- United States

- /

- Entertainment

- /

- NYSE:SPHR

Sphere Entertainment (SPHR): Valuation in Focus After Guggenheim’s Raised Forecasts on Strong New Show Performance

Reviewed by Simply Wall St

Most Popular Narrative: 8% Overvalued

The most widely followed narrative views Sphere Entertainment as overvalued by about 8% compared to its estimated fair value, based on forward-looking assumptions around revenue growth and profitability.

The ability to charge premium prices, achieve higher venue utilization, and generate significant advertising revenue from the Exosphere supports a positive outlook. Some bullish analysts highlight substantial long-term upside potential, estimating the stock could eventually exceed $200 per share.

Curious how analysts justify Sphere’s lofty valuation? The secret sauce combines bold revenue growth targets, impressive margin projections, and a future profit ratio that is rarely seen for a traditional entertainment company. Which assumptions underpin this rapid path to profitability? The answers, along with the numbers that could shake up this forecast, are only one step deeper in the full narrative.

Result: Fair Value of $53.90 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a sustained dip in Las Vegas tourism or underperformance of new venues abroad could quickly undermine Sphere’s growth projections.

Find out about the key risks to this Sphere Entertainment narrative.Another View: Our DCF Model Points the Other Way

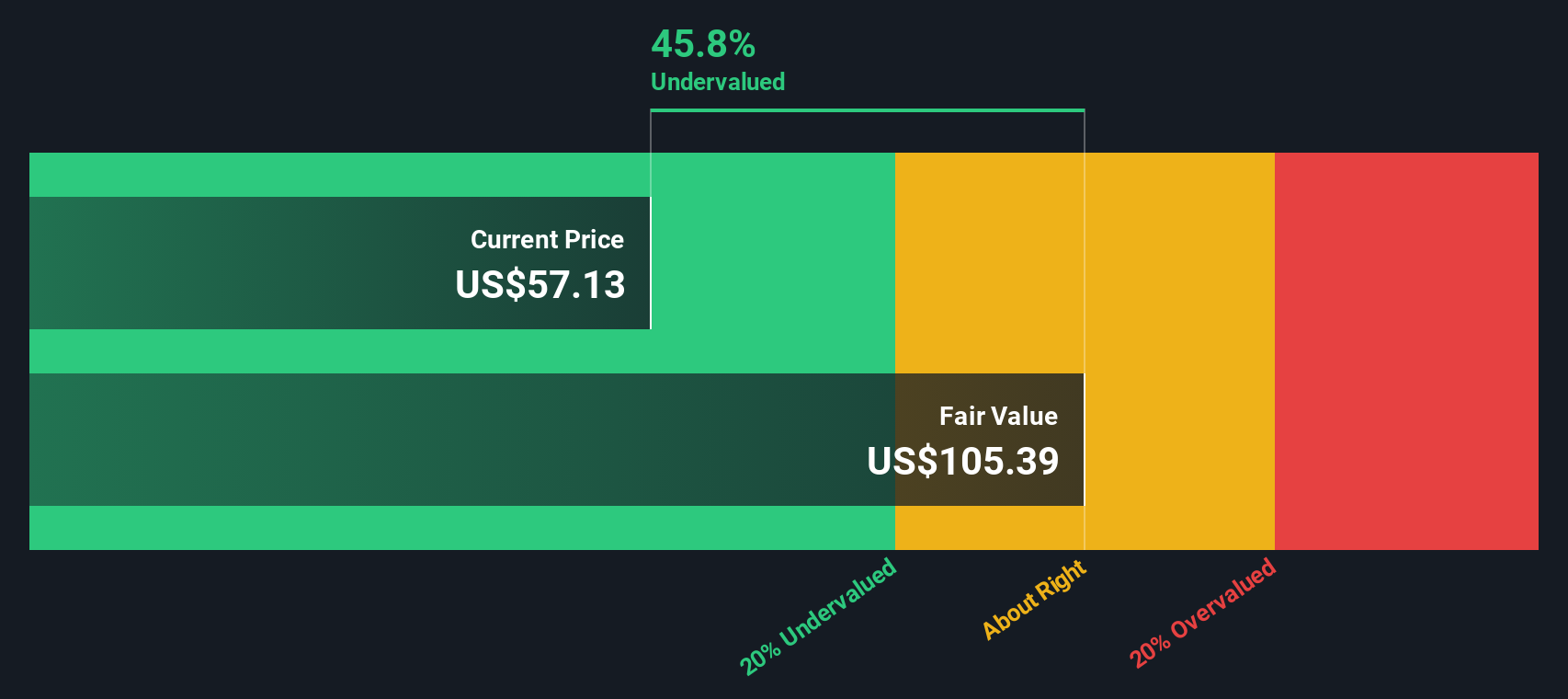

While analysts see Sphere Entertainment as overvalued, our DCF model paints a sharply different picture. It considers the company undervalued based on future cash flows. Could this perspective be the key everyone is missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sphere Entertainment Narrative

If you want to dig into the numbers or believe your outlook offers a different angle, you can shape your own perspective quickly. Do it your way.

A great starting point for your Sphere Entertainment research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Standout Investment Opportunities?

You’re not limited to one big idea. Powerful investing themes are emerging every day, and you can get ahead by targeting companies with strong growth catalysts, robust fundamentals, or untapped potential. Don’t wait for the market to hand you opportunities. Go find them now using these tailored ideas:

- Turn steady income into your superpower and secure your portfolio with dividend stocks with yields > 3% offering yields over 3% for reliable passive returns.

- Jump into tomorrow’s medical breakthroughs and accelerate your growth strategy with healthcare AI stocks shaping the future of healthcare innovation.

- Catch the wave of undervalued gems and position yourself for upside by using undervalued stocks based on cash flows to uncover stocks trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPHR

Sphere Entertainment

Operates as a live entertainment and media company in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives