- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

Snap (NYSE:SNAP) Unveils Innovative Specs For 2026 With Enhanced AR Features

Reviewed by Simply Wall St

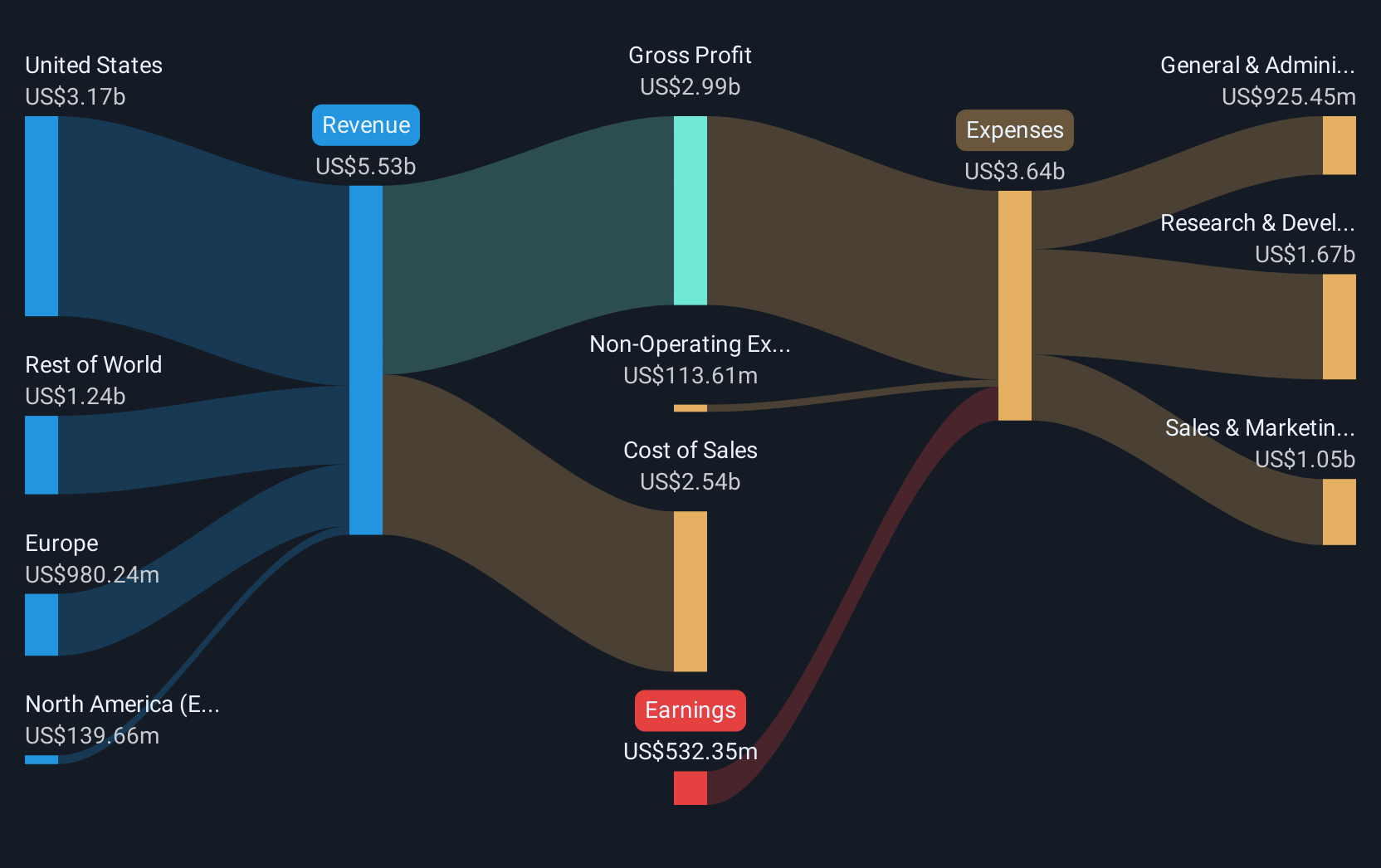

In a recent announcement, Snap (NYSE:SNAP) unveiled its upcoming Specs product, a next-generation wearable technology, expected to boost its augmented reality ventures. This innovation aligns with the company's robust development ecosystem, involving over 400,000 developers. During the past month, Snap's stock price moved 3% amid broader market conditions, where benign inflation data and improved U.S.-China trade relations bolstered investor sentiment across technology stocks. These product announcements added weight to Snap's price performance, reflecting investor interest in its advancing AR initiatives amidst favorable market trends.

Every company has risks, and we've spotted 1 warning sign for Snap you should know about.

Over the past three years, Snap's shares delivered a total return of 28.72% decline, highlighting challenges compared to its shorter-term price movements. In the context of one-year performance, Snap has lagged behind both the US Market, which returned 12.8%, and the US Interactive Media and Services industry, returning 13.2%.

The introduction of Snap’s new Specs product and other augmented reality ventures could potentially uplift revenue and earnings forecasts. However, the company's ongoing unprofitability and the recent significant insider selling may pose challenges. Current share price movements reflect a modest 3% increase, remaining discounted by about 13% to analyst consensus price target of US$9.62, indicating potential value recognition opportunities by investors if growth materializes as anticipated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives