- United States

- /

- Media

- /

- NYSE:WOW

Here's Why WideOpenWest, Inc.'s (NYSE:WOW) CEO Compensation Is The Least Of Shareholders' Concerns

Despite strong share price growth of 130% for WideOpenWest, Inc. (NYSE:WOW) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 06 May 2021. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

See our latest analysis for WideOpenWest

Comparing WideOpenWest, Inc.'s CEO Compensation With the industry

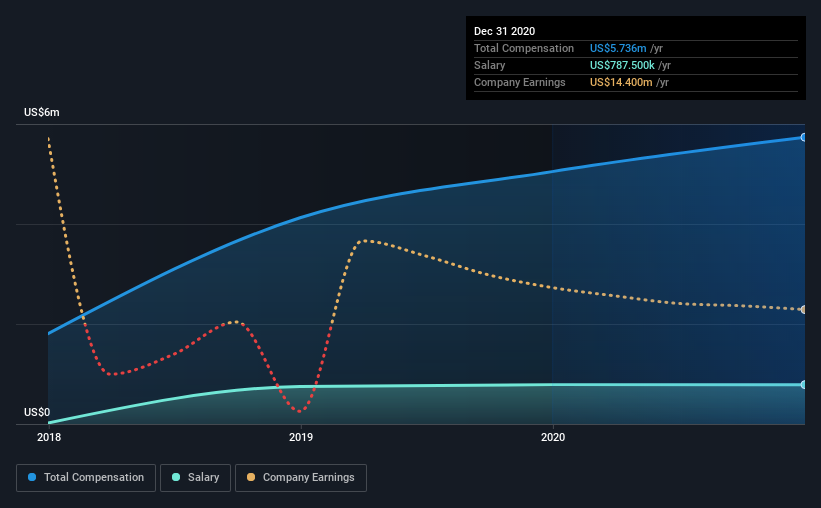

At the time of writing, our data shows that WideOpenWest, Inc. has a market capitalization of US$1.3b, and reported total annual CEO compensation of US$5.7m for the year to December 2020. Notably, that's an increase of 14% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at US$788k.

On comparing similar companies from the same industry with market caps ranging from US$1.0b to US$3.2b, we found that the median CEO total compensation was US$6.5m. This suggests that WideOpenWest remunerates its CEO largely in line with the industry average. Furthermore, Teresa Elder directly owns US$25m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$788k | US$788k | 14% |

| Other | US$4.9m | US$4.3m | 86% |

| Total Compensation | US$5.7m | US$5.0m | 100% |

Talking in terms of the industry, salary represented approximately 20% of total compensation out of all the companies we analyzed, while other remuneration made up 80% of the pie. WideOpenWest pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

WideOpenWest, Inc.'s Growth

Over the last three years, WideOpenWest, Inc. has shrunk its earnings per share by 58% per year. Revenue was pretty flat on last year.

Overall this is not a very positive result for shareholders. And the flat revenue hardly impresses. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has WideOpenWest, Inc. Been A Good Investment?

Boasting a total shareholder return of 130% over three years, WideOpenWest, Inc. has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 5 warning signs for WideOpenWest (of which 2 don't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from WideOpenWest, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade WideOpenWest, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if WideOpenWest might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:WOW

WideOpenWest

Provides high-speed data, cable television, and digital telephony services to residential and business customers in the United States.

Slightly overvalued very low.

Similar Companies

Market Insights

Community Narratives