- United States

- /

- Entertainment

- /

- NYSE:SPOT

How Spotify’s (SPOT) New Sales Leadership and Expanded Buyback May Influence Its Investment Narrative

Reviewed by Sasha Jovanovic

- In November 2025, Spotify appointed Tanmaya Trivedi as director of sales, bringing over 20 years of industry and leadership experience from companies like Meta and Sony Pictures Networks India.

- Spotify also increased its stock buyback authorization and introduced measures to address ad strategy gaps, reflecting management’s commitment to operational improvement and capital return.

- We’ll explore how the expanded buyback authorization and new sales leadership might reinforce Spotify’s growth and earnings outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Spotify Technology Investment Narrative Recap

Investors in Spotify generally expect that consistent global user growth, ongoing product innovation, and improvements in ad technology will drive sustainable long-term revenue and earnings expansion. The appointment of Tanmaya Trivedi as director of sales is a step towards strengthening Spotify’s advertising capabilities, but this specific leadership addition does not materially shift the most important short-term catalyst, accelerating advertising revenue, or the biggest risk, which remains Spotify’s ongoing margin pressures due to high music licensing costs.

Among recent announcements, the expansion of Spotify’s share buyback plan to $2 billion stands out. While buybacks can support shareholder value, the most critical catalyst for the business remains the scaling and monetization of its advertising platform, especially given recent underperformance relative to competitors.

In contrast, investors should be mindful that competitive pressures from global tech giants offering bundled services...

Read the full narrative on Spotify Technology (it's free!)

Spotify Technology's outlook anticipates €23.8 billion in revenue and €3.4 billion in earnings by 2028. This projection relies on a 12.8% annual revenue growth rate and an increase in earnings of €2.6 billion from current earnings of €806.0 million.

Uncover how Spotify Technology's forecasts yield a $748.60 fair value, a 29% upside to its current price.

Exploring Other Perspectives

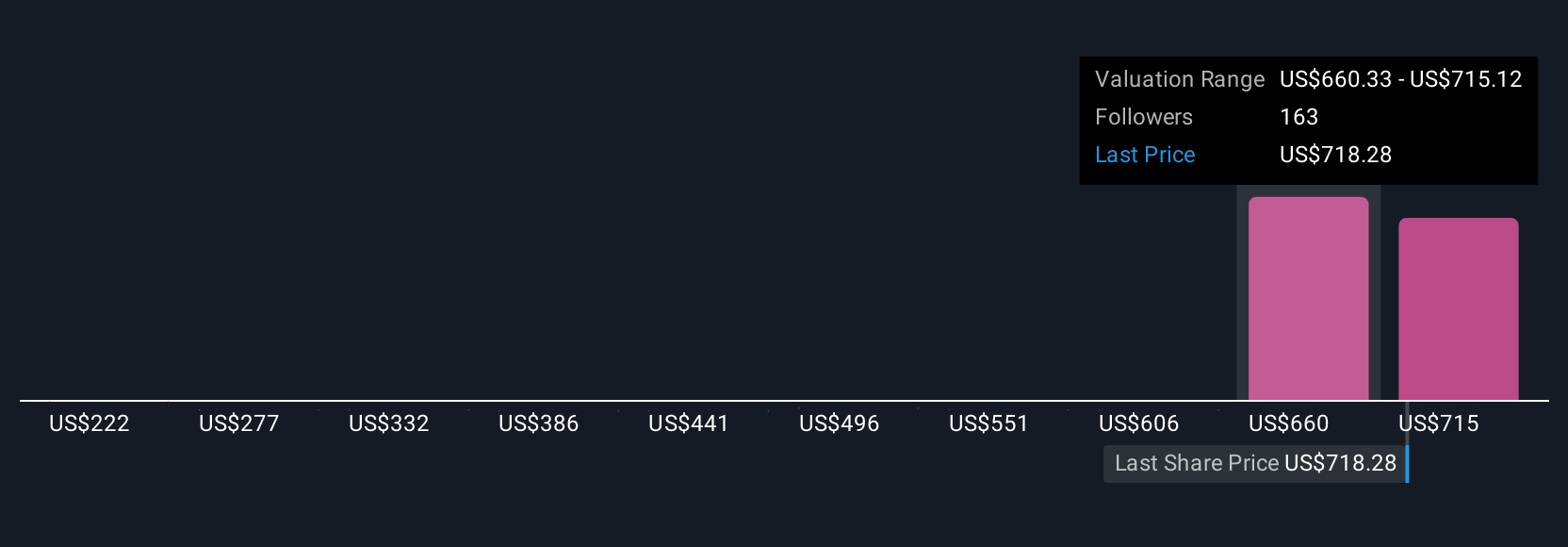

Twenty-three private investors in the Simply Wall St Community placed Spotify’s fair value between US$391.05 and US$913.70. As you consider this range, remember the uncertain path to advertising revenue growth remains a focal point for broader company performance.

Explore 23 other fair value estimates on Spotify Technology - why the stock might be worth as much as 58% more than the current price!

Build Your Own Spotify Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spotify Technology research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Spotify Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spotify Technology's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026