- United States

- /

- Media

- /

- NYSE:WLY

Did Wiley AI Gateway’s Launch Just Shift John Wiley & Sons' (WLY) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, John Wiley & Sons launched Wiley AI Gateway, the first AI-native research intelligence platform connecting researchers to peer-reviewed content from leading publishers through integrations with platforms like Anthropic's Claude and AWS Marketplace.

- By prioritizing interoperability and enabling publishers such as Sage and the American Society for Microbiology to participate, the platform aims to create an industry-wide, trusted network for AI-powered research discovery.

- We'll explore how Wiley’s new AI Gateway, designed to integrate scholarly content with major AI tools, could influence its growth outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

John Wiley & Sons Investment Narrative Recap

To be a shareholder in John Wiley & Sons, you need to believe that the company can successfully pivot to digital and AI-powered research tools, capturing new recurring revenue streams as traditional publishing faces structural challenges. The launch of Wiley AI Gateway could help reinforce Wiley’s position in AI content licensing, but it may not fully resolve concerns over the unpredictability of this rapidly changing market, which remains a key short-term catalyst and risk for the business.

Among recent announcements, Wiley’s new partnerships to integrate its AI Gateway with platforms like Anthropic’s Claude and AWS Marketplace stand out as particularly relevant. These collaborations aim to broaden Wiley’s reach into research intelligence and data analytics, supporting the push for high-margin, diversified revenue outside core academic publishing and reinforcing investor focus on digital growth catalysts.

However, investors should also be mindful of emerging risks that could disrupt Wiley’s digital transition, especially as...

Read the full narrative on John Wiley & Sons (it's free!)

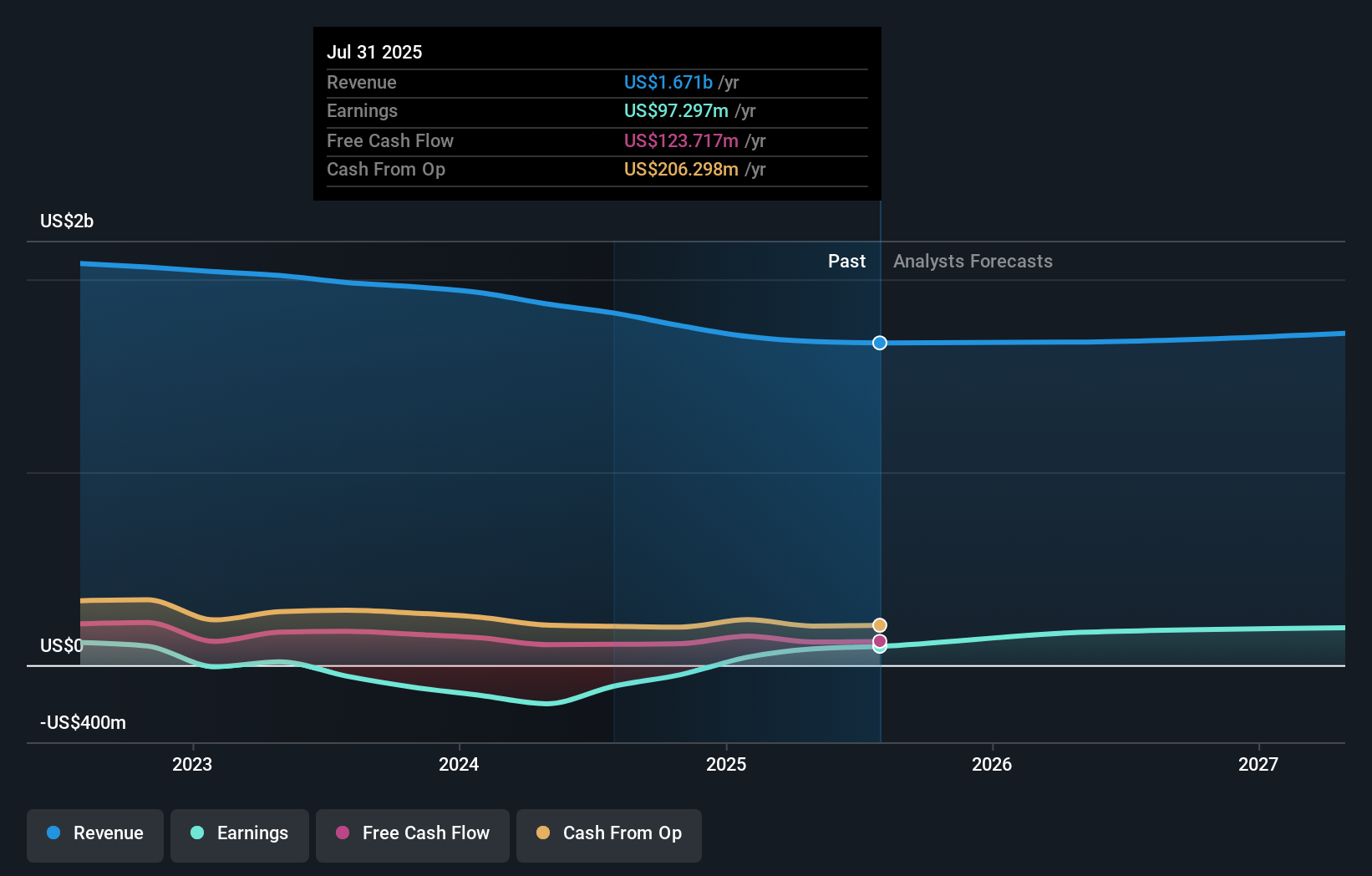

John Wiley & Sons' narrative projects $1.8 billion revenue and $266.1 million earnings by 2028. This requires 1.5% yearly revenue growth and a $181.9 million earnings increase from $84.2 million.

Uncover how John Wiley & Sons' forecasts yield a $60.00 fair value, a 61% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided three fair value estimates for Wiley, ranging from US$30.16 to US$60. These diverse viewpoints highlight how the uncertain trajectory of AI licensing could have wide-reaching impacts on Wiley’s future performance, consider these different perspectives as you assess the company for your own portfolio.

Explore 3 other fair value estimates on John Wiley & Sons - why the stock might be worth 19% less than the current price!

Build Your Own John Wiley & Sons Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your John Wiley & Sons research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free John Wiley & Sons research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate John Wiley & Sons' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WLY

John Wiley & Sons

A publisher, provides authoritative content, data-driven insights, and knowledge services for the advancement of science, innovation, and learning in the United States, China, the United Kingdom, Japan, Australia, and internationally.

6 star dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion