- United States

- /

- Software

- /

- NasdaqGS:DDOG

Exploring High Growth Tech Stocks In The US October 2024

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has shown a significant increase of 39% over the past year, with earnings expected to grow by 15% annually. In this context, identifying high growth tech stocks involves looking for companies that not only align with these optimistic earnings forecasts but also demonstrate strong potential for innovation and scalability in a rapidly evolving sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 21.08% | 28.73% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| TG Therapeutics | 28.54% | 43.77% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Amicus Therapeutics | 20.26% | 62.89% | ★★★★★★ |

| AsiaFIN Holdings | 60.53% | 81.55% | ★★★★★★ |

| Travere Therapeutics | 29.24% | 70.77% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Alvotech (NasdaqGM:ALVO)

Simply Wall St Growth Rating: ★★★★★☆

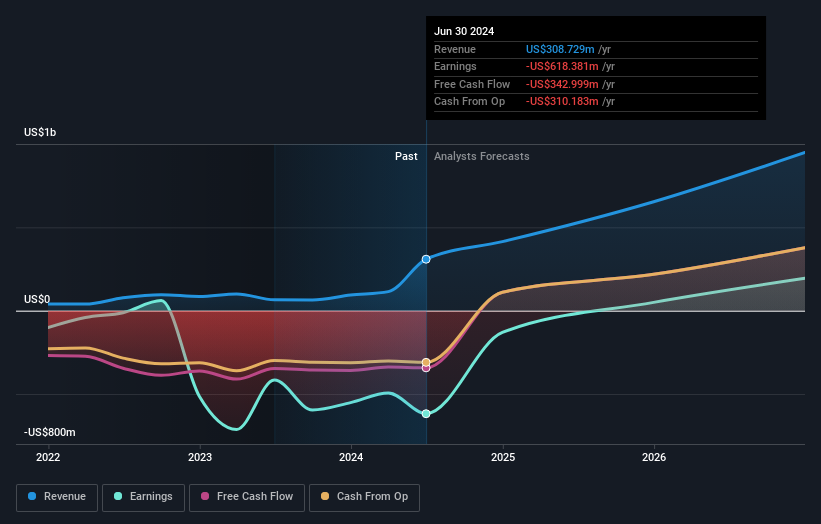

Overview: Alvotech, with a market cap of $3.95 billion, operates through its subsidiaries to develop and manufacture biosimilar medicines for patients globally.

Operations: With a focus on biosimilar medicines, Alvotech generates revenue primarily from its biotechnology segment, totaling $308.73 million.

Alvotech's recent FDA approval for SELARSDI and its strategic partnership with Teva highlight its innovative edge in the biosimilar market, projecting a robust entry into competitive territories by Q1 2025. With an expected revenue growth of 35.3% annually, surpassing the US market's 8.9%, and earnings forecast to surge by 101.42% per year, Alvotech is positioning itself as a formidable player despite current unprofitability. These developments not only enhance Alvotech’s portfolio but also promise substantial market penetration supported by advanced manufacturing techniques like the continuous perfusion process used in SELARSDI’s production.

- Navigate through the intricacies of Alvotech with our comprehensive health report here.

Gain insights into Alvotech's historical performance by reviewing our past performance report.

Datadog (NasdaqGS:DDOG)

Simply Wall St Growth Rating: ★★★★★☆

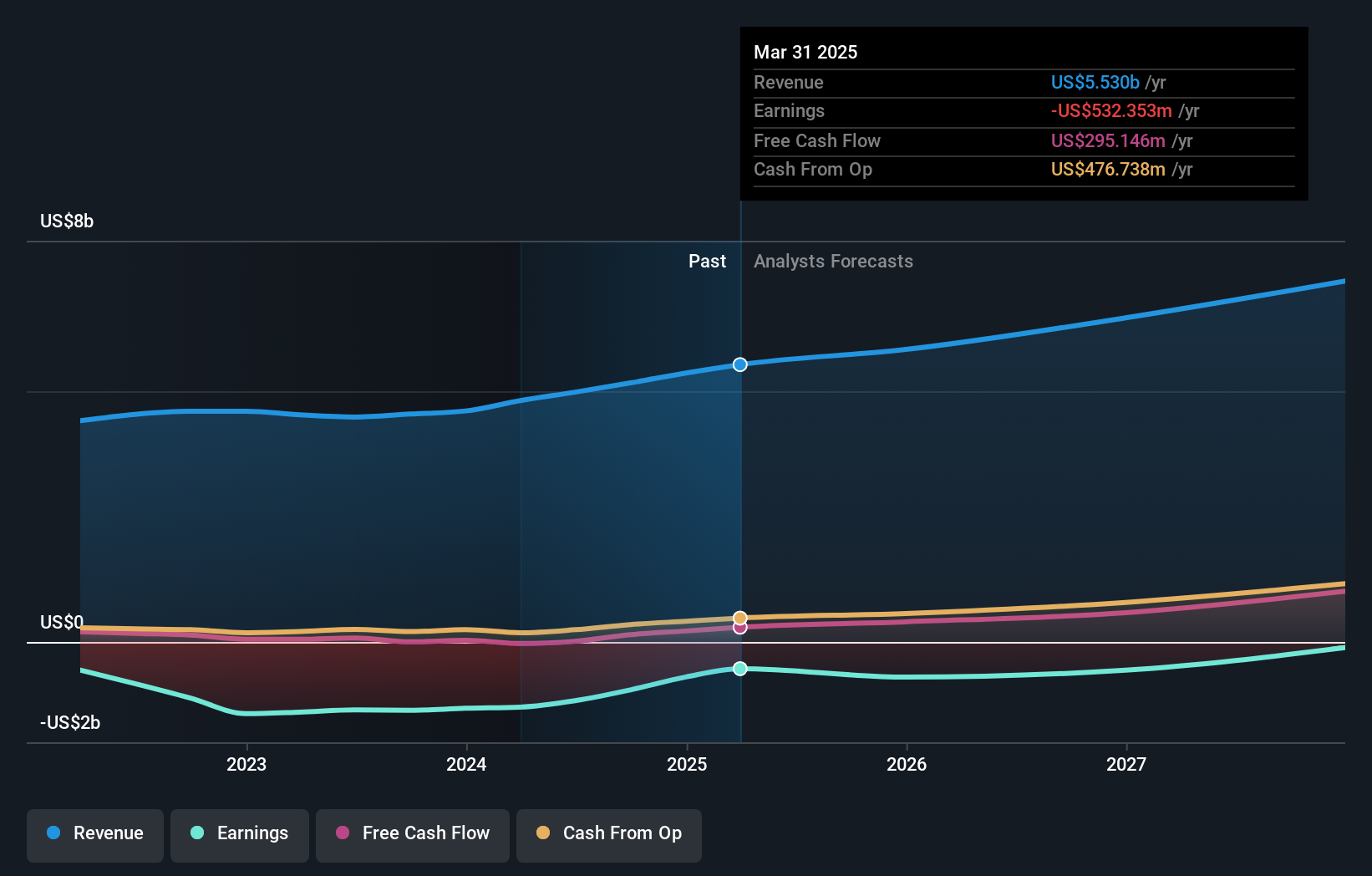

Overview: Datadog, Inc. provides an observability and security platform for cloud applications worldwide, with a market capitalization of $42.68 billion.

Operations: The company generates revenue primarily from its Information Technology (IT) Infrastructure segment, which amounts to $2.39 billion.

Datadog has demonstrated a robust financial turnaround, with its recent quarter showing a surge in sales to $645.28 million from $509.46 million year-over-year and transitioning from a net loss to a net income of $43.82 million. This growth is underpinned by strategic moves like the Akamai partnership, enhancing security operations through integrated SIEM solutions in cloud environments—an essential feature as cybersecurity threats evolve. Moreover, the appointment of Yanbing Li as Chief Product Officer injects fresh expertise likely to drive further innovation and efficiency in product development at Datadog, positioning it well for sustained growth amidst competitive tech landscapes.

- Get an in-depth perspective on Datadog's performance by reading our health report here.

Review our historical performance report to gain insights into Datadog's's past performance.

Snap (NYSE:SNAP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Snap Inc. is a technology company that operates in North America, Europe, and internationally with a market cap of $17.34 billion.

Operations: Snap generates revenue primarily from its Software & Programming segment, amounting to approximately $4.98 billion. The company focuses on developing and monetizing digital products and services across various regions globally.

Snap, despite its challenges, is navigating a transformative path with significant strides in its financial and operational strategies. The company's recent board appointment of Jim Lanzone adds a wealth of digital expertise that could steer future innovations and market adaptations. Notably, Snap's revenue has surged to $1.24 billion this quarter, up from $1.07 billion last year, reflecting an 11.9% increase which outpaces the broader U.S. market growth rate of 8.9%. Furthermore, Snap's aggressive share repurchase program underscores its commitment to shareholder value, having reacquired shares worth approximately $424.68 million over the past year. This strategic financial maneuvering is complemented by an optimistic revenue forecast for the upcoming quarter, projecting an increase between 12% to 16%, potentially elevating Snap’s position in the competitive tech landscape as it edges towards profitability with expected earnings growth of 62.25% per annum.

- Click here to discover the nuances of Snap with our detailed analytical health report.

Explore historical data to track Snap's performance over time in our Past section.

Make It Happen

- Navigate through the entire inventory of 249 US High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in North America and internationally.

High growth potential with excellent balance sheet.