- United States

- /

- Entertainment

- /

- NYSE:SPHR

Does Sphere Entertainment’s Swing to Profitability Mark a Turning Point for SPHR’s Investment Case?

Reviewed by Simply Wall St

- On August 11, 2025, Sphere Entertainment Co. announced its second quarter results, reporting sales of US$282.68 million and a turnaround to net income of US$151.82 million versus a net loss in the prior year.

- This swing to profitability included a jump in diluted earnings per share to US$3.39, reflecting a sharp improvement in operating performance and margin expansion during the quarter.

- We'll explore how Sphere Entertainment's shift from a net loss to significant net income may influence its future investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Sphere Entertainment Investment Narrative Recap

To be a shareholder in Sphere Entertainment, you need conviction in the long-term growth of immersive live entertainment and the company’s unique positioning in this space. The sharp swing to profitability in Q2 2025 may modestly ease near-term concerns about Sphere’s margin trajectory, but it does not eliminate the most pressing risk: whether high capital expenditures for expansion can consistently deliver returns above cost, especially if new venues underperform.

Among recent announcements, the launch of The Wizard of Oz immersive experience at Sphere stands out as most relevant. This showcases Sphere’s efforts to leverage proprietary technology and exclusive IP, supporting the view that premium, tech-driven events can fuel recurring, high-margin revenue streams, a catalyst for supporting both current performance and future growth potential.

On the other hand, investors should stay alert to the potential for expensive venue builds to weigh on profits if market demand shifts or partnerships stall…

Read the full narrative on Sphere Entertainment (it's free!)

Sphere Entertainment's narrative projects $1.3 billion revenue and $115.8 million earnings by 2028. This requires 7.6% yearly revenue growth and a $389.9 million earnings increase from -$274.1 million.

Uncover how Sphere Entertainment's forecasts yield a $53.90 fair value, a 27% upside to its current price.

Exploring Other Perspectives

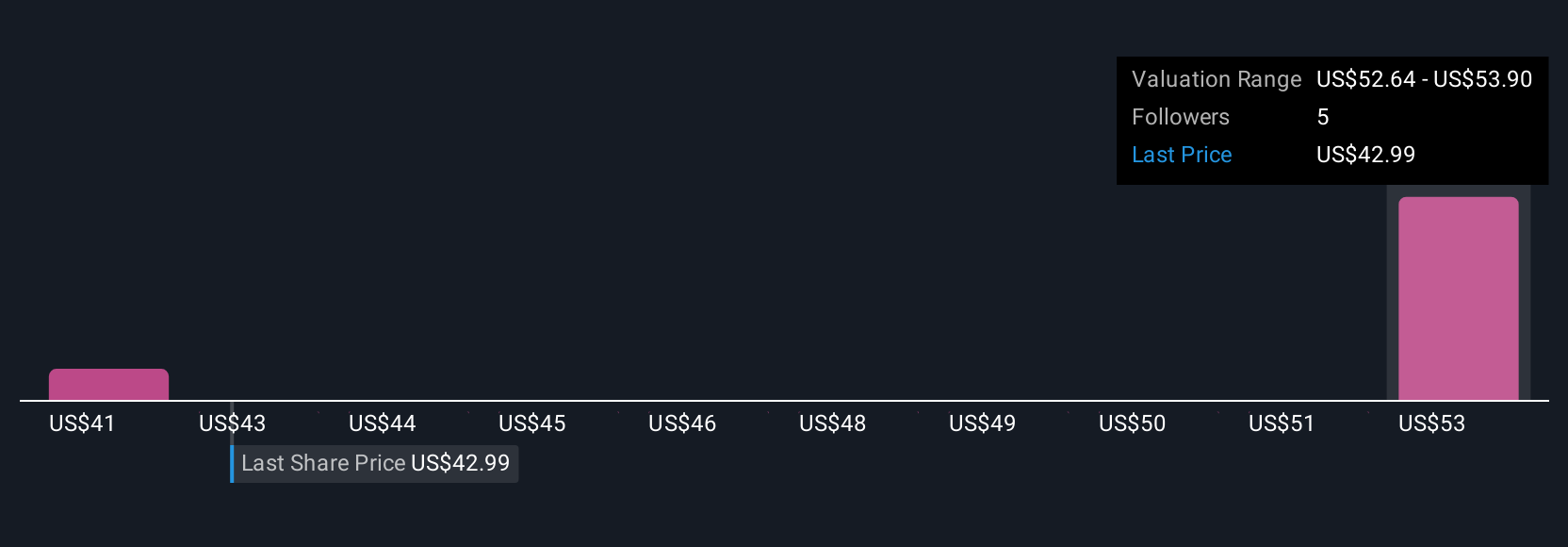

Simply Wall St Community fair value estimates for Sphere range from US$41.25 to US$53.90 across two distinct views. While optimism around new immersive content remains, concerns about capital-intensive expansion and unpredictable venue performance continue to influence expectations for the company’s future.

Explore 2 other fair value estimates on Sphere Entertainment - why the stock might be worth as much as 27% more than the current price!

Build Your Own Sphere Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sphere Entertainment research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Sphere Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sphere Entertainment's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPHR

Sphere Entertainment

Operates as a live entertainment and media company in the United States.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives