- United States

- /

- Entertainment

- /

- NYSE:TKO

Did TKO’s (TKO) US$150 Million Dividend and Insider Moves Just Redefine Its Capital Strategy?

Reviewed by Sasha Jovanovic

- TKO Group Holdings, Inc. recently declared a fourth-quarter cash dividend, distributing approximately US$150.00 million in total, with Class A shareholders set to receive US$0.78 per share on December 30, 2025, for holders of record on December 15, 2025.

- Alongside this sizeable dividend, insider activity has been active over the past year, with 30 insider purchases and 17 insider sales, including a recent sale of 254 shares by a deputy chief financial officer.

- With TKO committing to a sizeable fourth-quarter cash dividend, we’ll explore how this capital return shapes the company’s broader investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is TKO Group Holdings' Investment Narrative?

To own TKO, you have to believe in the long‑term power of its combat sports and media IP, and in management’s ability to turn that into durable cash flows while integrating acquisitions and content deals. The fresh US$150.00 million fourth‑quarter dividend, following September’s upsized payout, reinforces the story of a business currently generating enough cash to fund sizeable returns alongside previously completed buybacks. That said, it also nudges capital allocation into sharper focus when the stock already trades on a rich earnings multiple and past results include a large one‑off gain. In the near term, key catalysts still sit around execution on media rights, sponsorship and live event monetization, with the dividend more of a supporting signal than a fundamental shift. Insider trading activity, including recent sales, adds another layer investors will be watching.

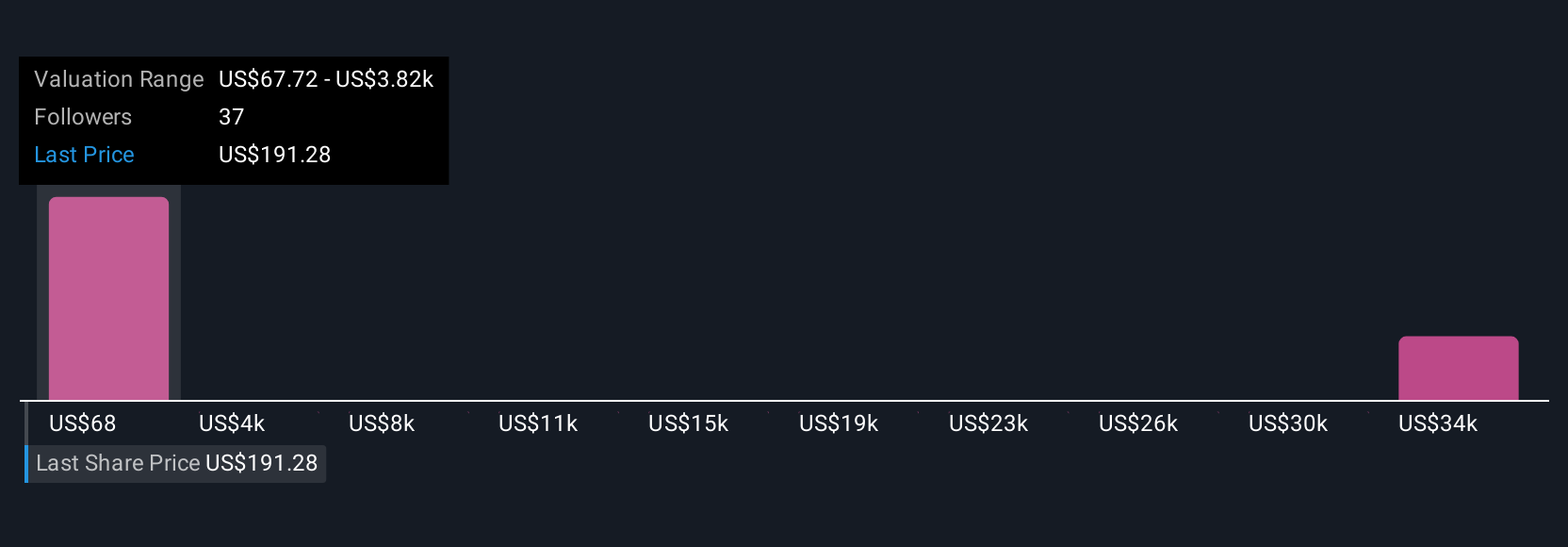

However, the combination of rich valuation and a relatively new board is something investors should note. TKO Group Holdings' shares have been on the rise but are still potentially undervalued by 8%. Find out what it's worth.Exploring Other Perspectives

Explore 10 other fair value estimates on TKO Group Holdings - why the stock might be worth less than half the current price!

Build Your Own TKO Group Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TKO Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TKO Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TKO Group Holdings' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026