- United States

- /

- Entertainment

- /

- NYSE:TME

Tencent Music Entertainment Group (NYSE:TME) Valuation: How Does Recent Share Performance Align With Long-Term Potential?

Reviewed by Kshitija Bhandaru

See our latest analysis for Tencent Music Entertainment Group.

After a solid run over the last three months, Tencent Music’s recent dip has caught some eyes, but it still boasts a modest 1-year total shareholder return of 0.7%. However, momentum from earlier in the year appears to be fading as short-term share price returns give back some ground, even though the company maintains a solid long-term track record.

If you’re curious about what other dynamic businesses are making moves, now’s a great time to widen your perspective and discover fast growing stocks with high insider ownership

With a modest annual return and revenue growth remaining steady, the key question is whether Tencent Music's current share price reflects all its future potential or if an attractive buying opportunity is emerging for investors.

Most Popular Narrative: 19% Undervalued

With Tencent Music's narrative fair value set at $28.34, and the latest close at $22.90, analysts see a substantial gap to the upside, reflecting optimism about the company's underlying momentum and future potential.

Strategic expansion into offline performances, artist merchandise, and cross-platform artist-fan interactions diversifies revenue streams and leverages the evolving "fan economy." This approach creates incremental revenue opportunities beyond traditional streaming while enhancing the company's resilience and brand power.

Want to know the secret sauce behind this bullish target? The narrative hints at bold financial projections, fueled by aggressive subscriber growth and escalating market reach. Discover which ambitious assumptions shape their verdict. Read the full story to catch the numbers everyone’s debating.

Result: Fair Value of $28.34 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory scrutiny and increased reliance on lower-margin offline events could limit future profitability. This may make the bullish outlook less certain.

Find out about the key risks to this Tencent Music Entertainment Group narrative.

Another View: What Do the Numbers Say?

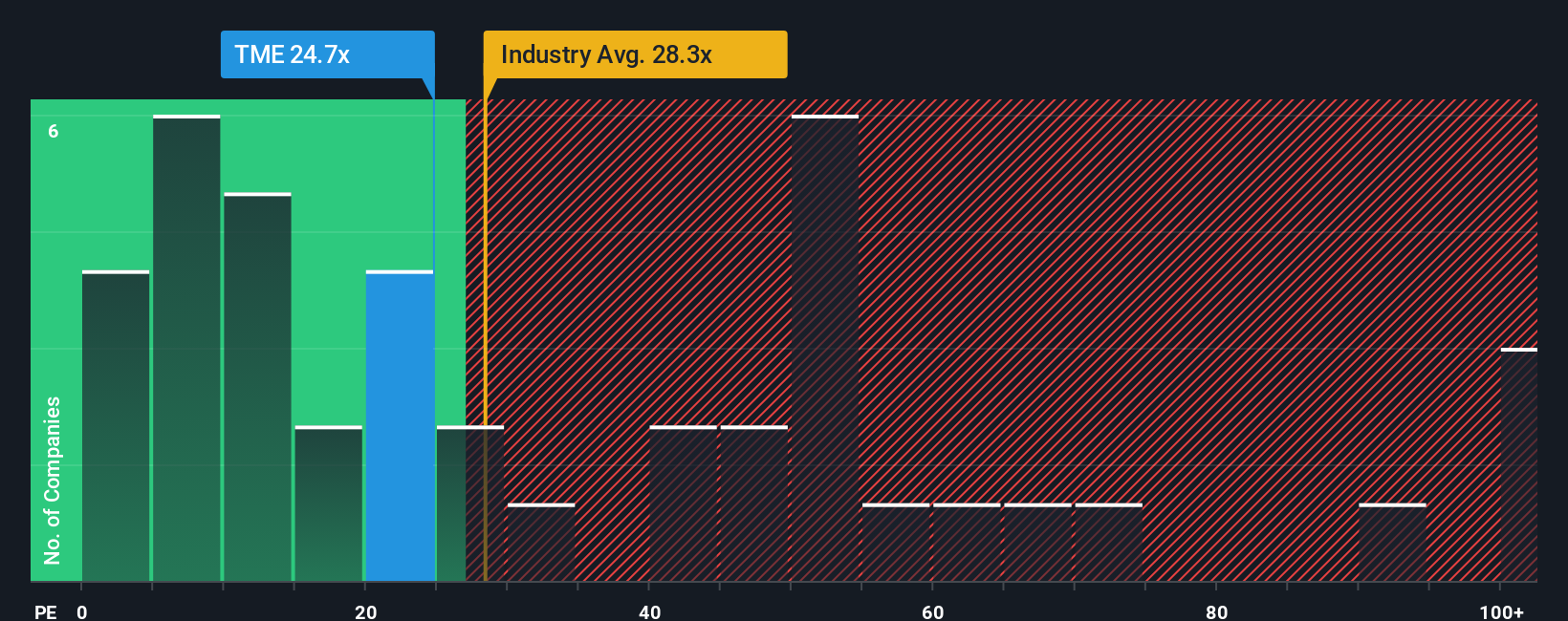

Looking from a different angle, Tencent Music’s price-to-earnings ratio sits at 25.2x, lower than both the US Entertainment industry average of 30.9x and the peer average of 75x. However, it is trading just above our fair ratio of 24.8x, suggesting limited valuation upside right now.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tencent Music Entertainment Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can put together your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Tencent Music Entertainment Group.

Looking for more investment ideas?

Smart investors never stop at one opportunity. To stay ahead, check out these powerful screens and uncover fresh stocks building momentum right now.

- Capture growth potential by backing visionary teams shaping the AI landscape. Jump in with these 24 AI penny stocks and find the next market leaders.

- Secure reliable income flows in today’s changing markets when you access these 19 dividend stocks with yields > 3% delivering yields above 3%.

- Seize undervalued gems that the market may be overlooking. See your options with these 893 undervalued stocks based on cash flows based on real, forward-looking cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tencent Music Entertainment Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TME

Tencent Music Entertainment Group

Operates online music entertainment platforms that provides music streaming, online karaoke, and live streaming services in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion