- United States

- /

- Entertainment

- /

- NYSE:SPHR

How Investors Are Reacting To Sphere Entertainment (SPHR) Blockbuster Wizard of Oz Ticket Sales Amid Financial Strain

Reviewed by Sasha Jovanovic

- Sphere Entertainment’s Sphere Experience featuring The Wizard of Oz in Las Vegas has already sold over 1.5 million tickets and generated nearly US$200 million in revenue since its August 2025 launch, highlighting strong audience demand for its immersive 4D format.

- This success comes even as Sphere faces financial pressures, including a negative operating margin and an Altman Z-Score signaling potential distress, underscoring the gap between headline attendance figures and the company’s underlying earnings profile.

- We’ll now examine how the Wizard of Oz experience’s nearly US$200 million revenue haul could influence Sphere Entertainment’s longer-term investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Sphere Entertainment Investment Narrative Recap

To own Sphere Entertainment, you have to believe its Las Vegas Sphere can turn blockbuster, IP-driven experiences into a repeatable, globally scalable business despite ongoing losses and balance sheet strain. The Wizard of Oz Sphere Experience’s nearly US$200 million in revenue supports the demand side of that thesis, but does little to change the near term risk around profitability, cash needs and a high short interest that could amplify stock volatility.

The recent appointment of Christopher Winters as Senior Vice President, Controller and Principal Accounting Officer is particularly relevant here, as tighter financial oversight could matter if Sphere pushes ahead with capital intensive growth. With the company still unprofitable, consistent execution on cost control and accounting rigor may influence how sustainable its current growth plans and headline successes like Wizard of Oz ultimately prove to be.

Yet behind the sold out shows and soaring share price, one issue investors should not overlook is the elevated short interest, which...

Read the full narrative on Sphere Entertainment (it's free!)

Sphere Entertainment's narrative projects $1.3 billion revenue and $118.7 million earnings by 2028. This requires 6.5% yearly revenue growth and an earnings increase of about $392.8 million from -$274.1 million today.

Uncover how Sphere Entertainment's forecasts yield a $75.30 fair value, a 9% downside to its current price.

Exploring Other Perspectives

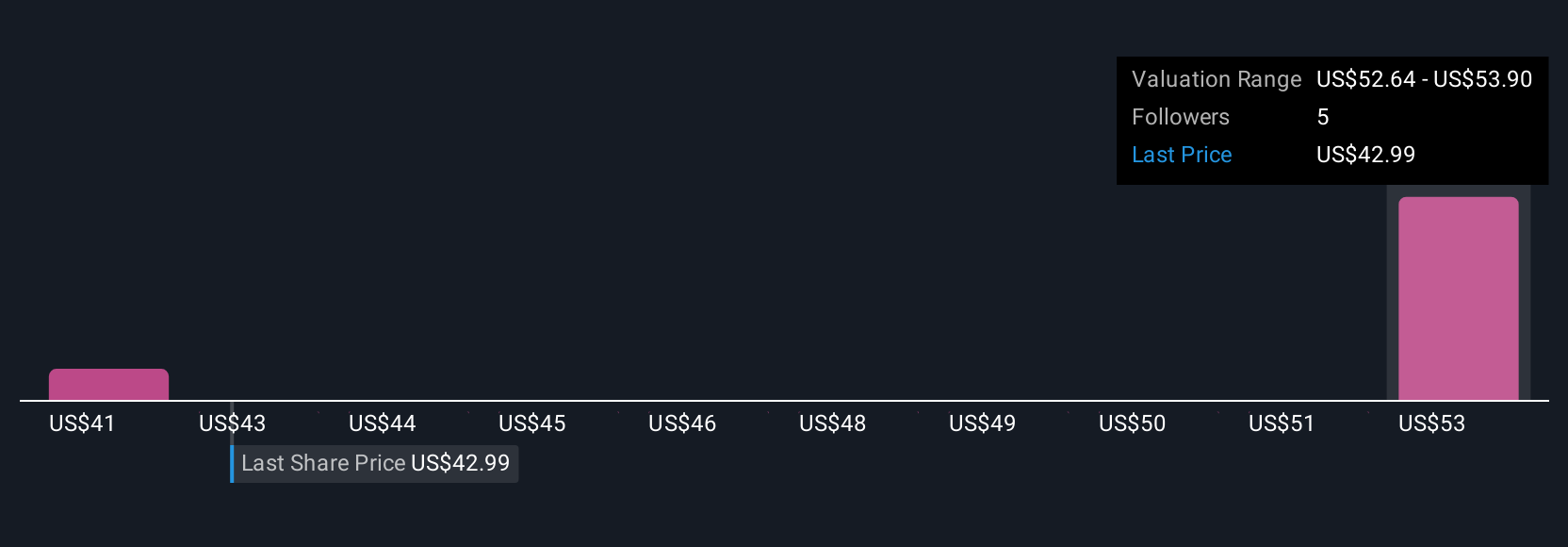

Three members of the Simply Wall St Community currently see Sphere’s fair value between US$41.25 and about US$90.70, highlighting a wide spread in expectations. Against that backdrop, Sphere’s reliance on evergreen, blockbuster content like The Wizard of Oz to support utilization and pricing shows why you may want to compare several such viewpoints before deciding how its story could play out.

Explore 3 other fair value estimates on Sphere Entertainment - why the stock might be worth less than half the current price!

Build Your Own Sphere Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sphere Entertainment research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Sphere Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sphere Entertainment's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPHR

Sphere Entertainment

Operates as a live entertainment and media company in the United States.

Imperfect balance sheet and overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026