- United States

- /

- Entertainment

- /

- NYSE:TKO

Should You Reassess TKO After WWE Event Success Drives Stock Up 38% in 2025?

Reviewed by Bailey Pemberton

If you are watching TKO Group Holdings right now and wondering what your next move should be, you are not alone. The company’s stock has been on quite the run, rising 1.1% in just the last week, 6.8% over the past month, and an eye-catching 38.7% year-to-date. If you zoom out even further, the shares are up 58% over the last year. It is no surprise that investors are asking if there is still room to grow, or if the risks are starting to outweigh the potential rewards.

Much of this momentum can be traced back to changes in the broader market environment. Investor appetite for growth has been high, and names like TKO Group Holdings have benefited from wider optimism. However, some are starting to wonder whether the stock’s rally has priced in all the good news.

Here is where valuation comes in. TKO Group Holdings currently gets a value score of 0 out of 6, meaning it is not considered undervalued on any of the key checks analysts usually lean on. That might sound a little concerning, but before you jump to conclusions, let’s break down exactly what this score measures and how much it should matter to your own investing decisions. Of course, there are standard ways to look at valuation, such as common ratios and benchmarks, but stick with me, because there is a more insightful approach that could help you see the bigger picture by the end of this article.

TKO Group Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: TKO Group Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its expected future cash flows and discounting them back to present value. This approach helps investors determine what a business is worth today, based purely on its future income potential.

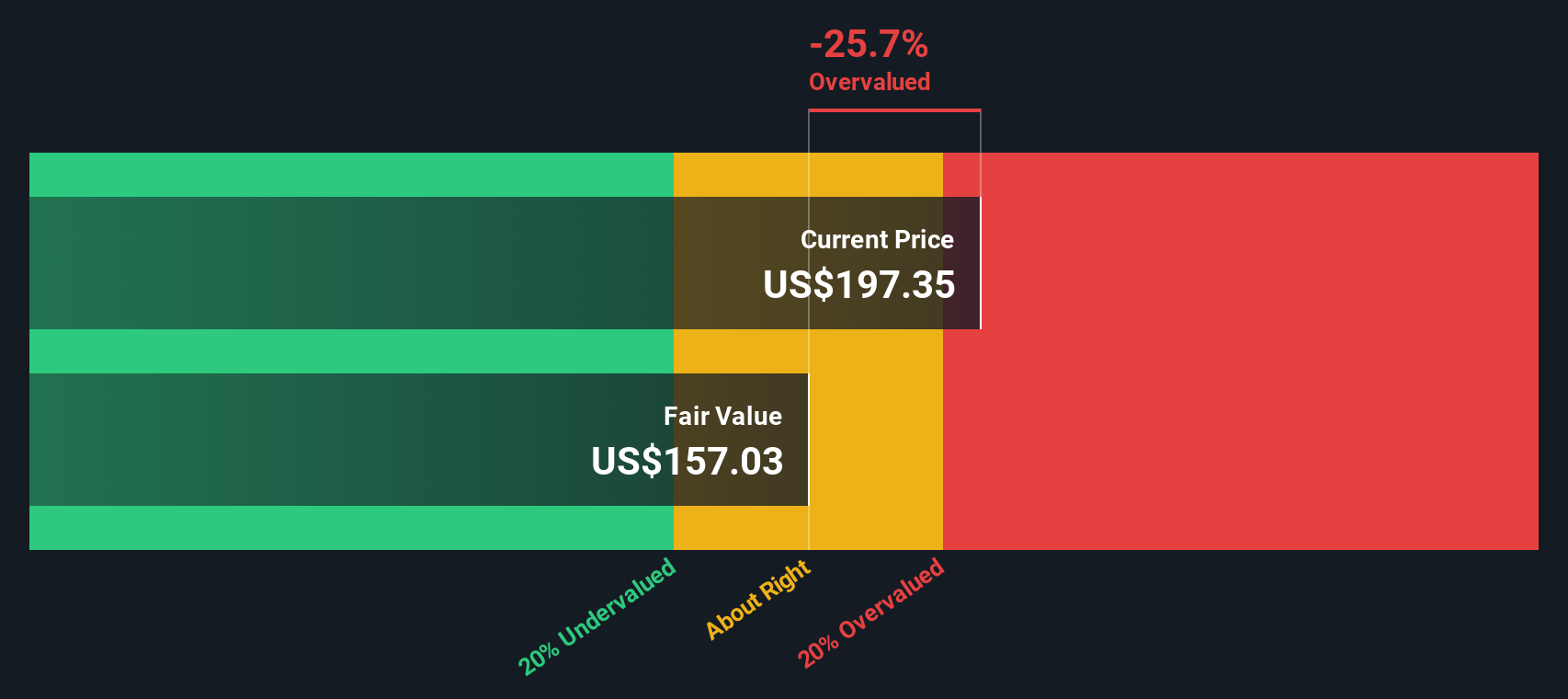

For TKO Group Holdings, the model uses recent Free Cash Flow (FCF) of $721.8 million. Analysts provide growth estimates for the next five years, with projected cash flows rising annually to reach $1.98 billion by the end of 2029. Beyond analyst estimates, Simply Wall St extrapolates cash flow figures for up to ten years, showing a steady pace of growth.

After discounting these cash flows to account for risk and time, the estimated intrinsic value comes out to $154.43 per share. When this figure is compared to the current stock price, the model shows that TKO Group Holdings is trading about 28.2% above its fair value. In other words, the market has priced in a lot of future optimism, more than the company's underlying cash flows support right now.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests TKO Group Holdings may be overvalued by 28.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: TKO Group Holdings Price vs Earnings (P/E)

For companies that are consistently profitable, the Price-to-Earnings (P/E) ratio is often the preferred way to gauge whether their stock price is justified. This multiple distills much of an investor’s expectations into a single number, helping you quickly compare value between companies. Typically, the higher a company’s future growth forecast and the lower its risk, the higher the P/E multiple investors are willing to pay. In other words, strong growth and stability make higher P/Es more reasonable.

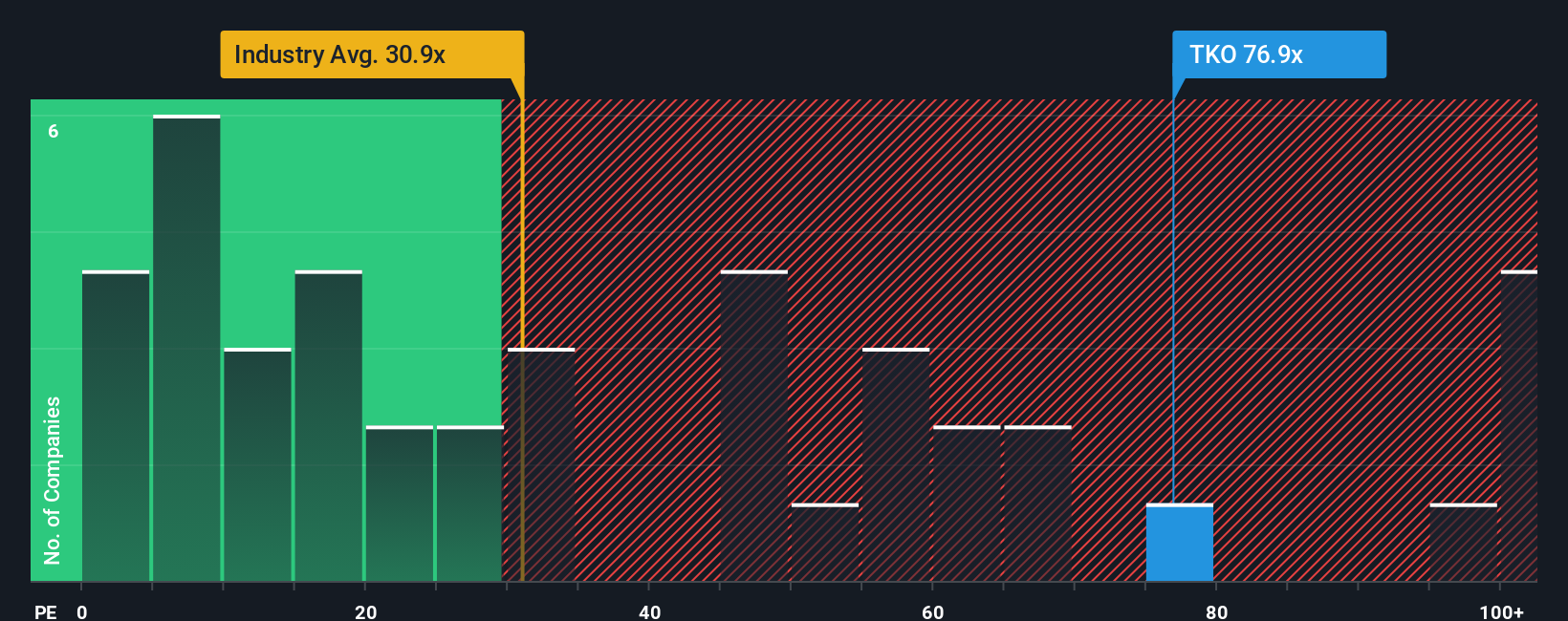

Right now, TKO Group Holdings trades at a P/E ratio of 77.1x. For context, the average P/E across the Entertainment industry is 30.1x, while its peer group sits even higher at around 62.2x. On the surface, that looks expensive, but it is important to move beyond straightforward comparisons. Simply Wall St’s proprietary “Fair Ratio,” which blends in factors like TKO’s projected earnings growth, industry trends, profit margins, and market cap, comes in at 36.4x. This is the multiple the stock should trade at given its specific profile and risk level, rather than just generic industry averages.

By using the Fair Ratio, you get a more rigorous valuation baseline that reflects the nuances of TKO’s unique business, rather than the blunt tool of comparing only to industry or peer averages. In this case, with the current P/E of 77.1x well above the Fair Ratio of 36.4x, TKO Group Holdings appears significantly overvalued based on its earnings potential and risk profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TKO Group Holdings Narrative

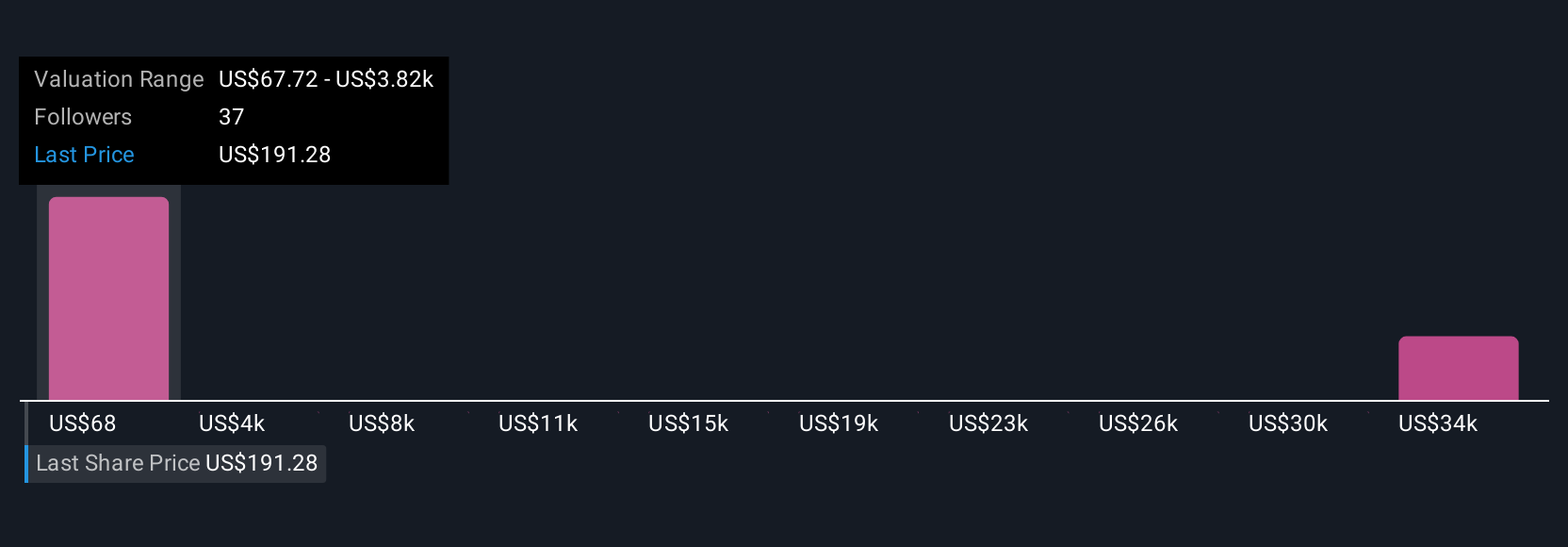

Earlier we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply your story about a company, connecting your unique perspective and assumptions about future revenue, profit margins, and risk with a financial forecast and, ultimately, a fair value estimate. Narratives allow you to look beyond just ratios or models by framing an investment around the specific reasons you think a stock is worth buying or selling.

On Simply Wall St’s platform, millions of investors use Narratives right from the Community page. This makes it easy and accessible to experiment with your own expectations, see the math behind them, and compare your view to others. Narratives help you decide whether TKO Group Holdings is undervalued or overvalued at today’s price and are updated dynamically whenever new news or earnings come in, so your perspective always stays relevant.

For example, one investor might build a Narrative where TKO Group Holdings’ bold expansion translates into the highest fair value estimate. Another, more cautious Narrative could lead to a much lower target price. Narratives make it simple to see both sides, empowering you to make decisions grounded in your own insights.

Do you think there's more to the story for TKO Group Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives