- United States

- /

- Entertainment

- /

- NYSE:SPOT

Spotify (SPOT): Examining Valuation as U.S. Price Hike Targets Profit Growth and Competitive Pressures

Reviewed by Simply Wall St

Spotify Technology (SPOT) is set to raise its U.S. subscription prices in the first quarter of 2026, following similar moves in other countries. The company aims to strengthen profitability as content costs continue to increase.

See our latest analysis for Spotify Technology.

Spotify’s planned U.S. price hike comes on the heels of a busy stretch, including leadership transitions, new sales and product launches, and a handful of price adjustments across global markets. After a strong start to the year, Spotify’s recent 30-day share price return of -9.9% and a 90-day slide of -13.8% reflect some short-term turbulence. Despite this, longer-term momentum remains powerful, highlighted by a remarkable 646% total shareholder return over three years. Investors seem to be weighing near-term profit strategies against Spotify’s sizable long-term value creation.

If you’re interested in what’s next for high-growth tech and AI companies, now is a great opportunity to explore See the full list for free.

With this backdrop, investors have to ask whether Spotify’s recent pullback and future price hikes represent a compelling entry point, or if the market has already factored in the platform’s growth potential and improved profitability.

Most Popular Narrative: 15.7% Undervalued

Spotify’s current share price trails the most popular narrative’s target, signaling a gap between market sentiment and what is projected if expected trends play out. The narrative argues that there is still considerable room for upside, given Spotify’s rapid shift from high growth to highly cash-generative operations.

"Spotify generated €700 million in free cash flow in Q2 2025, up 43% year-over-year from €490 million in Q2 2024. This brings last twelve months' free cash flow to €2.8 billion, far ahead of my previous expectations and a clear signal of improving capital efficiency."

The numbers behind this narrative could surprise you. Discover which growth levers, margin shifts, and future profit multiples drive such an aggressive price target. Do you want to know if Spotify’s operating transformation justifies the optimism or if there is risk of overreaching? The full story awaits behind this bold valuation thesis.

Result: Fair Value of $703 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition or weaker-than-expected user growth could still undermine Spotify’s bullish thesis and delay its margin expansion story.

Find out about the key risks to this Spotify Technology narrative.

Another View: What Do Valuation Ratios Say?

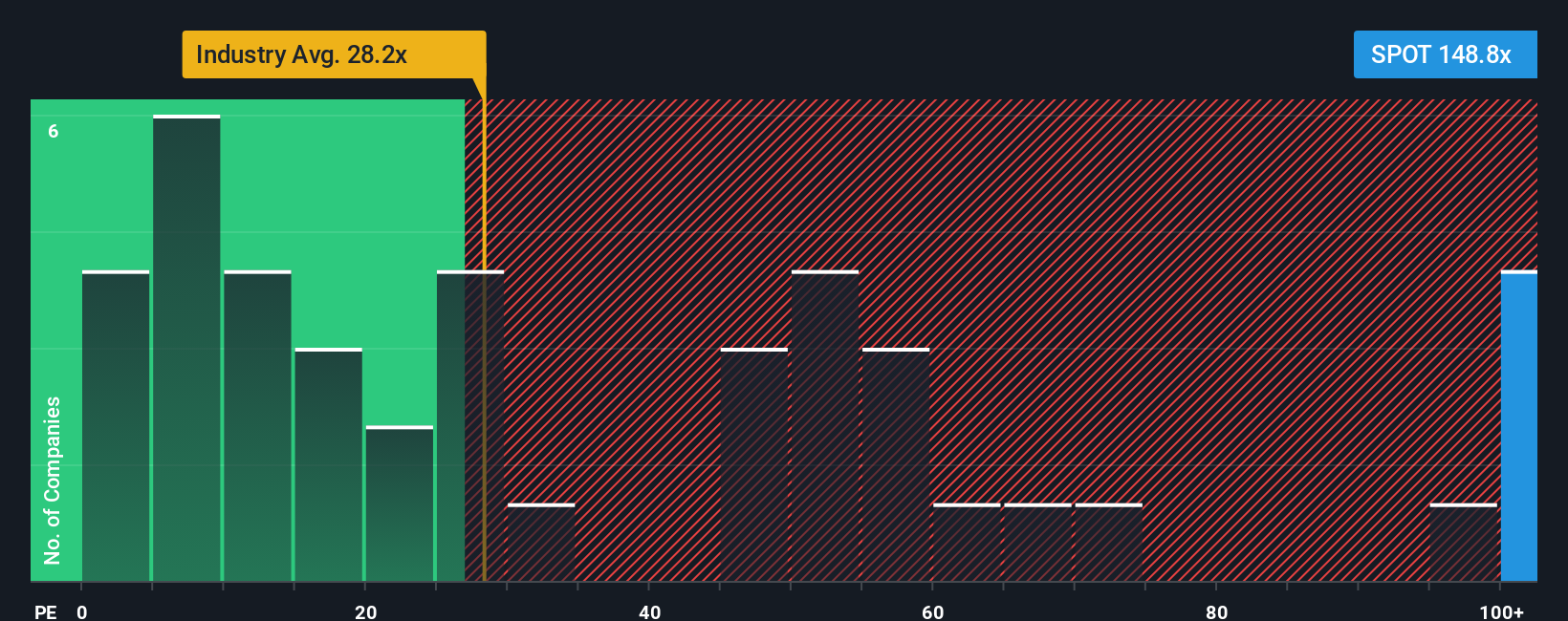

Looking at Spotify’s valuation from the earnings ratio angle, its current price is 75 times earnings. That is richer than both industry peers at 68.4 times and well above the broader U.S. entertainment average of 20.8 times. It also exceeds the fair ratio of 36.9 times suggested by market analysis. This leaves Spotify trading at a clear valuation premium. Could this price tag prove justified as Spotify’s growth story unfolds, or does it create fresh risks if expectations begin to slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Spotify Technology Narrative

If you see things differently or enjoy hands-on analysis, dive into the details and shape your own thesis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Spotify Technology.

Looking for More Investment Ideas?

Take the next step in your investing journey. Power up your portfolio with smart opportunities that others might miss. These handpicked stock ideas go beyond the obvious and give you an edge in spotting tomorrow’s winners.

- Capture reliable income streams when you browse these 15 dividend stocks with yields > 3% with yields above 3% and solid fundamentals.

- Ride the momentum of artificial intelligence breakthroughs by checking out these 25 AI penny stocks fueling tomorrow’s disruption.

- Unlock hidden value by targeting promising companies trading below their intrinsic worth through these 933 undervalued stocks based on cash flows before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success