Unpleasant Surprises Could Be In Store For ZipRecruiter, Inc.'s (NYSE:ZIP) Shares

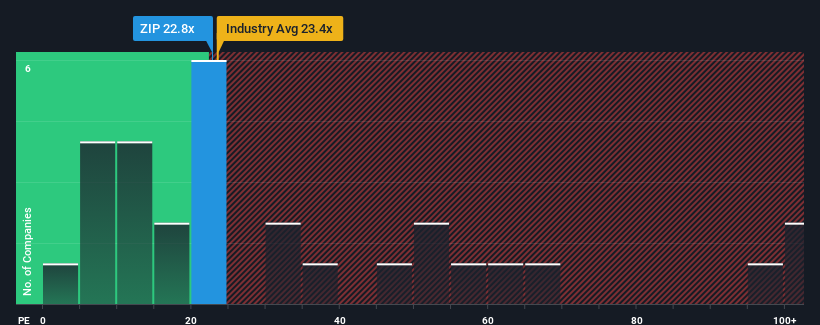

ZipRecruiter, Inc.'s (NYSE:ZIP) price-to-earnings (or "P/E") ratio of 22.8x might make it look like a sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 17x and even P/E's below 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

ZipRecruiter has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for ZipRecruiter

Does Growth Match The High P/E?

In order to justify its P/E ratio, ZipRecruiter would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 64% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

The Bottom Line On ZipRecruiter's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

And what about other risks? Every company has them, and we've spotted 2 warning signs for ZipRecruiter you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if ZipRecruiter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZIP

ZipRecruiter

Operates an online marketplace that connects job seekers and employers in the United States and internationally.

Undervalued with very low risk.

Similar Companies

Market Insights

Community Narratives