- United States

- /

- Entertainment

- /

- NYSE:SPOT

Is It Too Late to Consider Spotify After Its Huge Multi Year Share Price Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Spotify Technology is still a smart buy after its massive run, or if the easy money has already been made, you are not alone. That is exactly what we are going to unpack here.

- After a 625.6% gain over 3 years and a 71.7% rise over 5 years, the stock is still up 23.2% year to date, despite pulling back 5.7% over the last week and 8.8% over the last month.

- Recently, investors have been reacting to Spotify's push into higher margin products like audiobooks and podcast advertising, along with price increases across several subscription plans. These moves have shifted the narrative from pure user growth to a more balanced focus on monetization and long term profitability, which helps explain some of the volatility.

- Based on our checks, Spotify scores a 4/6 valuation score, suggesting it looks undervalued on most metrics we track. Next, we will walk through the key valuation approaches, before finishing with a more holistic way to judge what the stock may be worth over the long run.

Approach 1: Spotify Technology Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to their value in the present.

For Spotify Technology, the model starts from last twelve months free cash flow of about €2.9 billion and uses analyst forecasts for the next few years, then extends those trends further out. On Simply Wall St’s two stage Free Cash Flow to Equity model, free cash flow is projected to grow to roughly €10.6 billion by year 10, with the early years driven by analyst estimates and the later years extrapolated from those growth rates.

When all those future cash flows are discounted back, the intrinsic value is estimated at about $783.61 per share. That indicates the stock is roughly 28.0% below its current market price, which in this model suggests investors are not fully pricing in Spotify’s cash generation and profitability assumptions.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Spotify Technology is undervalued by 28.0%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

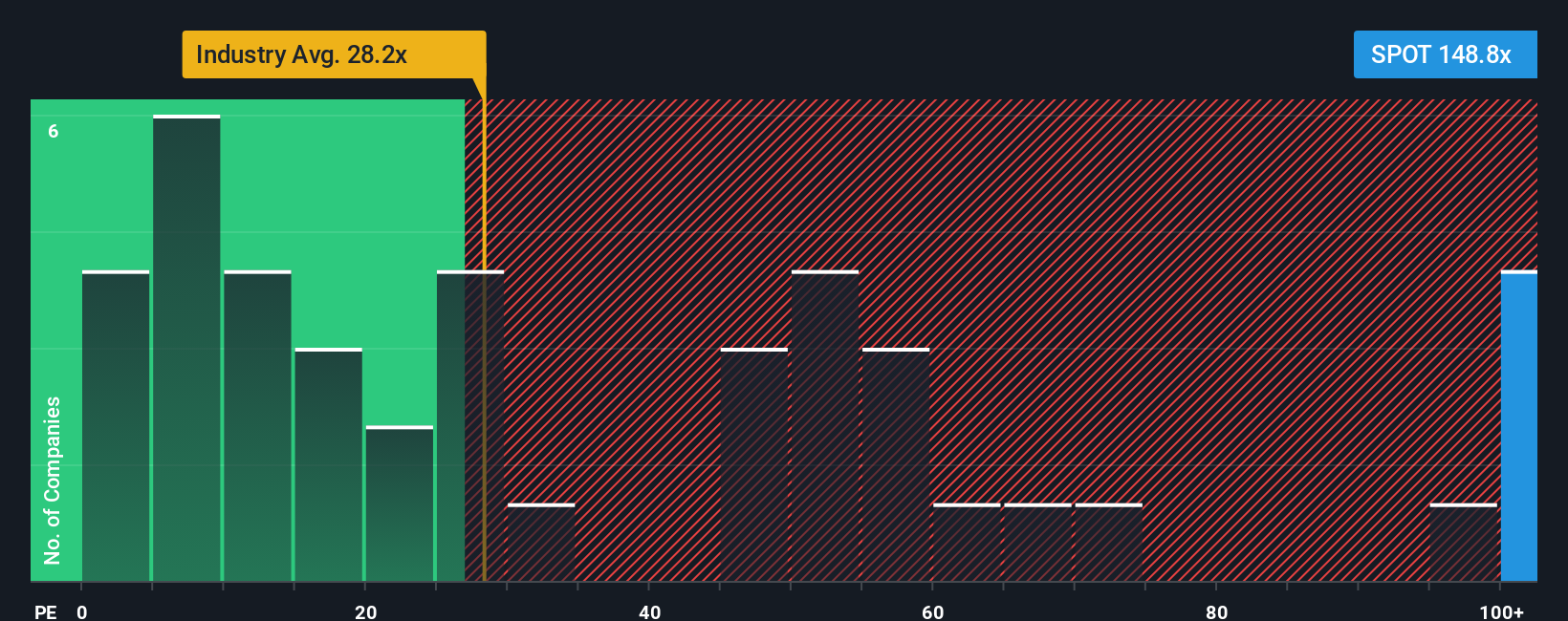

Approach 2: Spotify Technology Price vs Earnings

For profitable companies like Spotify, the price to earnings ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. This makes it a natural complement to the more detailed DCF view.

What counts as a normal or fair PE depends on how quickly earnings are expected to grow and how risky those earnings are. Faster, more reliable growth usually justifies a higher multiple, while slower or more volatile earnings typically deserve a lower one.

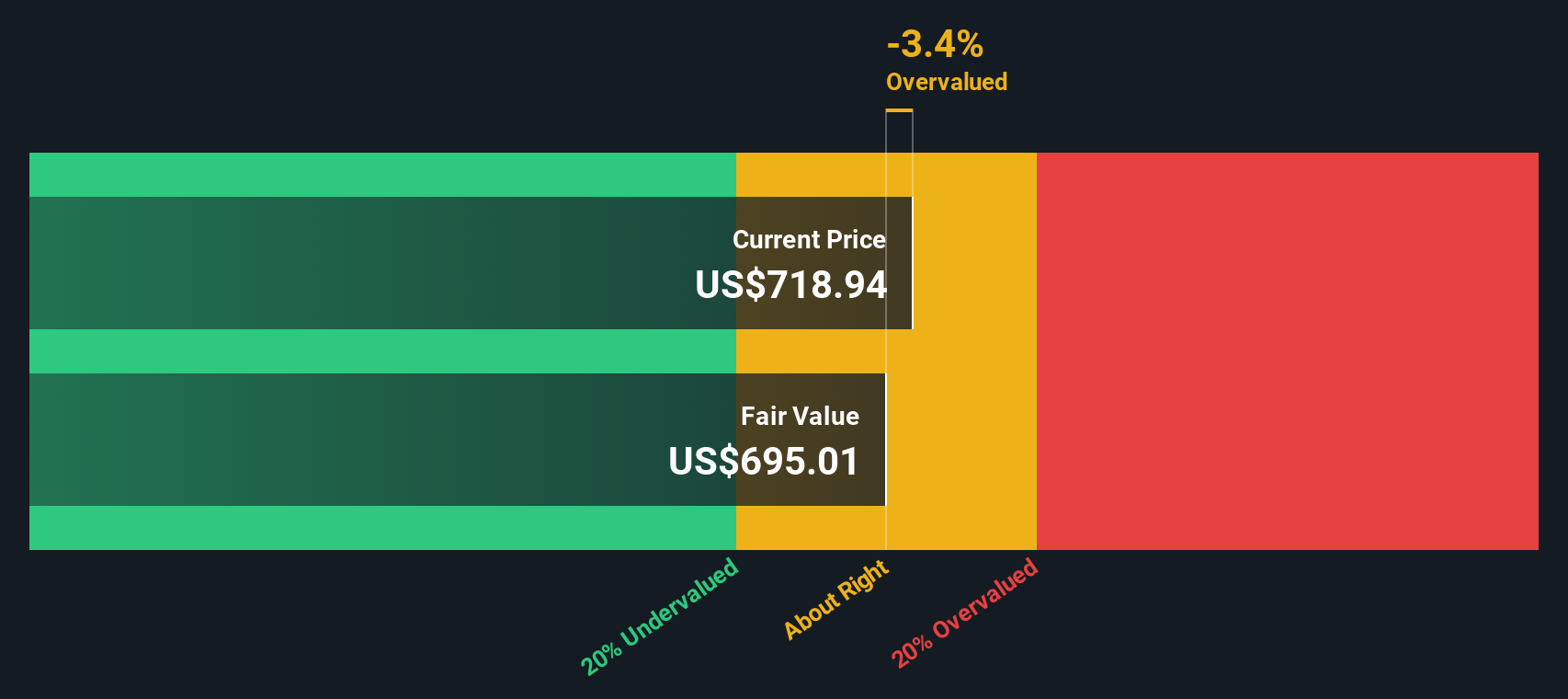

Spotify currently trades on a PE of about 70.6x, which is above the Entertainment industry average of roughly 22.2x and slightly below its immediate peer group, which sits around 74.3x. Simply Wall St’s proprietary Fair Ratio for Spotify is 34.7x, which reflects what investors might reasonably pay given its earnings growth, margins, industry, size and risk profile.

The Fair Ratio is more informative than a simple peer or industry comparison because it explicitly adjusts for Spotify’s specific growth outlook, profitability and risk, rather than assuming that all Entertainment stocks deserve the same multiple.

With the current PE of 70.6x sitting well above the Fair Ratio of 34.7x, the multiple-based view points to Spotify looking overvalued on earnings.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Spotify Technology Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach a clear story to your numbers by spelling out what you believe about a company’s future revenue, earnings and margins, then linking that story to a forecast and finally to a fair value you can compare with today’s share price.

On Simply Wall St, Narratives live in the Community page and are used by millions of investors as an easy, accessible tool to turn their views into structured forecasts that automatically update when new information, like earnings or major news, comes in.

For Spotify Technology, for example, one investor might build a bullish Narrative around sustained double digit revenue growth, rising free cash flow margins and a fair value near $1,012 per share. Another might plug in more cautious assumptions around slower ad growth and tighter margins that pull fair value closer to about $485. By comparing each Narrative’s fair value to the current price, they can quickly decide how Spotify fits into their own investment view based on the story they believe is most realistic.

Do you think there's more to the story for Spotify Technology? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion