- United States

- /

- Entertainment

- /

- NYSE:SPOT

Spotify (NYSE:SPOT) Valuation Check as Leadership Transition and Pricing Strategy Drive the Next Growth Phase

Reviewed by Simply Wall St

Spotify Technology (NYSE:SPOT) is heading into a pivotal leadership handoff as founder Daniel Ek prepares to step aside and long time executives Alex Norström and Gustav Söderström move into co CEO roles in January 2026.

See our latest analysis for Spotify Technology.

The leadership reshuffle and recent price hikes come as investors weigh short term volatility against Spotify’s strong execution, with a 27.17% year to date share price return and a three year total shareholder return of 649.24% signalling powerful underlying momentum.

If Spotify’s latest moves have you rethinking growth in digital media, it is also worth scanning high growth tech and AI stocks for other platforms riding similar structural tailwinds.

With analysts still targeting 30 percent plus upside and Spotify delivering triple digit earnings growth, the question now is simple: Is the market underestimating this next chapter or already baking in every leg of future expansion?

Most Popular Narrative: 17.2% Undervalued

According to MichaelP, the narrative fair value of $703 per share sits notably above Spotify’s last close, setting up an ambitious long term roadmap for growth and cash generation.

As of 2022, Spotify only monetised 14% of podcast listening time while it focused on user growth, engagement, and podcast investment. As the business ramps up monetization of content, achieves better deals with the labels, reduces growth expenditure and relies less on music, I expect its gross and net margins will improve considerably, which will also change the way investors value the stock.

Want to see how this narrative gets from modest current margins to a much richer profit profile using bold growth, margin and multiple assumptions? The full story reveals the combination of user scale, monetization levers and future earnings power that underpins that target valuation, but keeps the exact numbers under wraps until you dive in.

Result: Fair Value of $703 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competition from deep-pocketed rivals and slower-than-expected ad monetization could erode Spotify’s edge and derail the high-margin, cash-flow story.

Find out about the key risks to this Spotify Technology narrative.

Another View: Rich Multiples Signal Higher Expectations

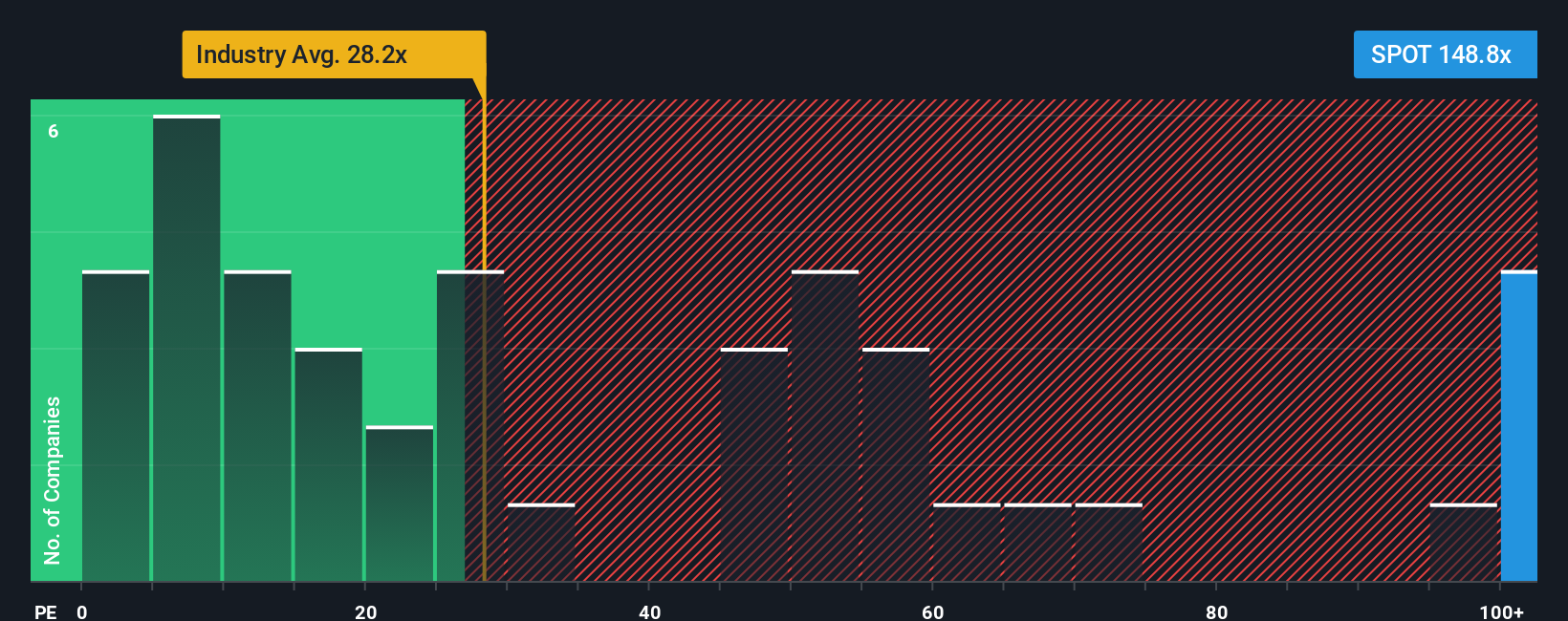

While the narrative fair value points to upside, Spotify’s current price implies a price to earnings ratio of 72.9 times, far above the US entertainment average of 20.5 times and more than double its 34.8 times fair ratio. This leaves little room for execution slip ups.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Spotify Technology Narrative

If you see the story differently or would rather crunch the numbers yourself, you can build a full narrative in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Spotify Technology.

Ready for your next investing edge?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover stocks with powerful tailwinds, solid fundamentals, and asymmetric upside.

- Capitalize on mispriced potential by targeting companies trading below their intrinsic value through these 910 undervalued stocks based on cash flows.

- Ride transformative innovation by zeroing in on fast moving opportunities across these 24 AI penny stocks.

- Strengthen your income stream by focusing on reliable payers with these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion