- United States

- /

- Entertainment

- /

- NYSE:TME

Assessing Tencent Music After a 100% Surge and New Tech Partnerships in 2025

Reviewed by Bailey Pemberton

If you were watching Tencent Music Entertainment Group’s stock lately, you’ve probably been wondering whether now is the right time to jump in, take some profits, or simply sit back. After a dizzying year-to-date surge of more than 100%, and a monster three-year return of over 500%, it makes sense that investors feel a mix of excitement and caution. Even with a slight -1.0% dip in the last week and a -6.5% move over the past month, these pullbacks barely dent the outsize gains that long-term holders have enjoyed, thanks to the company’s continued dominance in China’s music and audio streaming scene.

Behind the impressive numbers is a steady flow of news highlighting Tencent Music’s latest tech partnerships and content deals, reinforcing its leadership in a fast-growing market. These stories, along with ongoing fintech sector reforms in China, have kept the spotlight firmly on music streaming as a strong sector play. More investors are beginning to recognize the potential of leading Chinese tech platforms to deliver both innovation and resilience, fueling both optimism and some debate about what the stock should really be worth today.

Now, when it comes to valuation, Tencent Music Entertainment scores a solid 4 out of 6 on our value checklist, quite a feat given the strong run-up in price. So, how does that score hold up against different valuation strategies, and could there be an even smarter way to gauge whether Tencent Music is currently undervalued? Let’s dig deeper into the numbers and see if the data matches the market’s enthusiasm.

Approach 1: Tencent Music Entertainment Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is really worth today by projecting its future cash flows and then discounting those back to the present. This approach gives investors a data-driven view of underlying value, beyond what the market may be pricing in right now.

For Tencent Music Entertainment Group, the DCF model begins with its latest trailing twelve-month Free Cash Flow, which is reported at a robust CN¥7.7 billion. Looking ahead, analysts forecast steady growth, with Free Cash Flow projected to reach around CN¥17.1 billion by 2029. While analysts typically provide up to five years of detailed estimates, the model extends beyond that period using reasonable growth assumptions based on industry trends.

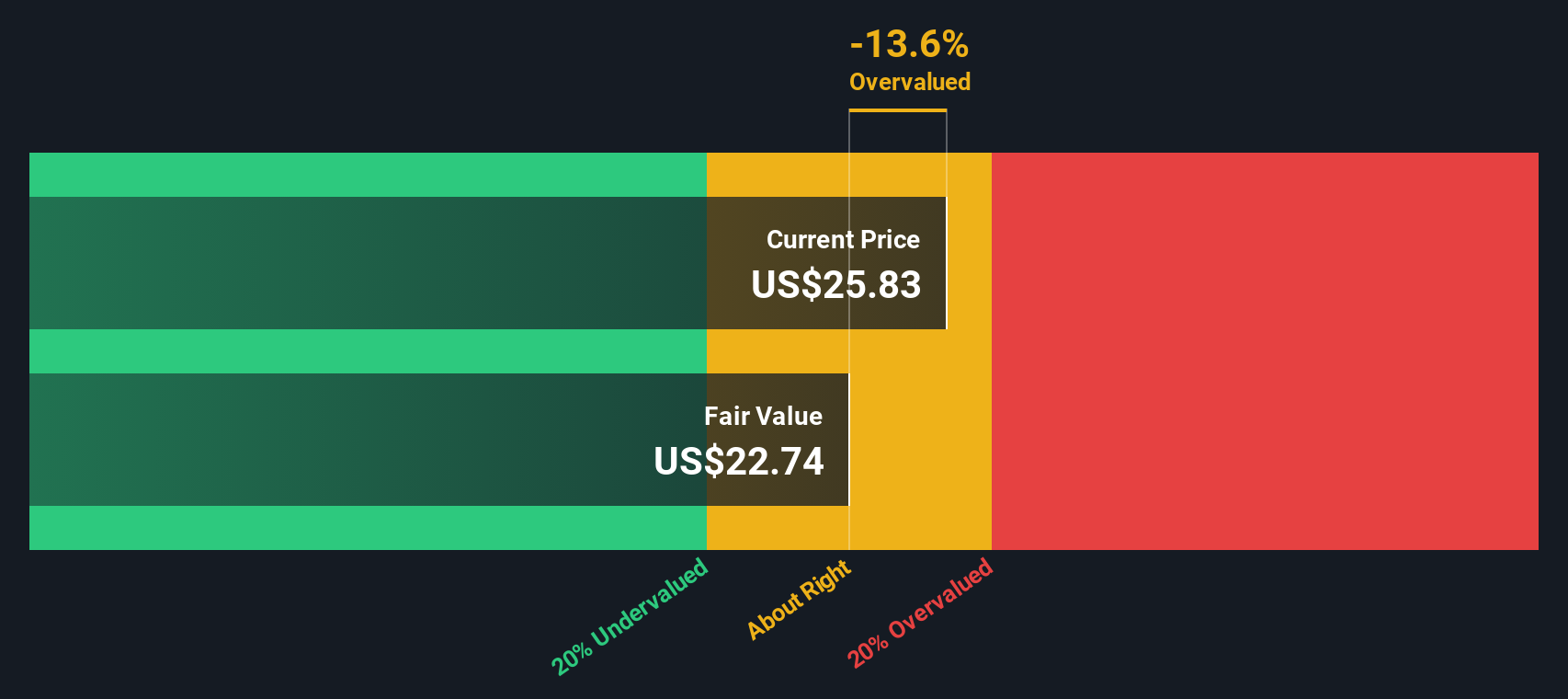

Based on this cash flow outlook, the model arrives at an estimated intrinsic value per share of $23.35. Since this figure is about 2.8% higher than Tencent Music’s current share price, the model indicates the stock is trading very close to its fair value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Tencent Music Entertainment Group's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Tencent Music Entertainment Group Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Tencent Music Entertainment Group because it reflects how much investors are willing to pay today for each dollar of current earnings. A higher PE ratio usually suggests expectations of faster growth, greater profitability, or lower risks, while a lower PE can point to more modest growth prospects or higher perceived risks. In short, what counts as a "fair" PE ratio depends on how fast the company is expected to grow, its risk profile, and how it stacks up against peers.

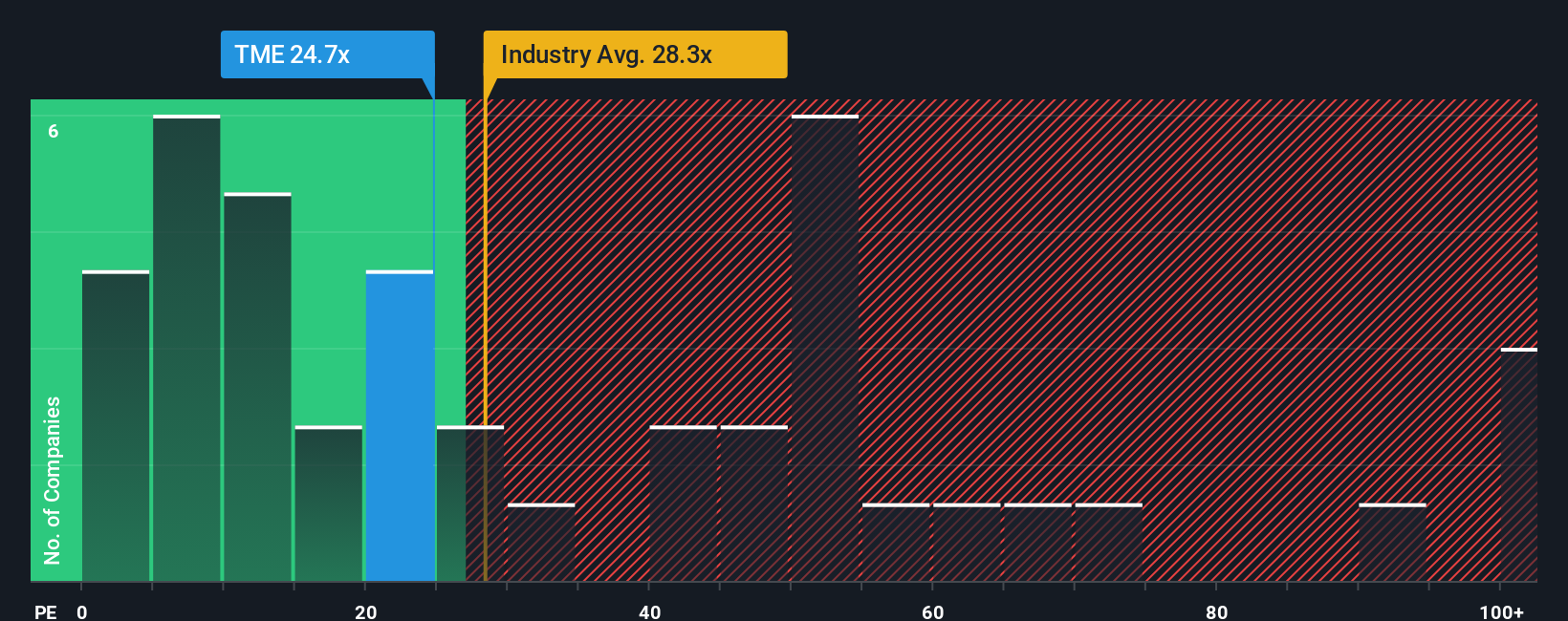

Currently, Tencent Music trades at a PE ratio of 25x, which is almost in line with the Entertainment industry average of 26.4x, but well below the average PE of its closest peers, which sits much higher at 73.6x. While this headline comparison can be insightful, it does not tell the whole story. Factors like profit margins, growth forecasts, and the company's position in the market all matter when determining how much investors should actually be willing to pay.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. Instead of simply benchmarking Tencent Music against broad industry averages or its peer set, the Fair Ratio considers a blend of the company’s earnings growth potential, margins, size, risk level, and its specific industry. For Tencent Music, the Fair PE Ratio is calculated as 24.7x, just a fraction below its actual PE of 25x. This close match suggests the stock is trading almost exactly where you would expect, given all relevant factors.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tencent Music Entertainment Group Narrative

Earlier, we mentioned there may be an even better way to understand valuation, so let's introduce you to Narratives, an intuitive tool designed to help investors connect Tencent Music's story with its numbers. Narratives let you create and view your own perspective on the company, backing up your outlook with forecasts for revenue, earnings, and profit margins to arrive at your version of fair value. Each Narrative links the company’s business story, market catalysts, and even changing industry risks to a forward-looking financial model, providing a powerful context for buy or sell decisions by comparing your fair value with the current share price.

What makes Narratives unique is they are live and automatically updated when new data or news arrives. Within Simply Wall St's Community page, used by millions, you can explore bullish and bearish Narratives for Tencent Music side by side. For instance, some expect all-around perfect quarters and $32.95 price targets based on rapid digital innovation, while others set $17.00 targets, warning of margin pressure from offline events and regulatory risks. Narratives make it easy to track changing opinions and decide where you stand in real time, all with a single, user-friendly tool.

Do you think there's more to the story for Tencent Music Entertainment Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tencent Music Entertainment Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TME

Tencent Music Entertainment Group

Operates online music entertainment platforms that provides music streaming, online karaoke, and live streaming services in the People’s Republic of China.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives