- United States

- /

- Entertainment

- /

- NYSE:SPOT

Evaluating Spotify After Recent Price Surge and Announced Customer Price Increases

Reviewed by Bailey Pemberton

If you are trying to decide what to do with your Spotify Technology shares right now, you are in good company. The stock has delivered some jaw-dropping gains recently, climbing 46.6% year-to-date and an astonishing 80.6% in the past year. Longer-term holders are also smiling, with a three-year return of 656.4% and a five-year gain of 147.4%. But more recently, Spotify shares have lost a bit of that momentum, slipping -0.5% over the past week and -4.5% in the last month. Is this just a well-earned breather after a sprint, or the start of something more significant?

On the news front, Spotify has been busy. The company signaled it will be increasing prices as it rolls out new services. This is usually considered a bullish sign for future revenues, but investors typically like to wait and see just how well users absorb the bump. At the same time, analyst sentiment has become at least neutral, with upgrades citing robust subscriber growth even as management warns of heightened operating costs and fresh investments. While a competitor like Apple makes moves in the digital radio space, it is clear that Spotify is pressing on with its own strategic bets and leadership changes.

All that activity makes it more important than ever to take a longer look at the stock's value. According to a six-point framework, Spotify scores a 1 out of 6 on undervalued checks, which suggests it is only considered undervalued by one common metric. But that is not the end of the story. Let's break down how these valuation approaches work, and then discuss what might be an even better way to unlock the real worth of Spotify's shares.

Spotify Technology scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Spotify Technology Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a business by projecting its future cash flows and then discounting them back to today’s value. This helps investors understand what the company is truly worth by using calculated expectations around future profitability.

For Spotify Technology, the most recent twelve months of Free Cash Flow amounted to approximately €2.8 billion. Analysts forecast steady growth, projecting Free Cash Flow rising to €5.9 billion by 2029. Looking even further ahead, Simply Wall St extrapolates these trends up to 2035, with annual Free Cash Flow projected to reach as much as €9.3 billion by that point.

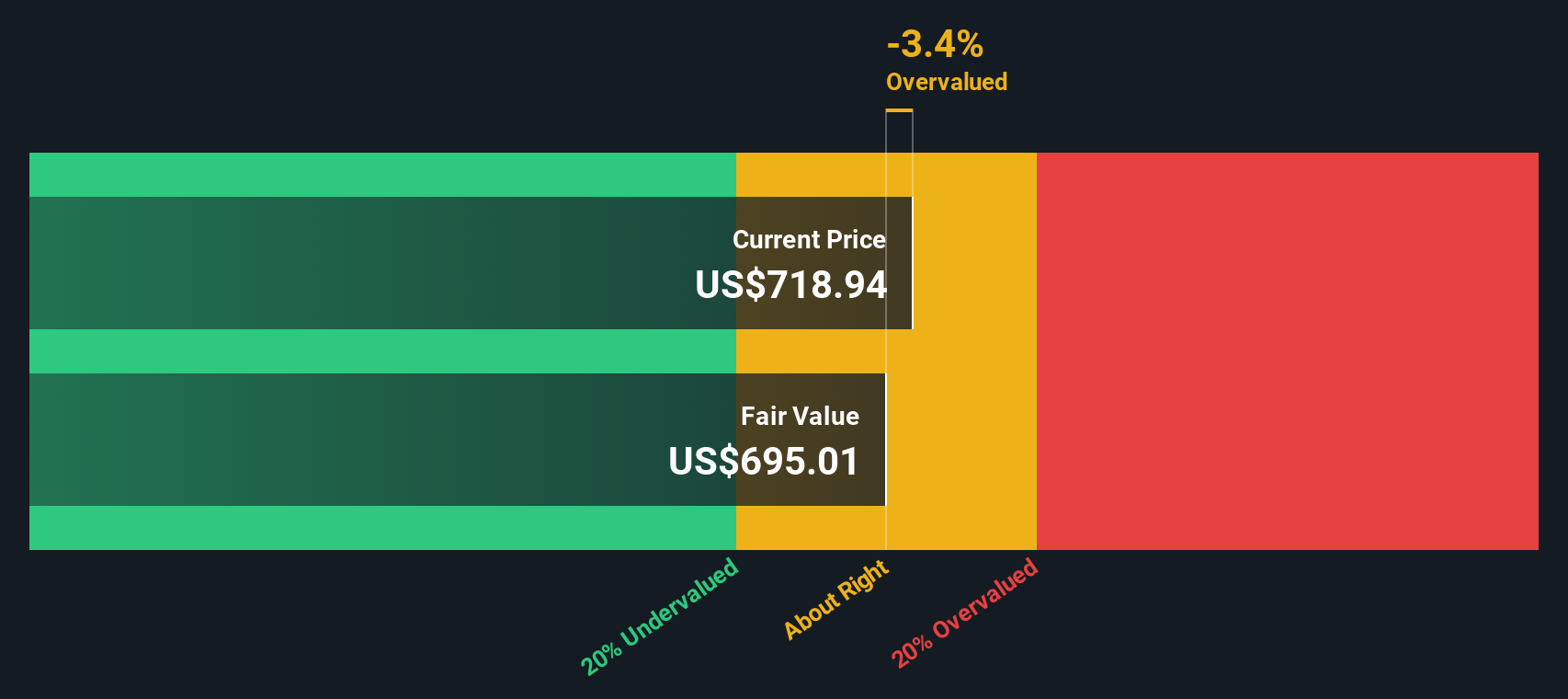

After discounting these future cash flows, the resulting intrinsic value for the stock is estimated at €696.30 per share. Based on this model, Spotify’s current market price is around 3.6% below this value. This indicates that the stock is trading at a small discount and is fairly close to its calculated fair value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Spotify Technology's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Spotify Technology Price vs Earnings

The price-to-earnings (PE) ratio is a go-to metric when evaluating profitable companies. It measures how much investors are willing to pay for each dollar of earnings and provides a quick way to gauge market expectations and compare valuations across companies in the same space. However, what constitutes a "fair" PE depends on factors such as growth prospects and risks. Companies expected to grow earnings swiftly or with lower business risks often trade at higher PE ratios. Those with slower growth or greater uncertainty typically command lower multiples.

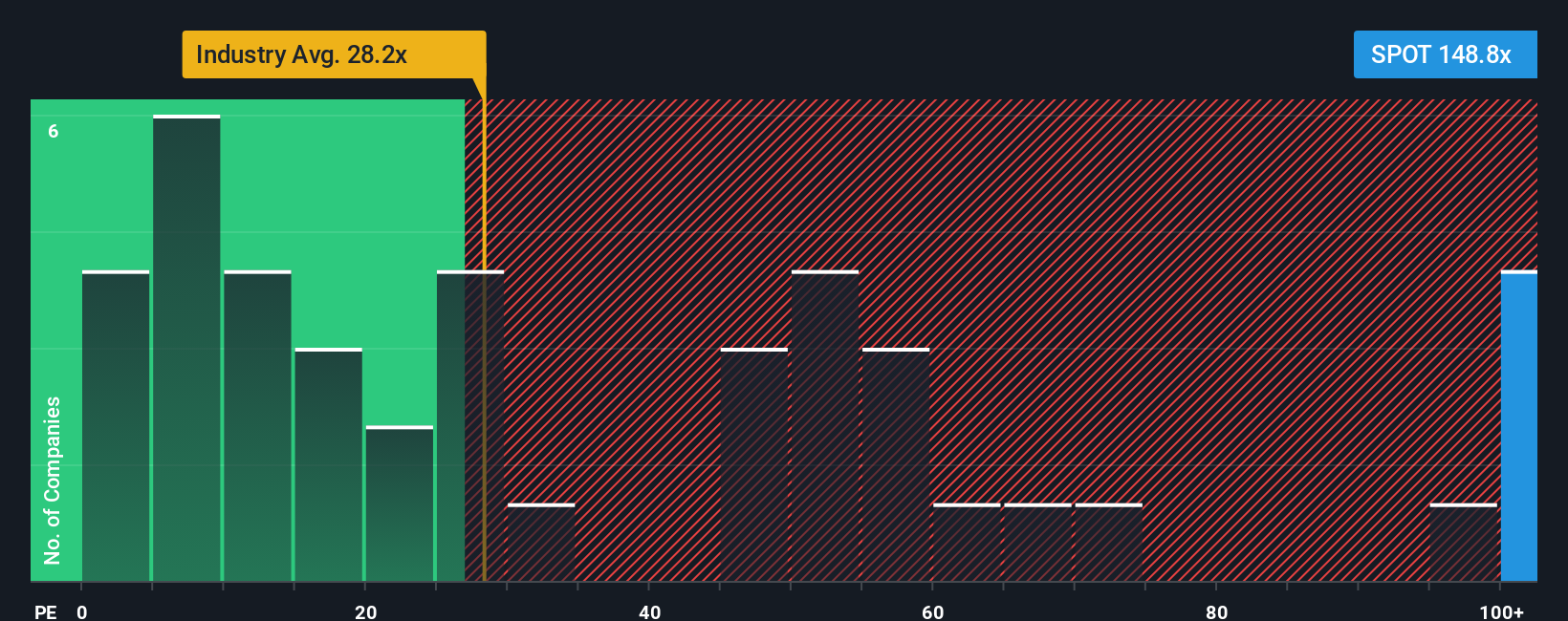

At the moment, Spotify Technology trades on a PE ratio of 147.26x, which is far above the entertainment industry average of 28.29x and its peer average of 48.04x. These headline numbers suggest Spotify is expensive compared to its sector. However, headline multiples can be misleading if they do not account for why a stock might deserve a premium, such as superior growth or profitability.

This is where Simply Wall St's “Fair Ratio” comes in. This proprietary metric indicates a personalized fair PE for Spotify, in this case 43.96x, based on factors like projected earnings growth, profit margins, risk profile, industry dynamics, and market capitalization. Unlike plain peer or industry comparisons, the Fair Ratio adjusts for Spotify’s unique strengths and circumstances and provides a more finely tuned benchmark.

Comparing Spotify's actual PE to its Fair Ratio shows the stock trades well above what would be expected given its fundamentals. The difference is significant enough to suggest the current market valuation is stretched.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Spotify Technology Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal, story-driven perspective about a company, where you connect its business outlook, such as future revenue, margin, and valuation estimates, with real events, data, and your reasoning behind it. Narratives help you move beyond just numbers by linking the company’s story to a financial forecast and ultimately a fair value. They are easy to create and explore on Simply Wall St's Community page, where millions of investors compare perspectives, assumptions, and insights.

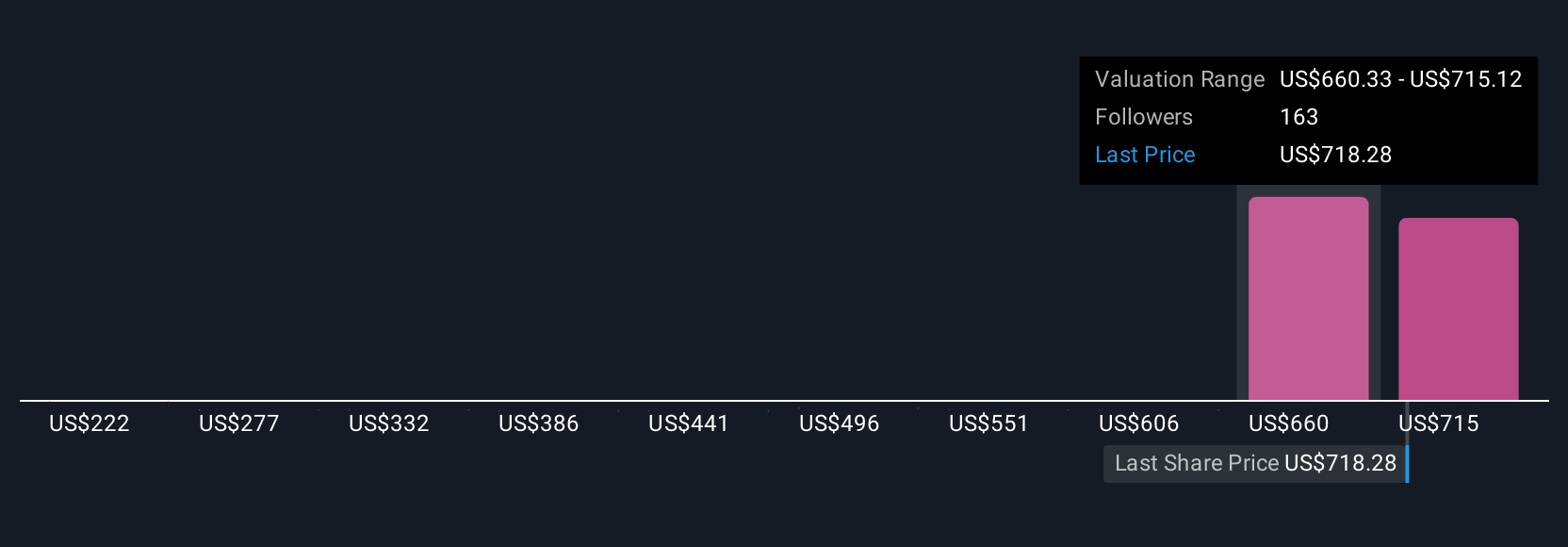

With Narratives, you can decide when to buy or sell simply by comparing the fair value you believe in against the current share price. Because they are updated dynamically as new information like news or earnings emerges, your Narrative always reflects the latest data. For example, one investor may see Spotify’s industry tailwinds and expanding monetization as supporting a fair value as high as $1,012 per share, while another may be more cautious, setting a fair value near $485 due to competition or margin risks. Your Narrative puts you in control, guiding your investment decisions with context and clarity.

Do you think there's more to the story for Spotify Technology? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion