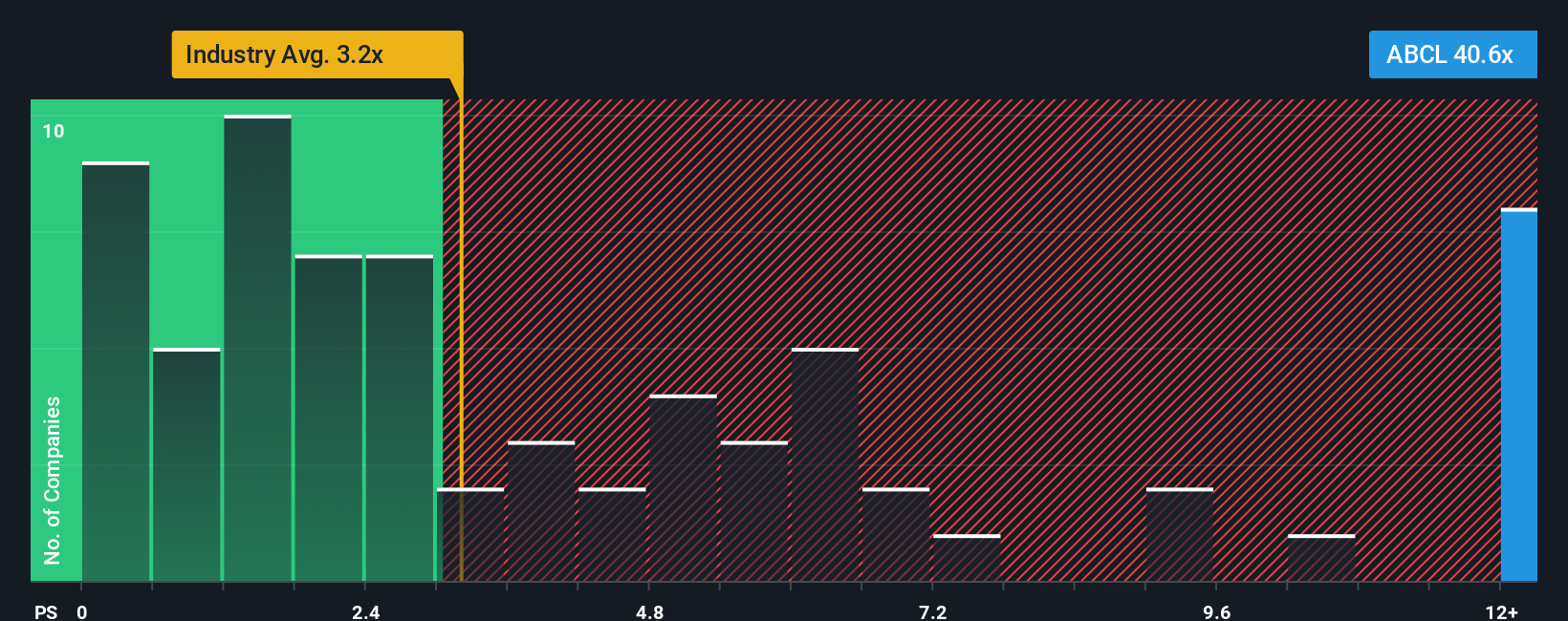

From a different angle, the current share price appears steep compared to others in the industry when considering revenue. While fair value estimates suggest there may be potential for upside, are investors taking into account the cost of this optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AbCellera Biologics Narrative

If you have your own perspective or prefer exploring the numbers firsthand, you can shape a custom narrative for AbCellera Biologics in just a few minutes. Do it your way.

A great starting point for your AbCellera Biologics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Staying ahead of the market takes smart choices and timely research. Step into new opportunities with hand-picked lists designed to help your portfolio grow.

- Uncover resilient cash flow performers and see what sets these companies apart by checking out undervalued stocks based on cash flows.

- Tap into game-changing medical breakthroughs and rapid innovation across health tech by searching the companies highlighted in healthcare AI stocks.

- Boost your passive income strategy and pinpoint stocks offering strong yields by scanning our selection of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:ABCL

AbCellera Biologics

Engages in discovering and developing antibody-based medicines for indications with unmet medical need in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives