- United States

- /

- Entertainment

- /

- NYSE:SPOT

Is Spotify a Bargain After a 54% Surge and Podcast Expansion in 2025?

Reviewed by Bailey Pemberton

- Curious if Spotify Technology is trading for less than it's truly worth? You're not alone. There’s plenty of buzz about where the stock should be valued right now.

- Despite some recent choppiness (down 5.9% over the last week and 8.6% in the past month), Spotify shares have powered up an impressive 34.8% year-to-date and an incredible 54.0% over the last year.

- Much of this excitement follows Spotify’s ongoing push into podcasting and audiobooks, as well as high-profile licensing deals and an expansion of its advertising business. These developments have investors and analysts rethinking the company’s long-term profit potential.

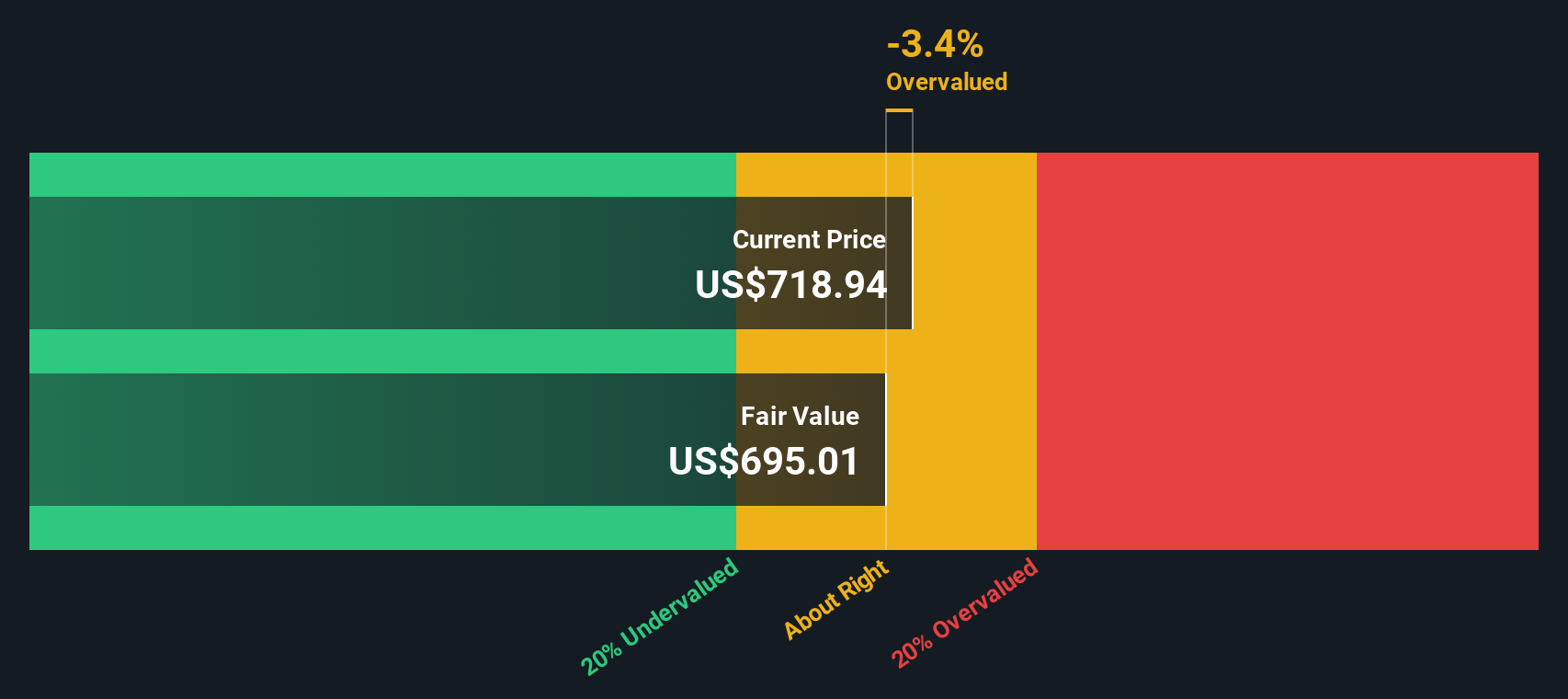

- On our six-point valuation check, Spotify scores 2 out of 6 for being undervalued, suggesting there’s room for debate on what a fair price should be. Next up, we’ll break down traditional and alternative valuation approaches, with a fresh perspective you’ll want to see at the end.

Spotify Technology scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Spotify Technology Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is really worth by forecasting its future cash flows and then discounting those values back to today. This approach highlights how much money the business could potentially generate in the years ahead.

Spotify Technology currently reports Last Twelve Months Free Cash Flow (FCF) of approximately €2.93 billion. Analyst projections suggest that annual FCF could climb to about €5.91 billion by the end of 2029, with estimates for the years between ranging from €3.42 billion in 2026 to €4.72 billion in 2028. For years beyond 2029, cash flow projections are extrapolated based on recent trends and growth rates.

Running these figures through a 2-stage Free Cash Flow to Equity DCF model, the estimated intrinsic value per share is $688.77. Compared to Spotify's current share price, this suggests that the stock is around 10.4% undervalued on a DCF basis.

DCF models offer just one way to view valuation, but these numbers indicate that Spotify could be trading below its perceived value based on future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Spotify Technology is undervalued by 10.4%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Spotify Technology Price vs Earnings (P/E Ratio)

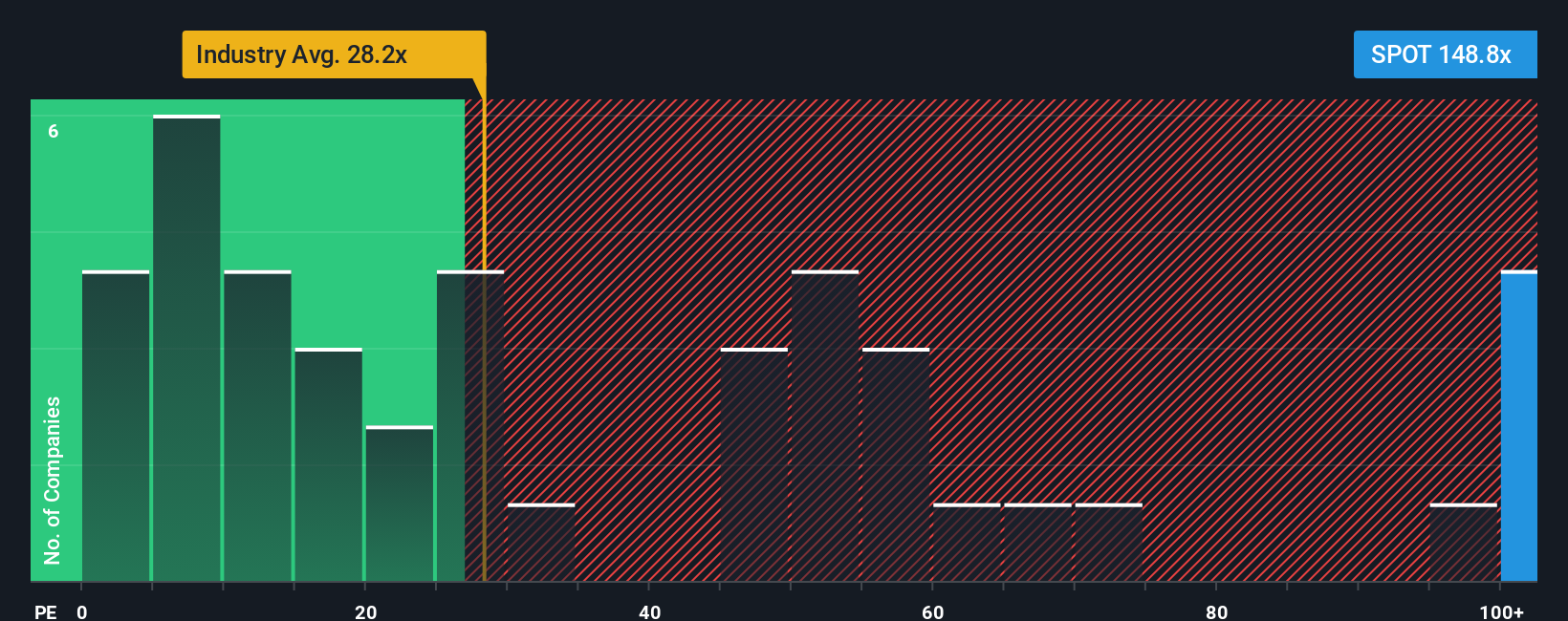

For consistently profitable companies like Spotify Technology, the Price-to-Earnings ratio (P/E) is a logical way to assess value because it directly relates a company's market price to its reported profits. The P/E ratio essentially tells you how much investors are willing to pay today for each dollar of current earnings, making it a popular metric for spotting both opportunities and red flags.

However, what is considered a "reasonable" P/E ratio depends on more than just profits. Higher expected growth or lower perceived risk can justify a steeper P/E. Conversely, a sluggish outlook or elevated risks can drag it lower. Spotify's current P/E ratio stands at 78.2x, much higher than the Entertainment industry average of 23.4x as well as its peer average of 69.6x. At first glance, this might make Spotify seem expensive compared to its industry and peers.

This is where the Simply Wall St “Fair Ratio” comes in, as it is a smarter benchmark because it factors in Spotify's growth potential, profit margins, risk profile, size, and industry conditions, all in one number. For Spotify, the Fair Ratio is 37.4x.

With the actual P/E (78.2x) nearly double its Fair Ratio (37.4x), this suggests investors are paying a premium that future growth or profitability may not justify at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Spotify Technology Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal, story-driven perspective about a company, where you lay out how you expect its business to evolve, such as its future revenue, earnings, margins, and fair value—not just the numbers, but the reasoning that connects them.

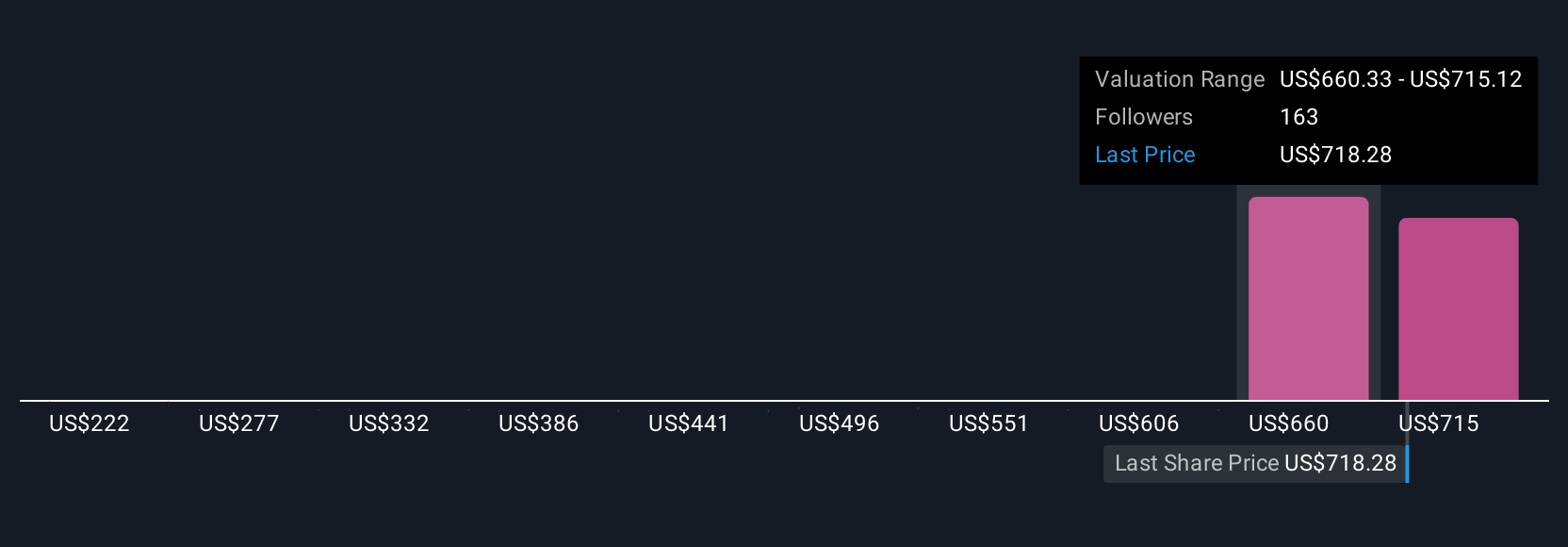

Narratives bridge the gap between a company’s story, a financial forecast, and an actionable fair value, giving you a clear, easy-to-understand investment thesis. On Simply Wall St's Community page, millions of investors already use Narratives as an intuitive tool to map out their view, sense-check their assumptions, and compare their Fair Value to a stock's current price so they can decide when to buy or sell.

Because Narratives update automatically as new facts, news, or earnings come in, they help you keep your investment case fresh and informed with the latest information. For example, looking at Spotify Technology, one investor’s Narrative might forecast strong user and revenue growth leading to a fair value of $1,012 per share by 2030. Another might see slower growth and margin pressures, resulting in a much lower estimate of $485. This shows how different perspectives, all backed by logic, can lead to very different valuations.

Do you think there's more to the story for Spotify Technology? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives