- United States

- /

- Entertainment

- /

- NYSE:SPOT

Spotify (SPOT) Is Down 6.9% After Beating Q3 2025 Estimates and Announcing Netflix Partnership – What's Changed

Reviewed by Sasha Jovanovic

- Spotify Technology S.A. recently reported its third quarter 2025 results, surpassing expectations with sales of €4.27 billion and net income of €899 million, alongside 713 million monthly active users and 12% subscriber growth year over year.

- The company also announced a partnership with Netflix to distribute select video podcast content, signaling a push to increase creator reach and diversify engagement beyond music streaming.

- With robust financial performance and a new collaboration with Netflix, we'll examine how these developments could impact Spotify's long-term growth story and investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Spotify Technology Investment Narrative Recap

To be a Spotify shareholder, one needs to believe in its ability to convert global user and subscriber growth into sustained margin and earnings expansion, as it scales beyond music into podcasts, video, and advertising. The recent earnings beat and partnership with Netflix reinforce Spotify's engagement strategy, but these developments do not materially reduce the key near-term risk: ongoing high content costs tied to major record label deals that continue to limit margin expansion.

Of the recent announcements, the Q3 earnings result stands out, with net income nearly tripling year over year and revenue growing 7%. This profitability surge supports optimism around product diversification and global user growth as catalysts, but does not fundamentally alter the margin pressure or questions around long-term profit resilience.

But while headline growth impresses, investors should be aware of the persistent content cost headwinds that may eventually...

Read the full narrative on Spotify Technology (it's free!)

Spotify Technology's outlook anticipates €23.8 billion in revenue and €3.4 billion in earnings by 2028. This projection assumes a 12.8% annual revenue growth rate and an increase in earnings of €2.6 billion from the current €806.0 million.

Uncover how Spotify Technology's forecasts yield a $736.43 fair value, a 19% upside to its current price.

Exploring Other Perspectives

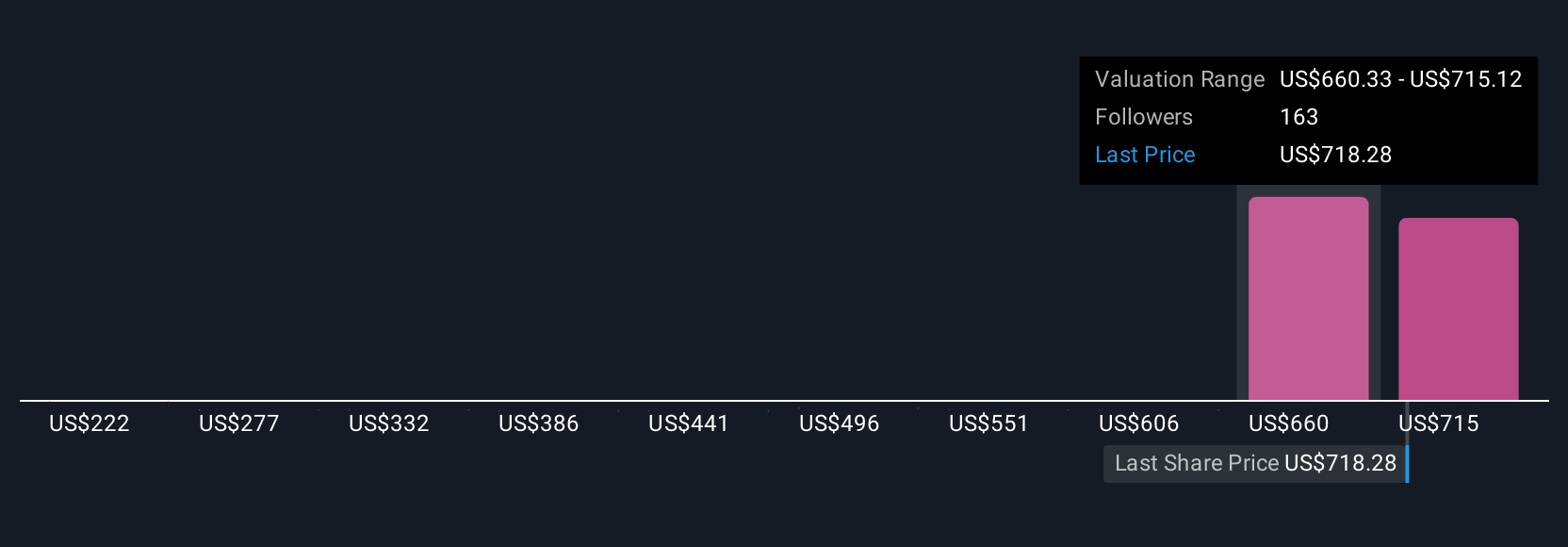

Fair value estimates from 22 Simply Wall St Community members span a wide range, from €324 to €914 per share. While most see positive catalysts in user and product growth, opinions about future margin improvement and profitability differ sharply, so consider how your outlook fits among these perspectives.

Explore 22 other fair value estimates on Spotify Technology - why the stock might be worth as much as 47% more than the current price!

Build Your Own Spotify Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spotify Technology research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Spotify Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spotify Technology's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives