ZipRecruiter, Inc.'s (NYSE:ZIP) Share Price Could Signal Some Risk

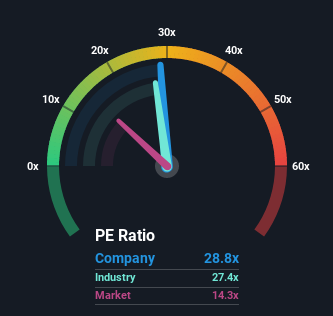

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 14x, you may consider ZipRecruiter, Inc. (NYSE:ZIP) as a stock to avoid entirely with its 28.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, ZipRecruiter has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for ZipRecruiter

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as ZipRecruiter's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 141% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the five analysts covering the company suggest earnings growth is heading into negative territory, declining 16% over the next year. That's not great when the rest of the market is expected to grow by 7.2%.

In light of this, it's alarming that ZipRecruiter's P/E sits above the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh heavily on the share price eventually.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of ZipRecruiter's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for ZipRecruiter with six simple checks will allow you to discover any risks that could be an issue.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

Valuation is complex, but we're here to simplify it.

Discover if ZipRecruiter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ZIP

ZipRecruiter

Operates an online marketplace that connects job seekers and employers in the United States and internationally.

Very low and overvalued.

Similar Companies

Market Insights

Community Narratives