- United States

- /

- Interactive Media and Services

- /

- NYSE:YALA

Analysts' Revenue Estimates For Yalla Group Limited (NYSE:YALA) Are Surging Higher

Celebrations may be in order for Yalla Group Limited (NYSE:YALA) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects.

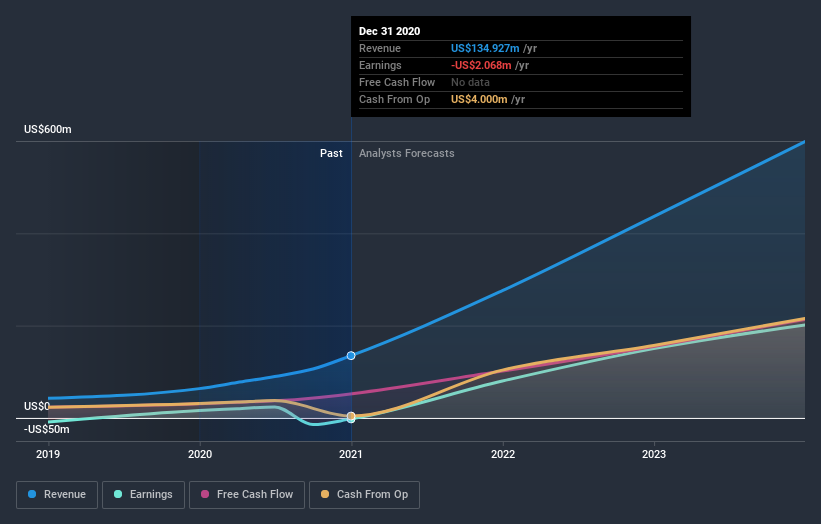

After this upgrade, Yalla Group's three analysts are now forecasting revenues of US$276m in 2021. This would be a sizeable 104% improvement in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing US$210m of revenue in 2021. It looks like there's been a clear increase in optimism around Yalla Group, given the considerable lift to revenue forecasts.

Check out our latest analysis for Yalla Group

Additionally, the consensus price target for Yalla Group increased 152% to US$27.67, showing a clear increase in optimism from the analysts involved. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Yalla Group, with the most bullish analyst valuing it at US$30.00 and the most bearish at US$23.00 per share. This is a very narrow spread of estimates, implying either that Yalla Group is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We can infer from the latest estimates that forecasts expect a continuation of Yalla Group'shistorical trends, as the 104% annualised revenue growth to the end of 2021 is roughly in line with the 112% annual revenue growth over the past year. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 16% per year. So it's pretty clear that Yalla Group is forecast to grow substantially faster than its industry.

The Bottom Line

The highlight for us was that analysts increased their revenue forecasts for Yalla Group this year. The analysts also expect revenues to grow faster than the wider market. There was also an increase in the price target, suggesting that there is more optimism baked into the forecasts than there was previously. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Yalla Group.

Unanswered questions? At least one of Yalla Group's three analysts has provided estimates out to 2023, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading Yalla Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Yalla Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:YALA

Yalla Group

Operates a social networking and gaming platform in the Middle East and North Africa region.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives